6 Easy yearend tax moves Bankrate Inc

Post on: 25 Июнь, 2015 No Comment

6 easy year-end tax moves

Posted: 2 pm ET

Regular readers of Bankrate tax stories this month have already received a lot of good advice on what they can do now to cut their 2011 tax bill.

But because I’m still in a festive, giving holiday mood, I thought it would be a nice post-Christmas gift to list some quick and easy moves you can make between now and Dec. 31 that could reduce what you’ll owe the Internal Revenue Service when you file your tax return next year.

1. Pay your home-related costs

Send in your January mortgage before the end of the year, and you can deduct that extra interest payment when you itemize.

Just above that interest entry on your Schedule A you’ll find a line for real estate taxes you paid. Remit that property tax amount to your county tax collector before 2011 ends and you can deduct it next filing season, too.

2. Make home energy improvements

Sticking with your house, consider adding insulation or replacing drafty windows or doors. Not only will it make the remaining winter days more comfortable, but also your heating bills likely will be lower. And so, too, could your 2011 tax bill.

If you make these or other IRS-approved energy efficiency upgrades to your residence by Dec. 31, you could be eligible for a $500 tax credit. That means $500 lopped off what you owe Uncle Sam.

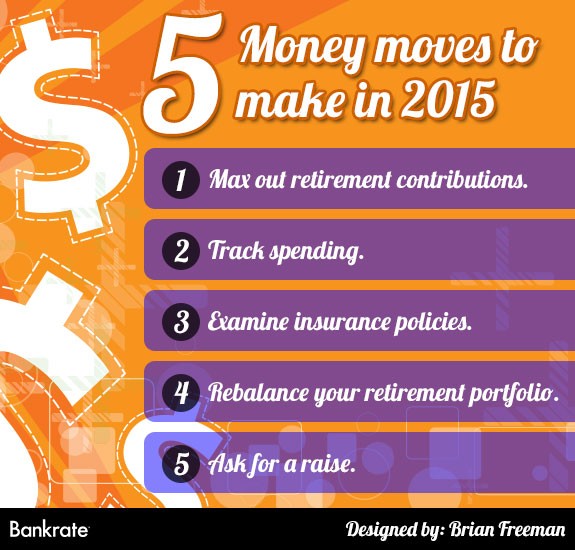

3. Add to your retirement accounts

Time is tight for workplace retirement account actions, but if you have a 401(k) plan at work and haven’t maxed out contributions for this year, check with your benefits and payroll offices about putting in some more money for 2011.

You have some more flexibility when it comes to individual retirement accounts. You might be able to deduct contributions to a traditional IRA on your taxes. If so, think about putting some money into that account now. Yes, you have until the upcoming April filing deadline, but if you have a few spare dollars now, adding it now gives it more time to earn interest and build your nest egg in addition to possibly lowering your current tax bill.

4. Give to your favorite charity

Charities have their hands full during tough economic times. More people need their services and fewer people can afford to support their good works. But if you do have a few extra bucks, continue the giving season by donating to your favorite nonprofit. If you itemize, you can deduct your gift.

5. Sell losing stocks

When you looked at your portfolio, you probably found some stocks that didn’t do so well. If you sell those losers by Dec. 31 you can use that loss amount to offset any capital gains you earned in 2011. Even if you have no gains, you still can use up to $3,000 of your capital losses to reduce your ordinary taxable income.

6. Buy a car

Don’t get too excited. I’m not suggesting that the IRS will help you make payments on that flashy little sports car you’ve had your eye on. But you can deduct the state and local sales tax you pay on an auto purchase. This amount is added to the general sales tax figure that the IRS calculates for each state.

And 2011 might be the last chance you get to write off this expense. The overall sales tax deduction, which taxpayers who itemize can claim instead of the state income tax deduction, ends with the 2011 tax year. Some members of Congress who represent states that have sales taxes but no income taxes are pushing for continuation of this tax break, but it’s hard to predict whether they’ll be successful.

So if you’ve been thinking about getting a car anyway, and you plan to deduct sales taxes instead of income taxes on your 2011 Schedule A, then it could be tax worthwhile to make your automotive purchase before the end of the year.

Follow congressional tax legislation and how it affects you by subscribing to Bankrate’s free Weekly Tax Tip newsletter. And when the 2012 tax-filing season arrives in January, Bankrate’s Daily Tax Tip newsletter will return, too. You can subscribe to one or both of the tax newsletters.

You also can follow me on Twitter @taxtweet .

Related posts: