3 Reasons Your Investment Portfolio Should Have a Clearly Defined Objective

Post on: 14 Апрель, 2015 No Comment

Give Your Portfolio a Job Just Like You Would an Employee

Before you invest a penny, you should be clear about what your investment objectives are. Otherwise, your portfolio is like a rudderless boat in the ocean. John Lamb / Photodisc / Getty Images

Now that you know the answer to the question, What is a portfolio? , we need to talk about the importance of clearly defining an objective for your own portfolio holdings.

Your money is like an employee. It’s purpose is to go out and earn more money for you, bringing it back so you can spend, save, reinvest, or donate the new funds without having to go out yourself and sell more of your time for a paycheck. If you’ve managed your financial affairs wisely, when you reach retirement age, your portfolio should be large enough to replace the household income you need, allowing you to maintain your standard of living even though you are no longer punching the proverbial time clock.

In practical terms, that means before your buy your first share of stock, acquire your first piece of real estate, write a check for your first mutual fund, or put aside cash to fund the purchase of your first bond, you need to sit down, take out a pen and paper, and write down a concise, two to three sentence explanation of the job you are giving your portfolio.

This process — defining your objective — is the very first step in crafting your own investment policy manual. There are many different types of objectives you might pursue, such as:

- Generating the highest amount of risk-adjusted passive income as possible, at the expense of growth, so you have more household income from your assets

- Growing the principal as fast as possible, at the expense of current passive income, so you have more money in the future

- Protecting principal (e.g. a portfolio of cash equivalents meant to be used as down payment money )

There are three reasons you should make your portfolio objective as explicit as possible. Let’s talk about each individually.

1. Defining Your Portfolio Objective Helps You Lower Your Investment Risk

When you know what you should be doing, you can avoid securities and assets that don’t fit with your goal. Imagine, for example, that you sold a business after a very successful career. Suddenly you have $5,000,000 in cash. You are 60 years old. You decide to take $2,000,000 of this and put it in intermediate duration tax-free municipal bonds. The purpose of this portfolio, the objective, is to always provide a safe, emergency source of backup household income that generates at least $60,000 per year in cash that you can live upon, even if all your other sources of income get cut off completely.

If that is your portfolio objective, it doesn’t matter if stocks crash and they are dirt cheap. It doesn’t matter if the investment of a lifetime comes along. You don’t buy it. Any deviation from your portfolio’s objective is a failure on your part. The entire purpose of having an objective is to make sure you never wake up in a position of having lost money you can’t afford to lose, or coming up short from the amount of cash you need. Many times, that requires turning down interesting opportunities.

2. Defining Your Portfolio Objective Helps You Avoid Mistakes

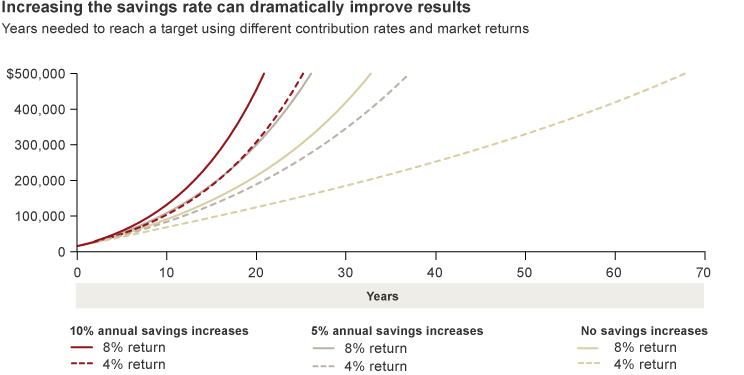

When you have a clearly defined portfolio objective, it is sometimes easier to spot mistakes in thinking. Say you wanted to build a very successful long-term collection of blue chip stocks to be held for the next 25+ years. You don’t want a lot of activity. You want to find a few, great companies, buy them, reinvest your dividends, and let compounding work its magic.

As you look for potential holdings to add to the portfolio, keeping the objective in mind can help you avoid adding something that might appear attractive on different grounds, but won’t fit with your goal. Say, for example, you find a very cheap car company. It might be a very undervalued asset. It might make a lot of money. Car companies are cyclical. They are not particularly good long-term holdings; certainly nothing like the performance you’d see with a Procter & Gamble. Colgate-Palmolive. or Coca-Cola. assuming your cost basis was rational relative to earnings and assets. Thus, no matter how attractive it appears, it has no place in your portfolio. Put it somewhere else if you must own it. Stick to your mission.

3. Defining Your Portfolio Objective Keeps Your Eyes on the Finish Line

One of the big traps investors seem to fall into is amassing more money for the sake of more money. It’s a fool’s game. Money is only useful to you for what it can do. Once you have enough to meet your particular needs and desires, your primary job is to protect it. Don’t keep escalating your commitments to certain assets simply because it has worked in the past. Spread your capital to enough places that you can survive a crashing stock market, a plummeting real estate environment, a recessionary business cycle, or even a banking crisis. You don’t want to be like the Texas oil millionaires of yesteryear who made vast fortunes, only to keep plowing all of their money back into oil. When the bottom fell out, they were forced into bankruptcy court and some ended up losing everything, working minimum wage jobs. It’s a foolish way to behave.