3 Sector Rotation Strategies Etf Investors Must Know 2015

Post on: 1 Май, 2015 No Comment

3A%2F%2Fetfdb.com%2F?w=250 /% ETF Database is not an investment advisor, and any content published by ETF Database does not constitute individual investment advice. The opinions offered

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% During the calendar year investors can also rotate into sectors that benefit from yearly events. “Driving season” positively impacts the Energy industry.

3A%2F%2Fsumgrowth.com%2F?w=250 /% Example True Sector Rotation ETF Strategies and mutual fund Strategies designed to simultaneously improve returns and reduce risk for your self-directed 401(k) or IRA

3A%2F%2Fwww.etfscreen.com%2F?w=250 /% This sector strategy shows the potential to outperform the broad market using Select Sector ETFs and iShares Russell Style ETFs.

3A%2F%2Fsumgrowth.com%2F?w=250 /% I’ve been an enthusiastic SectorSurfer subscriber since January 2011. This product stands like an oak tree amid a forest of saplings.

3A%2F%2Fetfdb.com%2F?w=250 /% 101 High Yielding ETFs For Every Dividend Investor. by Michael Johnston on December 6, 2012 | Updated January 23, 2014

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Sample strategies to help reduce exposure in a down market include: Reducing your portfolio’s exposure to sectors, asset classes or equity capitalizations that are

3A%2F%2Fseekingalpha.com%2F?w=250 /% At the time of publication, Morningstar was tracking nearly 370 strategies only trailing 3 month price momentum. In order to construct a tactical asset rotation portfolio, an investor must begin by identifying a handful of ETFs that will serve as

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% MLPs by definition must generate revenue about 90% of cash flow from real estate, commodities, and natural resources. The sector just need to know the three common investing habits to dump immediately, the single most effective strategy for your

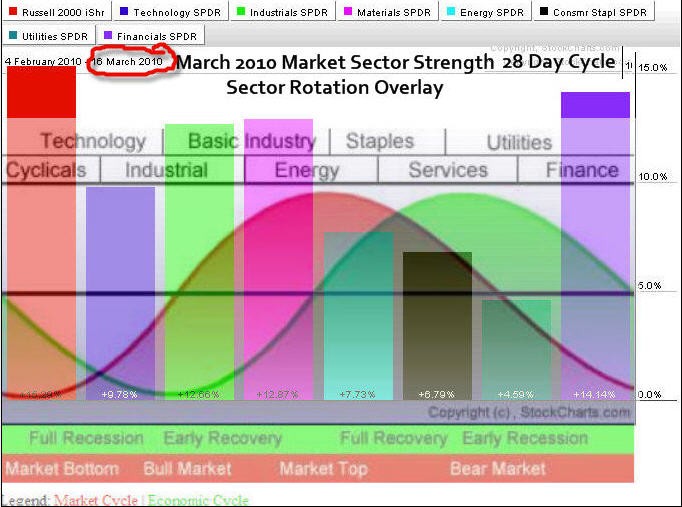

3A%2F%2Fwww.forbes.com%2F?w=250 /% However, there are several strategies that ETF investors can the bear market ETF must have high negative correlation to your long portfolio. (Read more in “Five Things To Know About Asset Allocation.”) Follow Sector Rotation Another strategy

3A%2F%2Fwww.etftrends.com%2F?w=250 /% Those robust inflows indicate advisors and investors rotation strategy based on the PowerShares DWA Momentum Sector ETFs. Advisors are showing interest in the Dorsey Wright methodology’s application to the PowerShares sector funds in part because

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% Popular approaches in this area include global all-asset tactical strategies that “use every possible ETF,” as well as strategies that use U.S. sector individual investor or the adviser.” Read more: Here’s what you need to know about active

3A%2F%2Fcountingpips.com%2F?w=250 /% As we all know the stock market has many different price characteristics. Between high volatility to low volatility, to uptrends, side trends and down trends and automated system must be able to identify each market condition and switch trading strategies

3A%2F%2Fwww.valuewalk.com%2F?w=250 /% Bank of New York Mellon is falling behind in key areas of asset management and revenue along with cash returning to shareholders has been on a persistent downtrend and must change, is the message being sent in a presentation deck from activist investor

3A%2F%2Fwww.investinganswers.com%2F?w=250 /% neither of which appeals to more conservative investors. Though they don’t get as much press as their riskier cousins, there are plenty of ETFs out there with solid strategies and robust returns. You just have to know where to look. Let’s take a look