5 HighYield Monthly Income Investments For 2014

Post on: 16 Март, 2015 No Comment

Be sure to put your feet in the right place, then stand firm. — Abraham Lincoln

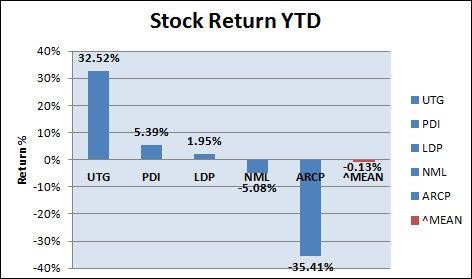

Many income-related investments have been poor performers this year. This is primarily due to the threat of rising rates in what investors may refer to as the taper tantrum of 2013. The year-end tax-loss selling, already exaggerated due to a skyrocketing general stock market, intensified the selling and pushed these investments even further to the downside.

With one week left in the trading year, investors have shifted their mindset to 2014. Distressed stocks and funds have been lifted over the past two days as bargains have been sought out in the value bin. This should continue through the end of the year as a positive 2014 outlook is combined with institutional repositioning and heavy volume.

Income investors may take advantage of this by setting up positions in healthy stocks and funds that pay out large dividends. Trending now are monthly dividend stocks and funds, which have been enamored by investors and command a increasingly higher retail demand versus similar, non-monthly dividend peers.

A Diversified, High-Yield Monthly Income Portfolio

The following portfolio includes four funds and one stock that yield 7.27% on average. Each holding is unique to the portfolio from a diversification perspective and covers the following asset classes: preferred shares, bonds, real estate, utilities/infrastructure and MLPs.

The primary concern with higher-yield securities is capital safety and as such, each security here has been vetted for value. The funds listed below are closed-end funds trading at a discount to NAV, while the one stock listed is trading at a discount to peers.

Category 1: Preferred Shares Income

Fund: Cohen & Steers Limited Duration Preferred & Income Fund (NYSE:LDP )

Yield: 8.29%

Cohen & Steers (NYSE:CNS ) is a boutique asset management firm specializing in income-producing assets around the world. The company offers mutual funds, closed-end funds and ETFs.

CNS manages $6 billion in preferred securities, led by investment manager William Scapell. $2.2 billion of that is in the preferred securities mutual fund (MUTF:CPXAX ), which yields 6.3% using monthly distributions.

The company also has two closed-end funds, the Preferred & Income Fund (NYSE:PSF ), launched in 2010, and the Limited Duration Preferred & Income Fund, launched in 2012. Both are managed by Scapell and have very similar holdings.

As an asset class, preferred securities have the highest yields in the investment-grade income asset class universe.

While CPXAX mirrors the index yield, LDP and PSF use leverage to enhance results. This turns 6.3% yields into 8%+ yields after expenses.

Historically these funds trade at or above par, however due to the taper tantrum, preferred securities have remained under pressure. As noted in the chart below, LDP is trading at a wide discount to NAV with a spread that has increased through the year.

LDP Premium/Discount History Chart

PSF follows this pattern as well, with a history of trading in synchronization with NAV until it was interrupted in late-May 2013.

PSF Premium/Discount History Chart

Through the purchase of LDP or PSF, high-income is achieved through diversified preferred securities. Leverage and a rare 10%+ discount give investors enhanced yield and room for additional capital appreciation should market price/NAV synchronization resurface.

While a 10%+ margin of safety found in the price to NAV discounts here is appealing, CNS offers additional shareholder value through a share-buyback program which may give a floor to the discount. In the CNS closed-end fund portfolio, the fund manager may buy back 10% of each fund’s outstanding shares each calendar year.

This remarkable program is unique in the closed-end fund world, as it may help attract more assets under management moving forward, but comes at the expense of forward revenue. A closed-end fund does not sell shares on the open market and as such, any repurchased shares will lower assets under management, thus lowering the fund manager’s management revenue.

This shareholder-focused approach is very helpful as every $100 worth of stock bought back at $90 brings $10 worth of extra profit to the fund. If 10% of the fund is sold at a 10% discount, this will add 1% to the total return of the fund on the year. Also this move will reduce the float, increase demand and with constant outside variables, the market price would move closer to par with NAV.

