XJO Iron Condors August Update Low Risk Income Strategies

Post on: 10 Июнь, 2015 No Comment

Note to new readers: This is a regular update on the status of our XJO Iron Condor Model Portfolio. Please read the setup post first in order to understand the objectives and the rules for trading this model portfolio.

Another month has passed and it is time for another update on our XJO iron condor model portfolio.

August was an exciting month as XJO finally broke above the 5550 resistance to reach new highs at the end of July, then corrected over 200 points in early August before resuming the rally again.

The XJO settlement price was 5682.2 upon options expiry on August 21 so our August 5675 short call was ITM by 7.2 points or $1440 for 20 contracts. After deducting the losses on our short calls, our net profit for August was $540 after brokerage.

So far we have had 8 winning months and collected $14,760 in gross premiums as shown in the table below. We will track our performance is a similar manner as 10percentpermonth.com, who do not include commissions as this will vary from broker to broker.

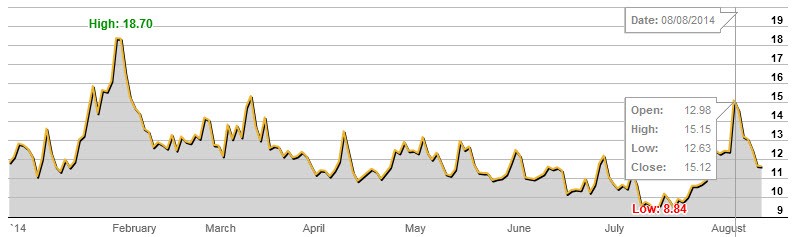

As volatility was so low in July, I decided to increase the duration of our trade in order to get wider “wings” in our iron condor. I was not comfortable with our 400 point wide iron condor in August. I opened our September trade on July 25, which was about 8 weeks to expiry. It turned out that extending duration was not really necessary as volatility spiked from a low of 8.84 in late July to a high of 15.15 on August 8 (see chart below), two weeks after I put on our September trade! As we do not have a crystal ball, we just have to take the best course of action based on the information we have at the time.

Just like our August trade, I sold a 200 point put credit spread (5275/5075) at close to 90% OTM probability for a net premium of 10 points or $1000 for 10 contracts. Similarly, I sold a 100 point call credit spread (5750/5850) at around 86% OTM probability for a net premium of 6 points or $1200 for 20 contracts.

By selling both call and put spreads, we collected a total of $2200 just like previous months. The total margin required for this iron condor is $17,800. Our maximum profit for September is $2,080 which we will get if XJO is trading between 5275 and 5750 when these options expire on September 18. The width of our September iron condor is 475 points (5750 – 5275).

The long rally in July caused the call side of our August iron condor to be tested, which sparked off some interesting debate with some experienced option traders on managing iron condor trades. When we set up this model portfolio, our risk management plan was to do no management and leave the trade on until expiry. This was because the “muse” for this model portfolio is my younger blog audience who still have full time jobs and do not have time to watch the markets and constantly make adjustments. Another reason for not doing active management is because we expect the XJO price to touch our short strike 20% of the time. Although the Probability of expiring ITM (PITM) for our short strike is 10%, the Probability of Touch (POT) is 2 x PITM so there is a 20% probability that the short strike will become ITM sometime during the life of the option, but not necessarily expire ITM. A more detailed discussion on POT can be found in my March update.

We only manage risk on order entry by

- selling options with high probabilities of expiring OTM

- sizing our positions appropriately

- extending duration to get wider wings

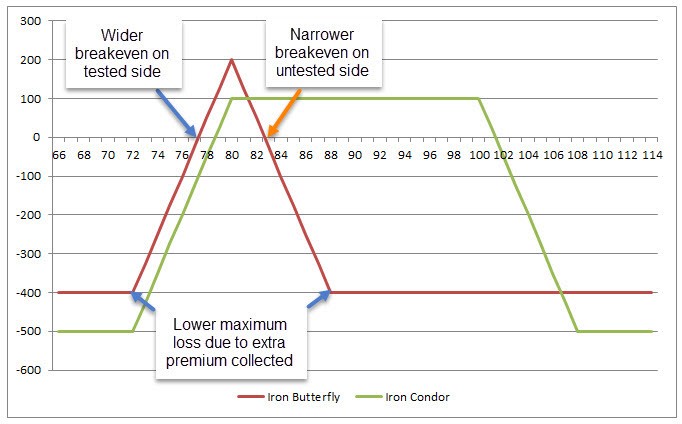

- widening credit spreads to increase our breakeven points and to reduce our likelihood of hitting maximum loss.

One experienced trader kindly shared with me some interesting tips which he got from Tasty Trade (TT) on managing option income trades (thanks Robin!). TT is a truly awesome free website / financial network dedicated to trading options. TT did a 2 year study on SPY comparing the results of a few popular trade management techniques such as rolling the tested side up in strike price or out in time when delta reaches 0.3 (or 30% probability ITM). For example, in the case of our August iron condor, our call side would be the tested side when XJO rallied up in July. An active trader would typically roll the August 5675 short strike up to a higher strike price, or roll it out to September. The results of the study are shown in the table below:

As you can see from the table, rolling the tested side does not provide a better result compared to No Management, so doing nothing is not such a bad idea after all! After many years of trading, I have to agree there is much merit in the KISS (Keep It Simple Stupid) principle. However, the same SPY study also shows that we can improve our performance if we roll the untested side up.

I have experimented with doing this in my personal account (using a very small number of contracts of course). When the delta of my September 5250 short put reached 0.3 on August 8, I rolled my 5725 September short calls down to 5625 and collected some additional premium and I now have an iron condor that is only 375 points wide. XJO has rebounded since that day and these 5625 short calls are now being tested (yikes!). I am not so sure if the additional premium will be worth it, especially if this new short call expires ITM on September 18! I will let you know how this goes in my next update.

There were also many other studies done by TT that showed managing “winners” was a superior trade management strategy compared to managing “losers”, which is what most iron condor traders are taught to do. They also had other studies which showed that there was no advantage in having stop losses in defined risk trades like iron condors. This video “What’s Undefined Risk? ” which includes a 6.5 year study on selling SPX strangles since the start of 2008, has helped me overcome my fear of hitting maximum loss, something I experienced when I was trading iron condors in October 2008. I am finally convinced that the risk of hitting maximum loss is not significant enough to warrant stop losses, so we will not be putting in stop losses from now on in our model portfolio.

I will provide another update after the September trade expires on September 18. If there are any readers out there who are trading XJO iron condors, I would like to hear from you. Please share your experience by leaving a comment or sending me an email. Thank you to all who have taken the time to share your knowledge with me.

Disclaimer. This post is for educational purposes only and should not be treated as investment advice. This strategy would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek investment advice if required.