5 Dividend Growth Businesses with High Switching Costs

Post on: 14 Май, 2015 No Comment

February 23, 2012 By M. Alden 10 Comments

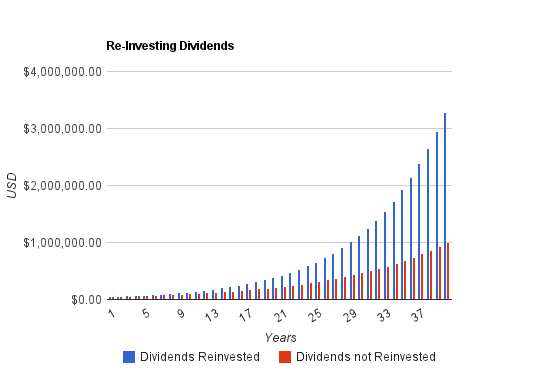

This is the fourth in a series of articles highlighting dividend growth companies that have large and durable economic advantages, or moats, that protect their business operations and allow years or decades of strong profitability. When looking for long-term investments, one typically wants to find a business that is performing well not simply because management is on top of their game right now, but rather because the business itself has fundamental and difficult-to-replicate advantages over its competitors. In the previous articles, examples of unrivaled economies of scale. powerful brands. and huge patent shields were provided.

Some companies have businesses where its naturally difficult to switch to a competitor. This increases pricing power and makes revenue more stable.

For example, if youre running a business, and youve outsized most of your human resource operations to another company, it would be a large hassle to switch to their competitor. Theyd have to mess up rather terribly to get you to switch; minor price increases wouldnt be enough. Or, for a consumer example, if you have money saved in a bank, have credit cards and checks with that bank, then switching is a hassle. As long as theyre operating reasonably well, youre not going to switch.

This is in contrast to, for example, buying Pepsico (PEP) products or shopping at Costco (COST). They may have other economic advantages, like brand strength and scale, but their switching costs are fairly low. If at any time a competitor was superior in your eyes, you could easily switch with little or no cost or difficulty for yourself simply by buying a competitors products next time.

Below are five examples of dividend growth companies that have high switching costs:

Automatic Data Processing

Automatic Data Processing (ADP), is the aforementioned business outsourcing company. They handle human resource needs, payroll, computing processes, direct deposits, tax reports, employee time and attendance, hiring services, record-keeping, and some other software services. ADP is five times larger than their largest direct competitor.

The company has more than three decades of consecutive annual dividend growth, and is one of only four non-financial U.S. companies with an AAA credit rating. Low interest rates are currently negatively affecting ADP, since they hold tens of billions of dollars worth of client funds and then invest them in conservative and liquid interest-producing securities, but for the long term, ADPs position looks rock solid.

Dividend Yield: 2.94%

Total Debt/Equity: 0%

Price to Free Cash Flow (FCF) Ratio: 17.2

Dividend Payout Ratio: 47%

Most Recent Dividend Increase: 9.7%

Microsoft Corporation

Microsoft (MSFT) has set up a near monopoly on the business personal computing environment. Employees become trained in using certain software, and so switching software requires substantial re-training, especially for a large enterprise. Ill tell you right now as an engineer, my organization is currently undergoing an unrelated but rather major software switch and the time-cost of this is rather enormous. And major enterprise IT hardware/software capital investments can last for a while.

At least, thats how it worked for the last decade, but the company faces new challenges today. Microsofts moat with regards to consumer software may be threatened by the various free options available, but their business position remains strong, and any reductions in Windows sales are being balanced out by increases in the Server and Tools division. Its the business environment rather than the consumer market where software moats can be formed.

A few key estimates and facts released by Microsoft with regards to 2011 fiscal year performance:

-The Windows segment revenue was slightly down, and operating income was modestly down, mainly due to a problematic PC market. The company estimates that PC sales to businesses grew by 11% compared to the previous year, but that PCs sold to consumers fell by 1%, with the biggest loss coming from netbooks. Overall, PC sales were slightly up, but the bulk was in emerging markets where prices are lower.

-The Server and Tools Division, Business Division (Office), and Entertainment Division all posted very strong growth in 2011.

-The Online Services Division continued to lose money.

Dividend Yield: 2.56%

Total Debt/Equity: 19%

Price to FCF Ratio: 9.8

FCF Dividend Payout Ratio: 22%

Most Recent Dividend Increase: 25%

Realty Income Corp

Real estate can naturally result in high switching costs. Realty Income (O) is a REIT that owns over 2,600 properties in 49 states, and leases these spaces out to commercial tenants. Moving is a hassle for a family, but the hassle is even greater for commercial tenant that tries to move a business. Plus, Realty Income signs long term leases and is known for high occupancy rates, large diversification, and a well-run business.

Realty Income, known as The Monthly Dividend Company pays out a dividend every month of the year and has a pretty good record of increasing their distributions annually. With a nearly $5 billion market capitalization, Realty Income Corp is a decently large REIT.