5 Things You Need to Know about the JOBS ACT and Equity C

Post on: 16 Март, 2015 No Comment

3E/quality/75/?url=http%3A%2F%2Fd1oi7t5trwfj5d.cloudfront.net%2Fcb%2Fc1290064dd11e29dc322000a1d0930%2Ffile%2Fjobsact.jpg /%

BRENDAN SMIALOWSKI / AFP / GETTY IMAGES President Obama signs the JOBS Act April 5, 2012.

Although President Obama, who was just inaugurated for his second term, signed the Jumpstart Our Business Startups (JOBS) Act more than eight months ago, the independent film industry remains in waiting to see the law bear fruit.

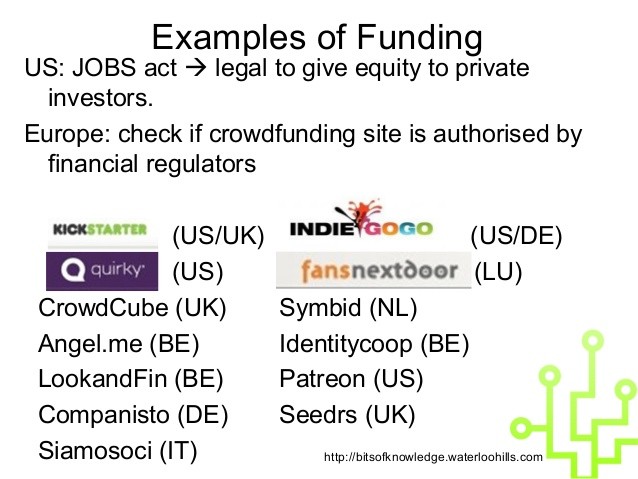

Created to help burgeoning small businesses, the JOBS Act is comprised of a collection of laws that would make it easier for startup companies — including independent film productions — to raise money up to $1 million, particularly through the new phenomenon known as equity crowdfunding. While sites such as Kickstarter and Indiegogo allow outsiders to donate money to projects, the JOBS Act would allow a whole new stratum of investors to put money into films.

READ MORE: Five Things Film Festival Programmers Told Us about How They Use Crowdfunding Sites

Previously, financial laws restricted filmmakers from raising funds because of a prohibition on public solicitation — any public call, whether wild-posting, email blasts or web pages, that asks for money. But under the JOBS Act, filmmakers can now accept money from anyone, as long as it comes through a funding portal that is registered with the U.S. Securities and Exchange Commission (SEC). But such frameworks have yet to be worked out.

To help navigate the new law, Indiewire reached out to a handful of experts who also are trying to make sense of the new landscape. Here are five things you need to know about the future of equity crowdfunding.

1. The JOBS Act is actually not in effect yet, and nobody knows when it will go forward.

Like everything else in Washington, the implementation of the JOBS Act is moving very slowly. The SEC was given until January to hammer out the rules of the act but missed that deadline. According to the Wall Street Journal. FINRA, an independent regulator that covers broker-dealers (equivalent to the funding portals), was also required to set its own equity crowdfunding rules. But it has no deadline. An SEC spokesman recently told The New York Times, We will continue working hard amid a busy rule-making agenda to get these crowdfunding rules done as soon as possible and to get them done right — with the appropriate investor protections in place.

According to several industry insiders, the rules may not be fully known until 2014. Duncan Cork, CEO of Slated.com, a website that already matches accredited investors with film projects, though not through the kind of crowdfunding model associated with the JOBS Act, hopes that at least the General Solicitation rules will be lifted in the middle of this year. That way, filmmakers could start soliciting funds publicly from accredited investors.

But not everyone is waiting for the funding portals to materialize.

I am telling my clients I’m giving the SEC until the end of the month, and then I’m going to go forward with it, says entertainment attorney Corky Kessler, who conducted a financing seminar at the Sundance Film Festival Monday, Jan. 21. I have drafted the PPMS (private placement memorandums) and the LLCs, and we’re all ready to go on some of my clients’ projects. What are we going to do: Wait until 2014 or 2015? At some point, we have to say I’m firing my gun now. That’ll force the SEC to do something.

“In a world of social media, the chance to advertise an investment opportunity is truly a game-changer. — Slated.com CEO Duncan Cork

2. Filmmakers should be preparing ways to advertise their projects to investors on a wider scale since they won’t have to rely on family members who are dentists, doctors and lawyers anymore.

One of the biggest benefits of the JOBS Act will be to allow filmmakers to solicit funds from a wide and diverse group of sources. The current rules state that a filmmaker cannot tell anyone about their investment opportunity unless they can prove a substantive relationship with the investor prior to making the offering. But under the JOBS Act, no prior relationship is necessary.

Before the JOBS Act, filmmakers were only allowed to take investments from accredited investors (meaning investors that have a high net worth) or up to $1 million from unaccredited investors with whom they have had a substantive relationship. Under the JOBS Act, a filmmaker can take funds from anyone, regardless of financial status or relationship to the filmmaker — albeit with protective guidelines.

This move will maximize the number of investors available to a filmmaker, says Slated’s Cork.

These non-accredited investors — earning less than $100,000 a year — can invest a maximum of $2,000, or 5% of their income, whichever is greater. (If their income is more than $100,000, they can invest up to 10% of their income.)

I think it’s a very good thing, says Kessler. There’s a lot of money sitting out there, and now filmmakers have the opportunity to reach out.

If filmmakers begin to accept anonymous investors via the Internet, however, these new investors will need to come through one of the SEC-registered-and-regulated funding portals, which will do some work to vet investors and make sure they are legitimate. Funding portals, however, are likely to be held up because of further oversight (see points 1 and 3).

“In a world of social media, the chance to advertise an investment opportunity is truly a game-changer,” says Cork. The important thing to note though is what hasn’t changed. The filmmaker is still responsible for knowing who is investing in their film and the size of the investment the investor is allowed to make.