Another benefit of purchasing LDP is the PSF pair-trade for future tax-loss harvesting. In the event that LDP would trade under the cost basis near year-end 2014 or beyond, the investor could sell the fund and then buy PSF on the same trading day. The investor would benefit from a realized loss while ensuring the same investment profile and uninterrupted dividends.

To recap, investors in these two closed-end funds reap a triple margin of safety. First, the fund is trading at a discount to NAV. Second, the fund usually trades at a premium. Third, CNS offers a share-buyback program to its closed-end funds which would add profitability and put a floor on the discount should the fund manager elect to buy back shares.

Category 2: Multi-Sector Bond Income

Fund: The PIMCO Dynamic Income Fund (NYSE:PDI )

Yield: 7.57%

Most income investors have bonds or bond funds as a core allocation to their portfolio. Investment-grade U.S. corporate bonds are yielding close to 3.6% on average, while high-yield bonds are closer to 7%.

While there are multiple bond funds to choose from, PIMCO has several attractive closed-end fund options that yield north of 7% by investing in multiple bond classes and enhancing yields through leverage. One fund is the PIMCO Dynamic Income Fund, which yields 7.57% and trades at a 3.68% discount to NAV.

Fund Strategy

The PIMCO Dynamic Income Fund is a multi-sector bond fund with absolute freedom to invest where PIMCO’s credit research dictates value and opportunity lie. Currently the fund is focused heavily on non-agency mortgage-backed securities as part of the PIMCO Mortgage Opportunities Strategy .

With the fallout of mortgage-backed securities from the financial crisis, non-agency issues have fallen to below investment grade ratings. PIMCO believes this offers attractive risk/reward profiles regarding yield and potential capital appreciation, which will be buoyed by further appreciation in the domestic housing index.

Insider Holdings

In October 2013, Bill Gross initiated a position of 100,000 shares in PDI, which is currently valued at over $3 MM. PDI fund manager Dan Ivascyn has been an active buyer since the fund’s IPO in May 2012. Currently Ivascyn owns over 370k shares worth north of $11 MM.

PDI Premium/Discount History Chart

Since inception in 2012, PDI has returned over 30% on NAV and nearly 24% on market price. During the taper tantrum the fund price did drop along with the bond market, however the NAV has recovered and is near the May 2013 high.

As noted by the premium/discount chart since inception, PDI has generally traded at a premium or near par to NAV before May 2013. The current discount may be unwarranted as NAV has recovered, most other PIMCO closed-end bond funds trade at a premium and returns on the mortgage strategy appear to be quite rewarding so long as the domestic housing market continues to appreciate at least 3-5% over the next two years. Income investors who are looking to boost the yield and potential return on the bond portfolio may be rewarded with PDI.

In the event that losses do occur in 2014, another PIMCO fund that could be traded out in a tax-loss strategic move is the PIMCO Dynamic Credit Income Fund (NYSE:PCI ). PCI is more diversified than PDI with a much smaller non-agency mortgage focus, yields 8.33%, has over $3 billion in assets and is trading at a 7.63% discount to NAV.

Category 3: Real Estate

Company: American Realty Capital Properties, Inc. (NASDAQ:ARCP )

Yield: 7.35%

Current Fact Sheet: June 30, 2013

Cole Merger Presentation: November 12, 2013

ARCP is a real estate investment trust (REIT) that went public in September 2011. The company is dividend-focused and seeks to be the world’s largest net-lease retail REIT. Once the Cole Real Estate Investments (NYSE:COLE ) merger is complete, ARCP will likely hold this title.

As a REIT, the company passes through at least 90% of income to shareholders in the form of ordinary dividends. According to ARCP, the dividend will be raised to $1.00 annually after merging with COLE. On today’s market price of $12.74, that would entail a YOC (yield on capital invested) of 7.85%.

The tenants of ARCP-owned property are mostly of investment grade and include well-known names. Post-merger the company will have over 83% of tenants that are rated investment grade.

ARCP-COLE Investment Grade Tenancy & Top 10 Tenants

ARCP on the downside has a short history and lack of proven, long-term acquisition-integration success. As such, investors have punished the company by pushing shares below peer valuation levels.

