Your Market Edge Combine Technicals Fundamentals

Post on: 11 Май, 2015 No Comment

When I started my investment and trading career I utilized my knowledge and education of fundamental analysis to determine the best investment ideas. There is nothing more satisfying than peeling the onion back of a company, analyzing the ins/outs and making the correct read. In the long run, fundamentals certainly win out over any other method.

In school, I learned how the efficient frontier mattered most as it relates to portfolios, and that efficient market theory ruled the day (all available information is reflected in stock prices).

Simply put, you have no edge over the market (or so I was told), and any alpha delivered was purely driven by manager skill. Yet, I had my doubts about this theory and whether other tools could exploit an advantage. Further, I was taught bits and pieces about technical analysis, told by professors this was just ‘voodoo,’ followed by only a few and really had no place in security analysis. Right then and there, I was interested in learning more about technical analysis.

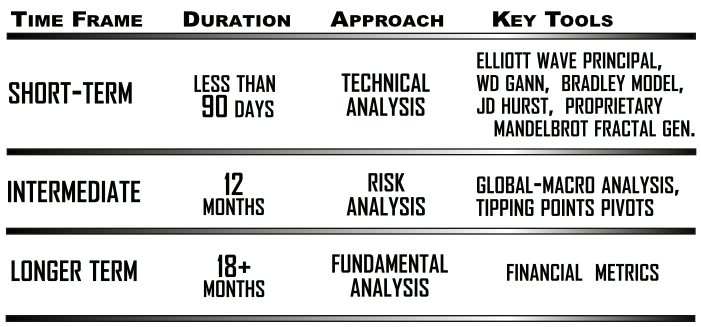

I bring this up here because I have been able to see value from both methods, and using them in combination gives me a far greater than only using one or the other. Fundamental analysis is an exhaustive search for value for current price.

There is no arguing against the numbers, a company’s valuation is based on performance and growth prospects. A multiple can be assigned to a company demonstrating a growth rate far better than its peers. In the long run, nothing better explains a stock price and performance.

Macro issues are always a determining factor — what is the Fed doing? Is the economy shaping up? How about emerging markets, are they safe to bet? How about our trading partners? Is China still growing by leaps and bounds? We must never underestimate the power of uncontrollable macro factors over any timeframe.

Yet, in the short term other factors come into play that are not explained by the fundamentals. Sentiment is one —the emotional reaction of investors/traders to price moves, news and events. In the realm of finance we live in a world where fear and greed dominate our decisions, and it’s usually at the wrong moment.

I look for ways to examine the emotions and psychology of the players in the market, technicals and charts give me that edge. In a crude sense, a price chart is a compilation of fear and greed, the emotions running fast through the markets. Further, I can use technicals to measure commitment and participation (volume and levels).

Finally, looking for trends and patterns that repeat over and over again. Human behavior never changes (think fear and greed), so I look for the same patterns to arise at different moments in time, and anticipate the next move.

Bottom line, combining technicals with a good sense of fundamental analysis is a great way to gain a market edge.

= = =

Bob Lang has been managing private options trading accounts for clients since 2004 and providing subscribers with guidance on trading options for income at Explosive Options since 2011. Connect with Bob Lang on: Twitter, Facebook, Google+, LinkedIn.