4 Steps to Effective Prospecting

Post on: 6 Апрель, 2015 No Comment

The success of many of the top-earning financial advisors hinges on their ability to simply get more clients. Although exceptions to this rule exist, the advisors who outlast their peers and are nearing retirement with a big book of business are usually those who did more prospecting (and more effective prospecting) earlier in their career. They are also more likely to have maintained the practice even when other advisors stopped.

Most advisors follow one of two routes when they go out prospecting. The first route, especially for new advisors, is to go after anyone you know or meet. Everyone gets a business card or three and a follow-up call. The other route, especially for professionals with a few years under their belt, is to follow the money by contacting whoever has the most likely access to investable capital.

We know that prospecting is essential. So how can an advisor – whether they are brand new to the business or trying to elevate a seasoned career – prospect more effectively in todays marketplace? Just because the tried-and-true prospecting methods of yesteryear dont work as well today, that doesnt mean advisors should scrap everything and go all-in on the marketing flavor of the month. You might be surprised at the answer.

If you want to make your prospecting easier and more effective, and ultimately generate more clients for you, here are four steps to find the perfect prospects faster and more effectively:

Step #1 – Look in the mirror:

If you want to find your perfect prospect, the best way to get started is to look inward and figure out who you are and whats important to you. How would people describe you? How do you like to spend your time? What values do you adhere to in your own life? What are your talents? What sets you apart from other advisors?

Once youve made this inward look, the next step is to look outward for prospects who might possess those same qualities. Where do they work? Where do they spend their free time? How can you connect with them?

People enjoy interacting with others who are just like them. Your prospects will see you as an ally who understands them and faces the same joys and struggles in life.

Step #2 – Look at your client list:

Your existing clients provide an excellent clue into who your perfect prospects are (even if youre a new advisor with only a small handful of clients).

Look at your client list and identify your favorite clients – the ones you love to work with the most. This doesnt necessarily mean that youll be looking for the ones with the most assets or the ones who generate most of your revenue. Instead, find the clients who you simply like to spend time and the ones who you really connect with; identify the ones who leave you feeling energized and valued as a professional.

Once you have a list of your favorite clients, determine what characteristics are common among all of them. Check for demographic characteristics, personality traits, aspirations, and values that are shared among a majority of your favorite clients.

Also look at what solutions you are providing for your client’s biggest problems. Does your experience with certain products or services make you an expert in working with those types of clients?

This step is critical because it starts to paint a picture of your favourite clients – the ones who give you a reason to get out of bed in the morning and face the day. Think about what you enjoy most about being an advisor and how your favourite clients make you feel.

Step #3 – Paint a picture:

Based on your findings in step 1 and step 2, describe what your perfect prospect profile is like:

- What is important to them?

- Who is important to them?

- What values do they possess?

- What motivates them?

- How would you describe them demographically?

- What personality traits do they possess?

- Where do they spend their time and money?

- Where do they typically work? Where do they typically spend their time when they are not working?

- What events in life are they facing now or will they be facing in the near future?

- What needs and challenges do they face that you can offer valuable insight into?

Craft an outline of what that person looks like and be able to describe that person if someone asks you who they can introduce you to.

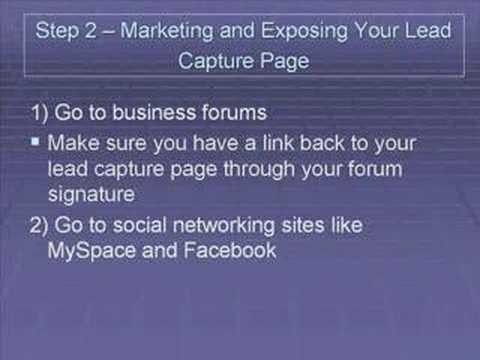

Step #4 – Figure out where that prospect is and go to them:

Take a look at your perfect prospect profile and determine where they spend their time.

Review available prospecting methods against the picture you developed of your prospect profile. Do your prospects even see or hear your prospecting message and is it something that resonates with them? Are there specific prospecting methods you can adopt (and adapt, because its never one-size-fits-all) to reach deeper into that pool of prospects?

Bonus Step – Segment your client list:

As you add more clients to your business, you may want to revisit the level of service you provide to each client. By segmenting your client list into three simple groups – top tier, middle tier (who might possess some qualities you prefer and have the potential to become top tier clients), and bottom tier clients (who are definitely NOT your favourite clients!). Create service level agreements for each tier that ties into your marking plan and budget. Provide a richer, more valuable experience with more frequent connections to your top tier.

Some of the benefits of working with your top tier are:

- Less stress as you are working with clients that you like

- Stream-line your business as you work with similar clients

- Focuses your marketing campaigns

- You are seen as an expert

- More revenue opportunities

- Your time and effort is respected and valued

Finding perfect prospects ensures a stronger, enjoyable and a longer-lasting career as a financial advisor. Follow these four steps to find more perfect prospects.

Authors. Rosemary Smyth, MBA, CIM, FCSI, ACC, is an author, columnist and an international business coach for financial advisors. She spent her career working at leading investment firms before pursuing her passion for coaching. She lives in Victoria, BC. Visit her website at www.rosemarysmyth.com. You can email Rosemary at: rosemary@rosemarysmyth.com

Aaron Hoos, MBA, has worked in the financial industry since 1997. Formerly a stockbroker, insurance broker, and award-winning sales manager, today he writes for the financial and real estate industry as an educator and marketer. He is working on his second book. Visit his website at www.AaronHoos.com and follow him on Twitter @AaronHoos .

www.sxc.hu/photo/443042,

Please Note: this article is for informational purposes only. We strongly encourage you to verify any content and information you use with your own compliance department or legal counsel.