300 Club Volatility does not measure true risk

Post on: 16 Март, 2015 No Comment

300 Club: Volatility does not measure true risk

In the fifth paper published by the 300 Club, Defining true risk, Stefan Dunatov, Chief Investment Officer of the Coal Pension Trustees Investment Limited, discusses how the investment industry has become so focused on using volatility as a measure of risk, that it has potentially dangerous implications for long-term investors in achieving their objectives.

Stefan Dunatov, 300 Club, said: The investment industry has two great failings: the inability to identify the right risks when considering investment objectives, and then measuring those risks the wrong way.

In my view, the increasing focus on forecasting risk, and the emergence of volatility as a popular measure of that risk, is a disappointing response by the investment industry to recent difficulties, he said.

Rising uncertainty in recent years that has driven a myopic short-term focus on risk.

Dunatov said: This has stemmed from significant changes in investment and accounting regulations; the impact on liabilities of a prolonged period of falling interest rates and therefore discount rates; and, perhaps most critically, the single largest market panic since the 1930s.

Asset owners have allowed the providers of investment services, including investment managers and consultants, to dictate the approach asset owners should adopt. External advisers naturally prefer to work with an easily-definable measure that is common to many clients. Their solution has been to replace the traditional focus on forecasting returns and all its difficulties with a short-term metric of volatility to forecast risk, which appears to be a more tractable measure. This touches on a separate key issue the industry also has to grapple with: a lack of alignment of interests between the asset owners, consultants and asset managers.

Volatility doesnt measure real risk

The reality is that volatility is a crude, poor measure of risk for a long-term investor, says Dunatov.

Like the assumption that markets are efficient, the assumption that volatility is a good measure of risk is clearly wrong.

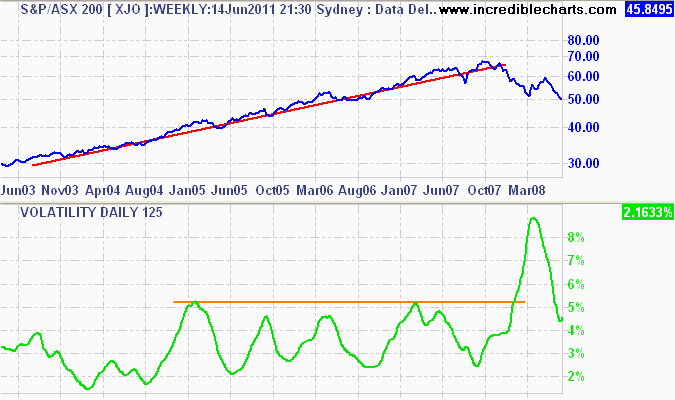

Dunatov continues: Volatility forecasting is only helpful in the very short-term. Volatility measures typically inform us about the state of the world at the current time and models that forecast volatility tend to only be able to do so with any degree of accuracy over a very short time frame. The most confident analysts believe six months is a long time horizon for forecasting volatility, which is of limited use to a professional investor with a medium to long-term investment horizon.

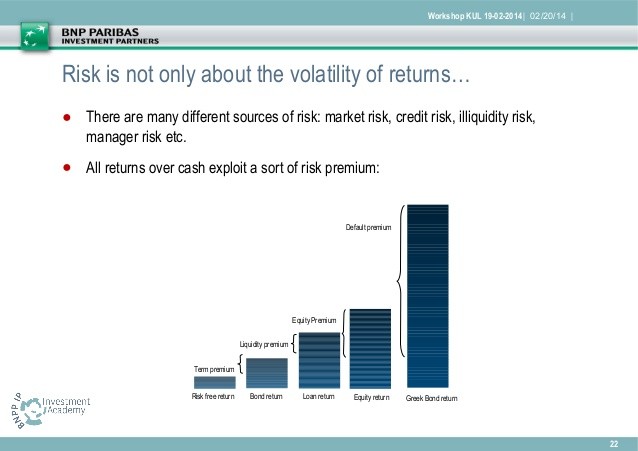

Succumbing to the pressure of providers to focus on short-term measures of risk instead of long-term objectives, investors are giving up their ability to exploit the illiquidity premium. This undermines the premise of being a patient, long-term investor. Long term investors should be able to absorb short-term fluctuations in risk premiums, yet risk models focus on these short-term fluctuations.

The real problem long-term investors face is how to deal with the uncertainty surrounding the likely paths asset prices might take over their investment time horizon:

This is not volatility. Instead, this is about understanding the range of possible macroeconomic outcomes, judging the likelihood of those outcomes occurring and choosing an asset allocation that best fulfils the investment objective within that context, said Dunatov.

More broadly, almost all investors share a balance sheet problem, which is not confined to assets alone:

Dunatov continues: Generally, investors such as pension funds and insurance companies, have a key balance sheet metric, which is the discount rate applied to liabilities, or, in the case of endowments and sovereign wealth funds, an inflation-plus return target. Both establish the rate of growth the assets need to achieve to either keep the balance sheet whole or reach the required target.

The true risk for all investors is the extent to which they are prepared to accept sub-optimal outcomes in their efforts to achieve their objective. A sub-optimal outcome is simply one that does not achieve the investment objective. Anything less than the target return is value destructive, anything greater is value creation. Measuring risk in terms of volatility does not help investors understand or effectively manage this problem. Instead, forecasting returns and economic scenarios are key.