3 Tips for Using Leveraged ETFs

Post on: 4 Июль, 2015 No Comment

Before jumping in, advisors and clients should do some homework on these tricky investments

Investors may need extra help with complex instruments like leveraged products.

ETFs that leverage performance are still held in contempt by many individuals within the financial services industry. Usually, its because those indivduals dont understand the products or they dont understand how and where leverage belongs in portfolio construction.

Before an advisor attempts to use leveraged ETFs inside client portfolios, its crucial to have a logical framework.

Only after an advisor has first built a persons core portfolio can the process of constructing the tactical or non-core portfolio begin. Remember, the core maintains exposure to all the major asset classes (stocks, bonds, commodities and real estate) at all times. The only tactical thing the core portfolio will ever do is to dial up or down a persons exposure to a particular asset class.

By comparison, the non-core portfolio is tactical and can invest in things like individual stocks, derivatives, private equity, venture capital, volatility and other non-core asset classes. Since the non-core portfolio is always complimentary to the core, its typically smaller in size and can also hold tactically designed assets like leveraged long or short ETFs.

Along with this disciplined framework for investing in leveraged funds, there are other factors that advisors need to know before diving in.

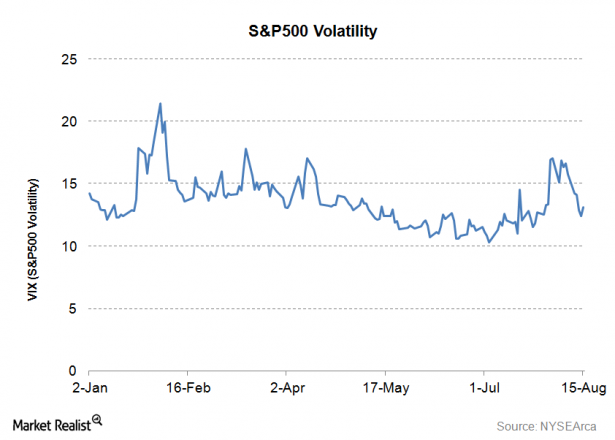

1. Use Leverage Only in Sharply Trending Markets

Big performance gains with leveraged ETFs can be had in sharply trending markets. In a bullish stock market, for insance, bull funds with 2x or 3x daily leverage will shine. On the other hand, bearish funds with 2x or 3x daily leverage are likely to perform best when stocks are moving sharply lower. Leveraged funds are not suited for use in neutral markets.

2. Focus on Where the Action Is

Leveraged ETFs follow a variety of asset classes beyond stocks and bonds, including currencies, commodities, real estate, and even volatility. (See Research Magazines quarterly ETP Reference Guide for ticker symbols.) Instead of trying to track all of these markets, focus your trades on the markets where the trend is strongest and the opportunity for reward is great.

3. Leveraged ETFs Are Short-Term Trades

If youre buying a leveraged ETF on behalf of a client, understand that youre making short-term trade, not a long-term investment. Generally, a short-term trade is one that lasts anywhere from one day up to several weeks. If youre buying a leveraged ETF as a long-term investment, youre using the tool the wrong way!

Ron DeLegges is Founder and Chief Portfolio Strategist at ETFguide. Join his next monthly Portfolio Workshop for financial advisors. Attendance is free.