101 Reasons Why A Capital Gains Tax Is A Howling DOG!

Post on: 20 Апрель, 2015 No Comment

101 Reasons Why A Capital Gains Tax Is A Howling DOG!

As John Key said in one of the recent televised debates, ….if it looks like a dog and smells like a dog — it’s a dog! John was describing Labour’s recent Capital Gains Tax (CGT) policy.

We have in fact had this debate for decades. Every time that common sense and investigative journalism finally prevails it has been proven beyond doubt that it is an expensive tax to administer and doesn’t produce the sort of revenue that was ever hoped for. And for good reason.

C.G.T. is a D.O.G.! Numerous countries have tried it and the sane ones have dumped it – the rest still suffer from it.

It’s disheartening to hear the leader of the opposition, David Cunliffe say property speculators don’t pay tax. It’s incorrect of course and it is misleading the voting public.

Vote snatching

The only reason that I can see for any political party to promote what I call a ‘State sanctioned theft’ is to embezzle a few miserable votes from the particularly naive ‘Greed & Envy Brigade’. There is no other logic for it!

This “policy” (which is an Antonym) pulls the votes of a few snivelling pack animals who must look over the fence at the hard working neighbour with a tidy house and a rental property or two, and say something ground- movingly insightful like, “It’s not fair!” Without giving an ounce of thought to the fact that the neighbours have got off their butts, taken personal responsibility for their family; skimped, saved and gone without; taken calculated risks; listened to countless excuses as to why the rent hasn’t been paid, or why there’s a hole in the wall; worked week-ends cleaning some other bugger’s mess; and finally prevailed after 10 to 20 years of hard graft.

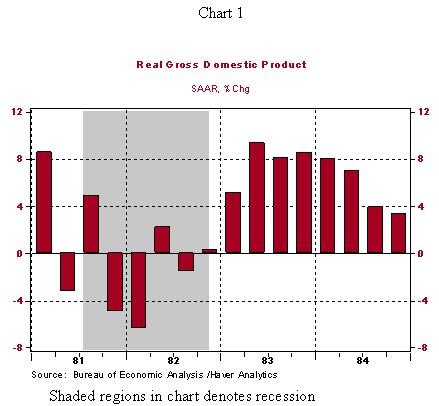

Crystal-ball gazing

Let’s play Devil’s Advocate for a moment and gaze down the Capital Gains pathway. This is what a future with CGT would look like:

• People would simply hold on to property for longer

• The supply would naturally dry up

• Less sales means less CGT would be recovered

• When supply is restricted, prices go up

• With prices higher than they would be without a CGT it is even more difficult for people to get their foot on the property ladder

• There’s your 101 – Economics 101!

The Real Barking Dog

BUT, what really infuriates me are the mutts who incessantly yap at our heels, howling on with this absurd wail for mediocrity. The proper response is, “Get in behind ya mongrel — we need another #$@%& tax like we need another hole in the head!”

Rather than adding a tax for the buffoons in Wellington to waste on pet projects, paper shuffling and gerrymandering, we should all be talking about stripping them away and leaving money in the community to help build a prosperous and democratic New Zealand; free of State theft, waste and interference. Now, that is something worthy of my vote!

Now, back to the real world

If you would like your interests and your investment property represented by a specialist Real Estate Agent with in depth knowledge of in the Property Investment Industry, where to promote your property cost effectively, and with his own database of active investors, then check out my website www.johnmay.co.nz or call me on Ph: 021 980-770.

Regards,

John May

PS. If you have received this from a kind, caring friend or even a wayward source and would like to receive my News, Views & Property Listing first hand — just Click Here .

PPS. If you have friends, neighbours or family who own an Investment Property, they might like access to FREE Tenancy Forms, Click Here ; or my Free eBook, “Never Have Another Vacancy Again!” Click Here . Just send this newsletter on to them.

Disclaimer: Whilst every care is taken in the preparation of our content, all material is written as opinion pieces and general guidelines only. As such, no responsibility is accepted for the information contained herein. Appropriate legal and/or professional advice must be obtained by any reader or recipient at all times. Please Click Here for our full disclaimer.