With a growing economy and rising interest rates, the retail REITs have come under additional pressure as most leases are long-term with slow rental bumps. As interest rates rise, retail REITs are unable to quickly adjust aggregate leases to reflect higher rates.

The company is also diversified with office and industrial exposure, which will be close to 38% of the portfolio upon the ARCP-COLE merger. The combined company will hold 3,732 properties with 102 MM SF and a 99% occupancy level.

Category 4: Utilities & Infrastructure

Fund: Reaves Utility Income Fund (NYSEMKT:UTG )

Yield: 6.29%

Traditionally utilities include energy and water distribution companies that service residential customers. These companies are sanctioned monopolies and for good reason, for competition may not be economically efficient as utilities use massive city resources to do business.

In addition to traditional utilities, there are several other regulated industries that provide staple services in a monopolistic nature that limits competition. Also, the demand for these services is inelastic and as such, investors could consider them a utility play as well.

Regarding investment research and personal investing, I feel that telecom and several transportation-related industries meet this definition. As such, I include telecom, telecom-related tower REITs, toll roads, airports, railways and marine ports as utilities in my asset allocation strategies.

These also could be classified as infrastructure stocks, in which a combination with traditional utilities would equate to a diversified portfolio of steady, regulated dividend payers that are essential in supporting daily human life.

The Reaves Utility Income Fund takes traditional gas, electric and water utilities and combines infrastructure-utility stocks to create a diversified monthly income fund that currently yields 6.29%.

The portfolio is global in scale and is diversified into 15 categories that are mostly defined as utility, with nearly 9% in energy (category 4). According to the fund’s objective, 80% of assets must be invested in utilities and up to 20% may be invested in other industries.

The top ten holdings include Verizon Communications Inc. (NYSE:VZ ) and AT&T, Inc. (NYSE:T ).

The fund is trading at a 8.66% discount to NAV, which could be linked to the taper tantrum as recent history dictates the fund usually trades close to par or at a premium to NAV.

In addition to trading at a discount, the fund uses leverage to enhance both yield and long-term gains. Currently UTG is the only monthly dividend fund in the utility sector as a competing fund, The Cohen & Steers Infrastructure Fund (NYSE:UTF ) went quarterly in 2009.

Category 5: Master Limited & Limited Partnerships (MLPs/LPs)

Fund: Neuberger Berman MLP Income Fund (NYSEMKT:NML )

Yield: 6.87%

The MLP area of investing includes MLPs and LPs, which support energy infrastructure in the U.S. and pay high yields. Due to the U.S. partnership tax structure, these companies avoid state and federal income taxes.

There are several funds which invest in MLPs, however the closed-end fund arena offers higher yields through leverage and market prices that are at a discount to NAV.

One fund I recently wrote about is the Neuberger Berman MLP Income Fund, which pays monthly distributions and yields 6.87%. The current discount is 4.87% to NAV.

NML has made a big move this week and as noted by the past six-month performance, the stock does experience short bursts of volatility. For this reason, investors may be well-served by waiting for a dip rather than buy after a huge upside move.

For a more detailed analysis on the MLP fund options and why NML is a top selection, please read The New High-Yield, Monthly Dividend Income Fund . published December 24, 2013.

5 High-Yield Monthly Dividend Portfolio Side-By-Side Analysis

Each of the four closed-end funds is trading at a discount to NAV, with three of the four at larger discounts than the normal 52-week discount. ARCP is not measured here, however it is trading at a discounted multiple to peers. For example, Realty Income Corp. (NYSE:O ) is trading just under 15x 2014 projected AFFO, while ARCP is trading closer to 11x 2014 projected AFFO (including COLE merger).

The size of each selection in terms of market capitalization (does not include leveraged assets in closed-end funds) is over $1 billion.

For the icing on the cake, the yields average 7.27% here.

Conclusion

Due to a poor 2013 performance regarding income-related investments, many stocks and related-funds are trading at discounts to normal valuation. As such, a high-yield portfolio can be built to take advantage of discounts and achieve stable monthly income.

The five options presented above represent value plays that yield north of 7% on average and provide excellent diversification. For investors looking to add or maintain utility, MLP, real estate, bond and preferred stock income and monthly payouts, the five selections here may warrant further research.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.