Your Fiduciary Responsibility A Better 401 K

Post on: 18 Июнь, 2015 No Comment

Consistently reviewing and improving your 401(k) plan results in larger financial benefits for you and your employees. Your attempts to make sure your plan is of the highest quality possible will be well rewarded.

Additionally, ensuring your plan is well managed results in you meeting your fiduciary duty. Serving as a fiduciary to your plan participants is an enormous responsibility and a job well done is one you should be proud of.

Fiduciaries have important responsibilities and are subject to certain standards of conduct because they act on behalf of the participants in the plan. These responsibilities include:

- Acting solely in the interest of plan participants and their beneficiaries, with the exclusive purpose of providing benefits to them;

- Carrying out their duties with skill, prudence, and diligence;

- Following theplan documents(unless inconsistent withERISA);

- Diversifying plan investments;

- Paying only reasonable expenses of administering the plan and investing its assets; and

- Avoiding conflicts of interest.

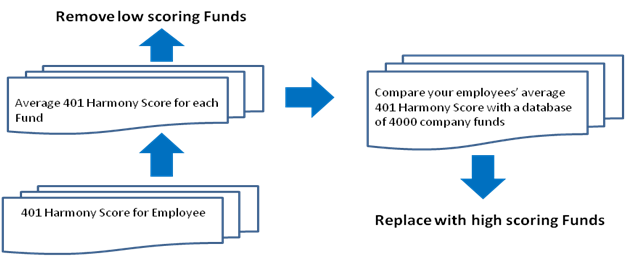

The fiduciary also is responsible for selecting the investment providers and the investment options, and for monitoring their performance.

Fiduciaries that do not follow the required standards of conduct may be personally liable. If the plan lost money because of a breach of their duties, fiduciaries would have to restore those losses, or any profits received through their improper actions.

Many small business owners mistakenly believe all plan service providers are the same (or very similar) and that once a plan is established and providers chosen, their responsibility ends. The truth is that there are wide variations in plan service provider costs and quality. As your plan needs change, so may your need for different plan providers.

Many small business plans pay far too much in fees and many have undesirable investment options. The fact is, if your plan has excessive costs and lower quality investments, you are not fulfilling your fiduciary responsibility.

A fiduciary who does not take their responsibility with the utmost seriousness is taking a big risk. As a small business owner, why subject your personal assets (including your business) to any kind of risk by not properly managing your plan?

Has some time passed since you last reviewed your plan? Contact us here to set up a no cost no obligation review.