5 Most Important Factors when Considering a 1031 Exchange

Post on: 2 Август, 2015 No Comment

** This is the first article by 1031 Exchange expert Grant Conness. Grant will be a consistent contributor to the REI Brain team. If you have any specific questions about 1031 exchanges, shoot us an email through the contact form and well have Grant answer them on future articles. Thanks! And enjoy Trevor**

To assist in determining if a 1031 exchange is the right strategy for your situation, below are a few guidelines that a potential seller/exchanger should consider. While these are certainly not all the applicable factors, it may serve as a brief overview of what one should look out for.

1) Pay attention to mandatory IRS 1031 exchange guidelines – Section 1031 of the IRS code permits a seller/exchanger to defer the applicable capital gains taxes on the sale of their property by exchanging it for “like-kind” property of equal or greater value. The exchanger has 45 days from the close of escrow to identify his/her replacement property(s) and has 180 days from the close of escrow to close on the identified property(s).

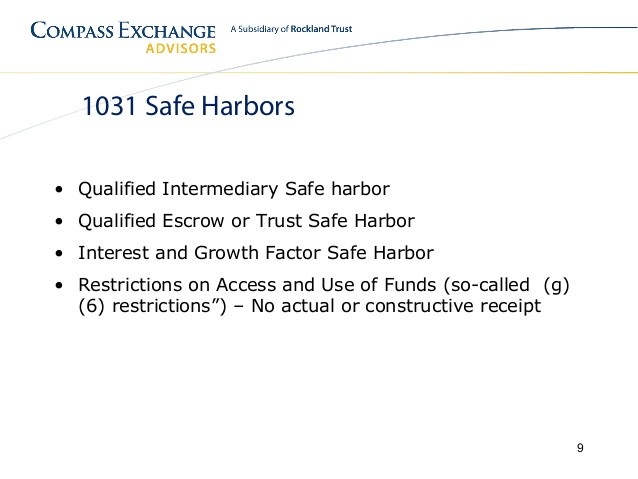

2) Engage a reputable qualified intermediary – The seller/exchanger may not take constructive receipt of his/her sales proceeds or the taxes will be triggered. The proceeds must be directed to a qualified intermediary (QI), accommodator or facilitator at closing. The QI will then be responsible to acquire the identified properties on behalf of the seller/exchanger. To avoid major disasters, it is very important to work with an experienced, certified QI who is licensed and bonded.

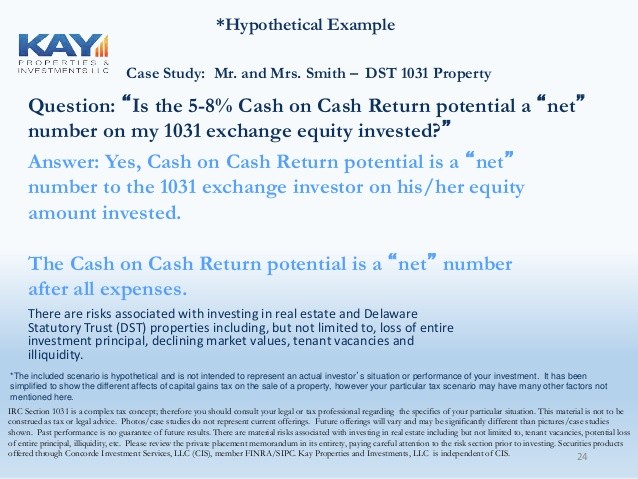

3) Capital Gains Tax Implications – A seller/exchanger determining whether to execute a 1031 exchange should consider several factors before doing so. First, what is their total tax liability including federal & state capital gains taxes plus any depreciation recaptures taxes (if applicable)? Next, the seller/exchanger should consider their liquid assets outside of their real estate holdings. Generally if the seller/exchanger has a large tax liability and sufficient liquid assets, a 1031 exchange can be very advantageous.

4) Locate suitable replacement properties – Replacement properties must be “like-kind ” real estate. This typically includes all types of real estate other than your primary residence, second home (some acceptations), partnerships and inventory property. Examples may consist of an apartment building, raw land, commercial property, single family rental, duplex or tenant in common (TIC) properties.

5) Work with experienced 1031 exchange professionals – It is extremely important to work with experienced firms that are well-versed in the field of 1031 exchanges. These professionals or advisors may consist of Qualified Intermediaries (QI), 1031 Exchange Coordinators, Real Estate focused Financial Advisors, Tax Attorneys, CPA’s, Real Estate Attorneys, and/or Real Estate agents/brokers. A 1031 Exchange is a very complex tax strategy with a lot of moving parts. Sellers/exchangers should carefully determine who they decide to work with.

** Editors Note: From my experience many people believe 1031 exchanges are more difficult than they actually are. They are actually rather simple when you break them down into their essential working parts and when you work with a reputable accommodator who has done many of these transactions they can ensure that these essential parts are fulfilled and followed. 1031 exchanges can be a great part to an investors long-term real estate investing strategy.

If you have any specific questions about 1031 exchanges. shoot your questions our way through our contact page .