Woodford Equity income funds “the natural home” for retirement investors

Post on: 1 Май, 2015 No Comment

This site uses cookies. Some of the cookies are essential for parts of the site to operate and have already been set. You may delete and block all cookies from this site, but if you do, parts of the site may not work. To find out more about cookies on the website and how to delete cookies, see our Privacy and Cookie Policy.

Woodford: Equity income funds “the natural home” for retirement investors

Equities should be the natural home for the majority of investors in retirement, according to star manager Neil Woodford, who believes lower risk products may not give them the income they require.

Woodford (pictured ), who has run both equity and mixed asset funds in a career spanning more than 25 years, thinks investors and advisers have a too cautious approach to retirement, pointing out that the average retiree is a long-term investor in their own right.

While Woodford welcomes the decline of annuities, viewing them as unbelievably poor products, he says investors would be better off keeping it simple and opting for a core equity income fund rather than trying to find a more complicated vehicle to fill the void.

Investors in the private sector can expect to retire at around 65. Based on that, youre looking at a time horizon of at least 20 to 25 years. Why someone in that position isnt a natural owner of equity is beyond me, he said.

A raft of new products are expected to be launched in the aftermath of the pension reforms due to kick in this April. A number of global multi-asset income funds from the likes of Threadneedle and Schroders have been launched in recent months, and many other similarily structured products from retail banks and life companies are expected to follow.

While Woodford sees the benefits of multi-asset income funds, he says the vast majority of investors dont need the diversification and risk aversion that they offer.

If you have a long-term time horizon, why do you need to obsess over protection? You dont have realisation risk, he said.

If youre living off the income, why not look to a long-term asset that gives you capital growth, thus allowing you to collect more income?

Woodford adds that any product that seeks to guarantee an income should be all-out avoided.

I think people are sometimes too sophisticated about this kind of thing. For too long have people been on the receiving end of poorly constructed products that are complicated and expensive, he said.

Im always dubious about guaranteed products. The costs always seem to outweigh the returns youre ever going to get.

Gary Potter (pictured ), co-head of multi-manager at F&C, runs a number of multi-asset funds including one with a specific focus on income: the 1.1bn F&C MM Navigator Distribution portfolio. He agrees that equity income funds are suitable for many investors in retirement, though for those with a shorter-term time horizon he says a greater layer of insulation is needed.

If your retirement is a long one Id have to agree with [Woodford], but it depends on what your objective is, said Potter. In general, if youve got 15 years or more and are looking for total return, Id agree equities make the most sense, but everyones got different pots doing different jobs.

If youre a 55-year-old and have just been made redundant and dont get your pension until you are 60, you might want to go for an enhanced drawdown vehicle which is very low-risk. If youre 60 and arent as reliant on income on a regular basis, you can go for more growth.

Potter adds that multi-asset income funds may not give investors the protection they need even in the shorter term, giving further support to the case for equity income.

Its my view that multi-asset income funds have yet to be properly tested. Multi-asset means investing in equites, bond, infrastructure, commodities, investment trusts and so on, and are therefore diversified, but if you look at where we are in the cycle valuations across the board at very high levels, he said.

Ben Willis, head of research at Whitechurch Securities, also sympathises with Woodfords view and thinks a greater number of investors will be more open to equity income funds in the future. At the moment, however, he expects global multi-asset income to be the natural replacement for annuities.

It comes down to what investors attitude to risk is. People are naturally used to building up a pension pot over many years and dont want it exposed to any risk, said Willis (pictured ).

Multi-asset income funds are making all the right noises. They can deliver an attractive income which they can hopefully grow, are less volatile than equities and over the long term will deliver some capital growth as well.

As people get used to the legislation, however, and realise they can do whatever they want with the money theyve made, there could be a shift towards higher-risk products. If youre looking at yourself and have a 10, 15, 20-year time horizon and are feeling fit and healthy, you can afford to stomach a bit more volatility.

Investors who rely on dividends on a monthly basis are probably better off going for a multi-asset income fund, says Willis, as their income stream is much more diversified. Over the long term, however, he says equity income managers are in a better position to deliver income growth.

It again comes down to your appetite for risk. If youre in equities then the capital base has more potential to grow, but there is also more risk to that in the short term.

Among the best income-payers of the last 15 years are a handful of UK equity income funds, including Adrian Frosts Artemis Income portfolio.

According to FE data, a 1,000 investment 15 years ago has delivered dividends in excess of 920. This puts it ahead of popular multi-asset income funds such as Jupiter Merlin Income .

Income earned from 1,000 investment since July 2000

Willis says investors who are considering equity income in retirement should look for managers who prioritise both income growth and capital protection.

Woodford has a phenomenal track record of risk-adjusted returns. Hes done it time and time again, he said.

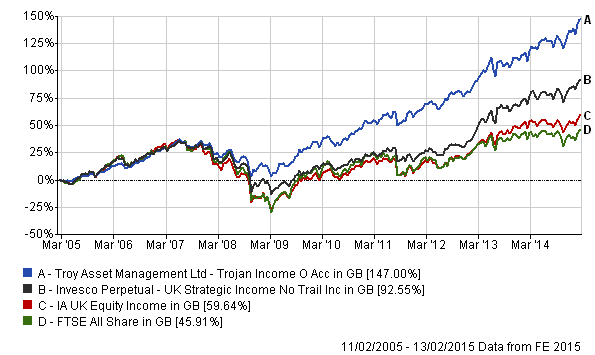

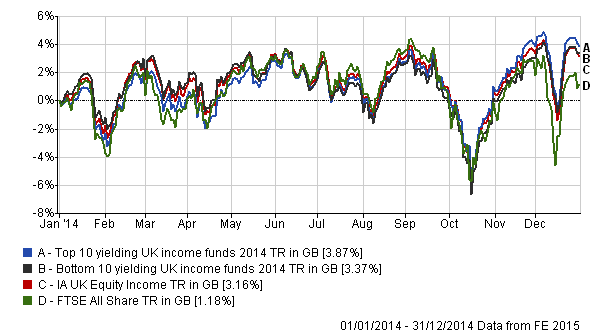

Other equity income managers that have a proven record of protecting investors on the downside include Trojan Incomes Francis Brooke, Invesco Perpetual UK Strategic Incomes Mark Barnett, Newton Global Higher Incomes James Harries and Murray Internationals Bruce Stout.

All significantly outperformed their peers in the down years of 2008 and 2011 from a capital growth point of view, and are sector-toppers from a total return point of view over the long term as well.

Capital growth performance over 10yrs

He says enhanced income products that use call options such as Schroder Income Maximiser and Fidelity Enhanced Income are also attractive options, though their very punchy yield targets mean they are susceptible to dividend cuts.

Even if investors find the ideal equity income manager, Willis says its still important to give portfolios an element of diversification.

Just holding a UK equity income fund is too narrow, says Willis, who believes in the very least investors should hold a basket of equity income funds with exposure to developed and emerging markets.

He adds that investors who opt for equity income funds will most probably need to reduce their risk exposure as they get older.

You cant just sit back. Similar to the build up to retirement, youre going to need to lifestyle your pension pot so that youre not 100 per cent in equities at the point of realisation, he said.

FE Trustnet will highlight some of the equity income funds that could be set to fill the void left by annuities in a number of upcoming articles.