3 Reasons Why Municipal Bonds Could Be A Bad Investment RIght Now

Post on: 16 Март, 2015 No Comment

April 27, 2014

I have written at length about municipal bonds and will continue to harp on this issue until I am blue in the face. I believe the opportunity is far too great to ignore. Other than investing in mid-large cap dividend paying companies I do not know of a better way to compound your wealth passively.

What Is A Municipal Bond?

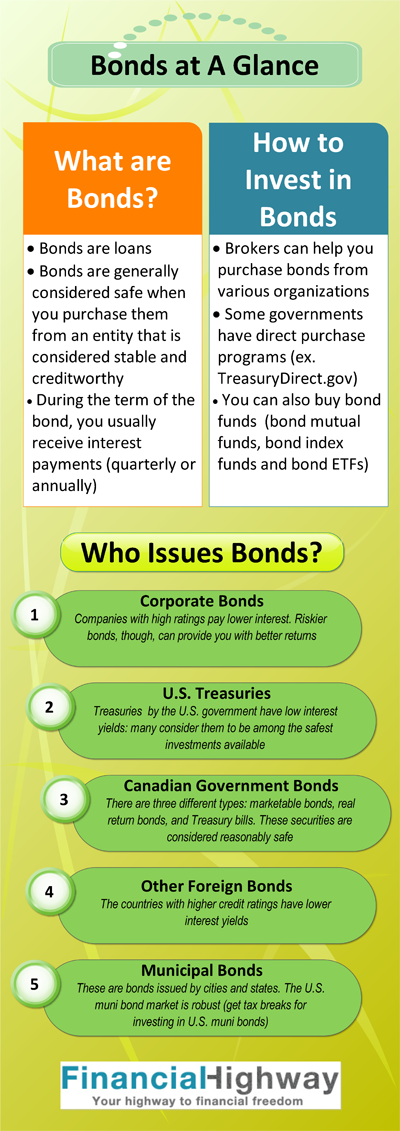

When a local government wants to construct a new toll road, school, or facility they typically have to borrow the money because they do not have the necessary funds available at that time. In order to acquire the necessary funding the local government obtains a loan from the public, this is “note” is called a municipal bond. As with any loan there is an established amount that is borrowed, an interest rate, and a specific payback date. The government then agrees to pay back the money it borrowed through revenues from the municipality or state. These revenues may come from the taxes of residential real estate, businesses or tolls. As an investor in municipal bonds you are technically the lender and can now consider yourself “The Bank.”

Are Bonds A Good Investment Right Now?

I cannot say with absolute certainty but I am 97.99% sure there will be a crash in the bond market within the next two years. You may think that is a bold statement, and youre absolutely correct. That is a bold statement but I want you to take a couple of things into consideration for a moment:

Interest Rates – The benchmark for all bond investors and most investors in general is the 10 year U.S. Treasury. If you need a point of reference, consider the 10 yr U.S. Treasury the S&P 500 of the bond market. For bond investors the amount of risk they take with their investments is generally determined on the current yield of the 10 yr U.S. Treasury.

For example, if the current yield for the US Treasury is 3% a bond investor would want a yield higher than 3% because the general assumption is that the U.S. Government is the most credit worthy and will never default on their loans. With that concept in mind, simple logic tells you as an investor that your baseline for any investment should be a 3% return. Any investment return lower or equal to 3% is a waste of time, money, and resources.

Yield Hungry Investors – From looking at the photo below you can see the 10 yr U.S. Treasury has been sliding for the last 20 years.

This has been an absolute nightmare for investors seeking income.

- In 2000, a portfolio of $1,000,000 invested in the 10 year U.S. Treasury would have yielded $67,500/year

- But in 2014, a portfolio of $1,000,000 invested in the 10 year U.S. Treasury only yields $26,660/year

That’s a reduction in income of about 60%. In the meantime, everyday items that you and I purchase have done nothing but get more expensive. Take a look!

Coffee prices have doubled!

Corn prices have more than doubled!

Sugar has tripled!

Tobacco has increased 10 fold!

Wheat has almost tripled!

The price of crude oil has quadrupled!

Almost everything we use in our everyday lives has increased in price since 2000!

The Underlying Problem With The Bond Market

Rising prices in consumer goods have done nothing but force individual investors to take on more risk by chasing higher yields in the municipal bond market in order to keep up with increasing prices in almost every aspect of their lives.

Specifically bond holders have been “bidding up” the price of municipal bonds while looking for yield. The redeemable value of a bond commonly referred to as “par value” is $1,000 and the interest it pays is referred to as “the coupon”. For example a new bond issuance will look something like this:

Par value of $1,000 @ 5% for 5 years

This means that the coupon payment will be $50 a year for owning that bond, which will total $250 at the end of 5 years. I have seen investors pay $1100 for a bond knowing full well once it is redeemed they will only receive $1,000 in return. Investors who pay more than par value are willingly accepting a lower return on their money and thus lower income payments.

