3 Ways to Pick the Best Canadian Dividend Stocks SU Investing Daily

Post on: 16 Март, 2015 No Comment

By Chad Fraser on November 23, 2013

If youre a regular Investing Daily reader, you likely know that weve long been bullish on investing in north of the border. Here are a few reasons why:

- Many Canadian firms boast highand risingdividends: The best Canadian dividend stocks tend to have long records of making outsized payouts. Right now, for example, our Canadian Edge advisorys portfolios include stocks with yields up to 10.3%.

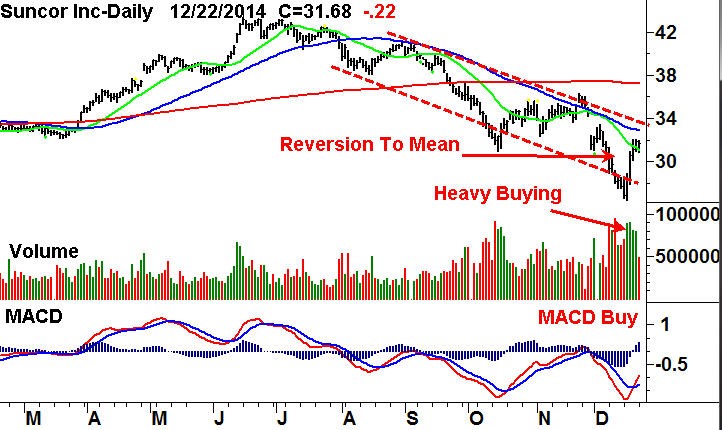

The sector got a shot in the arm after Warren Buffett took out a big stake in Suncor Energy (NYSE: SU). the largest oil sands producer, in the second quarter of 2013 and added to his stake in Q3.

We think it is a positive for the sector, Robert Bedin of ITG Investment Research recently told the Financial Post. Suncor is probably a pretty good proxy for the Canadian oil price, and if Mr. Buffett is bullish on the oil price, its good across the board for Canadian names.

In addition, Canadas federal government is on track to balance its books by April 2015. The countrys finance minister, Jim Flaherty, recently said the government plans to post a surplus of C$3.7 billion in the year starting April 2015, up from his earlier projection of C$800 million.

Sunny Outlook for the Best Canadian Dividend Stocks

Recent signs are pointing to a continued strengthening of the Canadian economy. As analyst Ari Charney reported in a November 8 Canadian Edge article. the countrys gross domestic product (GDP) grew 0.3% in August, soundly beating the consensus forecast of 0.1%. That result followed an increase of 0.6% in July. Employment gains have also come in ahead of expectations recently.

The Canadian economy should continue to gain strength along with a rebound in the U.S. (The U.S is by far the countrys largest export market, taking in 74.5% of the goods Canada ships out, according to the CIA World Factbook.)

Thats an obvious plus for all Canadian companies, including dividend payers, but not all will benefit equally. Below are three criteria David Dittman, chief investment strategist at Canadian Edge, uses to separate the best Canadian dividend stocksthe ones with the safest payouts and the strongest potential for gainsfrom the pretenders.

(You can get our complete guide to Canadian dividend investingincluding three of our favorite high-yielding picksin our new free report, The Top 3 Canadian Income Stocks. Click here to download your copy now.)

- A reasonable payout ratio. This figure is a key measure of dividend safety for investors in Canada and anywhere else. Its calculated by dividing the indicated quarterly dividend rate by the previous quarters income per share. Lower percentages generally indicate a greater degree of dividend safety.

Generally speaking, Canadian Edge advises that payout ratios should be below 90%, but thats highly dependent on the sector the company operates in. Firms in steadier businesses, such as real estate investment trusts, can generally support higher payouts than stocks in more volatile ones, such as oil and gas production.

- A low debt-to-assets ratio. This metric compares each companys total obligations to the value of the assets on its books. Its calculated by dividing total debt by total assets. As with payout ratios, the general rule is the lower the better. Our upper limit in Canadian Edge is 60%, but here again, its important to keep in mind that what makes a suitable ratio varies widely from industry to industry.

- No dividend cuts in the past five years: As all investors know, the past five years have been some of the most turbulent in stock market history, both here and north of the border, so companies that can meet this standard are particularly worthy of your attention.

Its been one stress test after another for the companies in the Canadian Edge coverage universe over the past five years, writes Dittman. Any company thats been able to avoid a dividend cut through that is a true gem, and not because of the nature of its business. Rather, all the credit goes to managements skill in keeping the ship pointed in the right direction.