2013 Investment Tax Rates

Post on: 26 Апрель, 2015 No Comment

Now that a new year is underway, its time to start thinking about taxes, and what you can expect for 2013. Investors have some new taxes to think about at least those investors who are considered rich have more investment taxes to think about.

As you plan your investing tax strategy for the new year, heres what you need to know:

Long-Term Capital Gains and Dividends

The passage of the fiscal cliff tax deal added a 20% bracket for long-term capital gains for top earners. The good news, though, is that dividends retain their favored status of being taxed like long-term capital gains.

For many investors, this is good news. Instead of being taxed at your regular income rate on your investments, you might be taxed at a lower rate when you have long-term capital gains or dividend income.

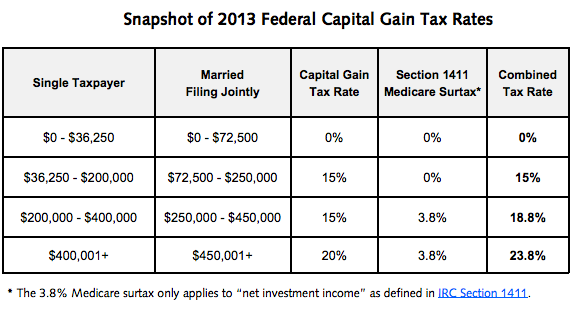

The 20% top rate doesnt apply to everyone. Only single filers earning more than $400,000 a year and joint filers making more than $450,000 a year, and heads of household making more than $425,000 a year are subject to the new higher rate for long-term capital gains and dividends. For other investors, the rate is 0% for those making up to $36,250 (single), $72,850 (joint), $48,600 (head of household). Everyone else pays 15%.

Medicare Surtax from Obamacare

Provisions from the Patient Protection and Affordable Care Act (PPACA, also called Obamacare) have been implemented over time, starting in 2010 when the law was passed. In 2013, a Medicare surtax is being instituted. This is a 3.8% extra tax on unearned investment income for those at certain Modified Adjusted Gross Income (MAGI) levels.

The tax will apply to capital gains, sale of investment real estate, interest in a business in which you do not materially participate, and other investment income that is concerned unearned by the IRS. Its a good idea to check with a knowledgeable and trusted tax professional to find out whether or not your investment income qualifies.

If you make more than $250,000 filing jointly, or $200,000 filing singly, you are subject to this tax.

In order to reduce your exposure to the Medicare surtax, you can look for ways to reduce your MAGI. Find out which deductions are allowed, and how you can finagle things a bit so that you come in under the threshold. This can be especially helpful if you are just over the edge, and would like to avoid the 3.8% surtax if you can. You can also take steps to ensure that you are a material participant in your business interest, or that you meet the designation of real estate professional. This can help you shield some of your income from the surtax.

Bottom Line

Its a good idea to check you tax situation each year. There are always new laws related to taxes, and you need to stay on top of them. The earlier you find out about new tax policies, the more time you have to set up a plan that will help you legally reduce your tax liability throughout the year. Its times like these a good accountant can be quite valuable.