For the individual investor who paid $1,100 for the bond they would receive approximately 4.5% a year on their investment but lose $100 on their principal after 5 years. While this return on investment is still higher than the current 10 year U.S. Treasury rate you can start to see how investors hungry for income can bid up the price to insane levels.

Fiscal Irresponsibility & Obligations – Hundreds of municipalities are facing serious budget issues. This is due to a number of economic factors but one of the most notable being pension obligations. Over the last several decades local governments and municipalities have made numerous promises to their employees in regards to retirement. These promises include but are not limited to pensions, medical benefits, etc. This sounds good and fair in theory but what most governments are noticing is that these retirement obligations are putting a significant strain on their budget especially if a municipality is no longer receiving the income they once did.

Overwhelming Panic & Stampede towards the Exits

If you take the 3 issues I outlined above you have what I call a perfect storm. Here is what I mean:

1. Interest rates are at all time historic lows, I cannot pinpoint when they will rise specifically but interest rates have to rise eventually. This sounds so basic but it’s the law of economics, interest rates cannot stay here forever. When they eventually rise, investors will no longer need to take the risk they once were and pay premium prices for municipal bonds because they will be able to get similar yields through the U.S. Treasury.

2. Once investors realize they can gain 4-5% and possibly even more through simple U.S treasuries they will exit the municipal bond market in droves. When this happens you may see some bonds trading at a discount to “par value” meaning you could buy a bond for $950. For new investors this would allow you to accrue a capital gain while receiving interest payments until maturity. But for investors who are looking to exit they may have to take larger losses than expected.

3. Once local governments start declaring bankruptcy I believe this will lead to what I consider the checkmate of the bond bubble. Once the mainstream media catches wind and reports the mass exodus from the bond market in general, regardless of the underlying bond the emotion, fear, and potential loss of investments will be far too great for the general public. Investors will simply want out and will be willing to cash out whatever chips they have left. It happens in every market crash.

How to Survive the Unavoidable Bond Market Crash

There are two primary ways one can purchase Municipal bonds.

You can buy the bond outright through your broker at issuance or in the secondary market – An individual who invests in the bond directly has his or her initial investment tied to that bond. In the unfortunate event of a bond collapse/meltdown the individual who bought the bond outright can evaluate the risk of the bond and make the decision to hold or sell. Additionally the investor runs the risk of their bond possibly defaulting and losing their entire investment. I believe these situations will be few and far between.

You can purchase numerous municipal bonds through an ETF or mutual fund – This option immediately gives you diversification in the municipal bond sector, protecting you from a massive loss if a single bond goes into default. While this is far easier, there is a huge risk that needs to be identified. In the unfortunate event of a bond collapse/meltdown the individual who invested in the ETF or mutual fund is stuck holding a stock that is declining in value with no guarantee of their initial capital. Remember ETFs and mutual funds are not bonds themselves and are therefore non redeemable.

You must remember how bonds operate. All things being equal, the market value of the bond may decrease but if the municipality does not default then the investor who purchased the bond outright will receive the par value of the bond at the end of its term. While the individual who purchased the bond fund runs the risk of the stock losing significant value during a sell off during a market collapse.

How to Safely Invest in Municipal Bond ETFs or Mutual Funds

A lot of investors have heard of mutual funds but I’m willing to bet, not a lot of investors have heard about closed end mutual funds. Your average investors who pile into mutual funds through their 401ks or IRAs are contributing to open-end funds.

Open-end funds issue as many shares as investors are willing to buy. So when mom and pop investors invest more money into this type of fund, the fund simply creates more shares, then turns around and buys more shares of the underlying stock/bond at the current price. Because of this, the price you pay for one share of an open-end fund will always be the total value of the overall portfolio divided by the current number of shares outstanding. This is called the “net asset value (NAV).”

Closed-end funds are completely different, they issue a limited number of shares. If mom and pop investors want to buy these shares, they must go into the stock market where they trade like a normal stock. Therefore in order to buy a share of a closed-end fund, another investor must be willing to sell their shares. Because of this, closed-end funds fluctuate considerably more than open-end funds in share price but this is not a reflection of the actual NAV of the fund’s portfolio.

In short the underlying assets in closed end funds always remain the same and so do the number of shares they issue. In relation to municipal bonds, these types of funds will not let additional shares dilute the fund. Instead they allow “the market” to determine the price they are willing to pay for the assets in their portfolio.

What Am I Doing With My Money?

I have personally invested in a closed end municipal bond fund and plan to add to my position significantly during the coming bond market collapse. I have my trailing stops in place to ensure I do not lose a significant portion of my investment capital but I literally believe I can make a small fortune in the municipal bond market during this inevitable situation.

Do you have any plans to invest in municipal bonds?