Will DoddFrank Alter Corporate Hedging

Post on: 16 Май, 2015 No Comment

New rules will boost costs for swaps dealers. As dealers pass those costs on to end users, companies could decide to change the way they hedge.

As Congress enacted the Dodd-Frank Act of 2010 and regulators wrote rules to implement the changes it mandated in over-the-counter derivatives trading, companies have been lobbying long and hard to protect their ability to use such derivatives to hedge their risks. And while they won the battle, they may have lost the war.

As the Dodd-Frank rules and other regulatory changes take effect for dealers, the cost of using OTC derivatives is expected to rise, a development that could push corporates to alter the way they hedge in spite of the exemption they won from many Dodd-Frank rules.

Traditionally, corporates have gone directly to their dealerstheir banksto put on over-the-counter (OTC) trades to hedge such exposures as foreign-exchange and interest-rate risk. Such bilateral trades with dealers usually werent cleared. Companies use OTC derivatives rather than exchange-traded products because one of their key goals is to achieve a structure that closely replicates the time frame and cash flows of the risk being hedged so that the derivative transaction qualifies for hedge accounting.

In the wake of the financial crisis, Congress enacted Dodd-Frank to increase the transparency and stability of the derivatives market by requiring that derivatives market participants clear their trades and report more information about them. Companies that qualify as corporate end usersnonfinancial companies that use derivatives to mitigate their risks rather than to speculateare exempt from many of Dodd-Franks provisions, including the requirement to clear trades.

But Dodd-Frank and other regulatory changes, such as Basel III, the new global regulatory framework on bank capital requirements, will make it more expensive for dealers to trade OTC derivatives. Dealers are expected to pass those cost increases on to their customers.

And the question isnt whether using OTC swaps will be more expensive, but when the cost will rise and by how much, according to Luke Zubrod, a partner at Chatham Financial, a financial risk management advisory firm. One of the factors boosting dealers costs is Basel III, which will require them to allocate more capital for uncleared trades, such as those they do with corporate end users, Zubrod said. Theyll get that capital by increasing the transaction price.

And after a bank does a derivative trade with a corporate end user, it usually turns around and does an offsetting trade with another dealer to hand off that risk. While dealers typically collateralize those offsetting transactions, they dont tend to over-collateralize their interbank transactions with initial margin, Zubrod said. New rules will probably mandate them to post initial margin when they transact with each other, and if they clear the trades they transact with each other, theyll have to post margin. So that will increase the funding they have to have in place for a transaction with an end user, he said.

In the meantime, prices have begun to rise for one type of derivative, said Jiro Okochi, CEO of Reval, which provides treasury and risk management technology solutions. Some of our clients are seeing some of the impact already on longer-dated cross-currency swaps. It seems like banks are starting to widen out the offer spread on some of those, especially longer out. It implies some banks are building in a spread to cover capital costs.

In addition, its possible that U.S. banking regulators, led by the Federal Reserve, could decide that banks must require margin from their customers, including corporate end users. The Commodity Futures Trading Commission decided that end users didnt need to post margin, but some banking regulators have sounded a different note. Its not clear when U.S. banking regulators will make a decision on this as they are awaiting a report from a global working group on this topic.

Currently only a minority of corporate end users post collateral. said Greg Hart, managing director and head of corporate rates origination at the Bank of America Merrill Lynch. They do that for a couple of reasons: to manage their overall counterparty exposure, to lower the cost of dealing, as it becomes less expensive if theyre posting cash collateral against their derivative trades. And some companies are finding it opens up capacity as well if they happen to be large users, Hart said.

If bank regulators were to impose bilateral margin requirements, I think it would dramatically impact how corporates use the derivative market, Hart said. Certainly it would significantly increase the costs of doing transactions for the vast majority of clients.

In fact, a study commissioned by the Business Roundtable in 2010 concluded that a 3% margin requirement would force publicly traded non-financial companies to put up an average of $269 million in collateral, or roughly 15% of the cash held on the balance sheet, according to Tom Deas, chairman of the National Association of Corporate Treasurers and treasurer and vice president at FMC Corp. a Philadelphia-based chemical company. If companies have to set aside money to post margin on derivatives trades, it will subtract from the money they have to reinvest in their businesses, he said.

Posting margin would also force end users to deal with daily margin calls, making the process of hedging that much more complex. The back-room requirements for meeting a daily margin call on derivatives are not something were equipped to do, Deas said. We would have to be allowed a transition period to develop the systems to do a mark-to-market and provide for these daily settlements.

Though, while its possible banking regulators will impose a margin requirement on end users uncleared trades, the proposal that regulators are considering allows for margin to be posted only when the market value exceeds some threshold, said Luke Zubrod of Chatham. That would mean the margin required would still be lower than that required for cleared trades, he said. With clearing, youre over-collateralizingcollateralizing 100% of the market to market value, plus initial margin, which is essentially an over-collateralization, Zubrod said.

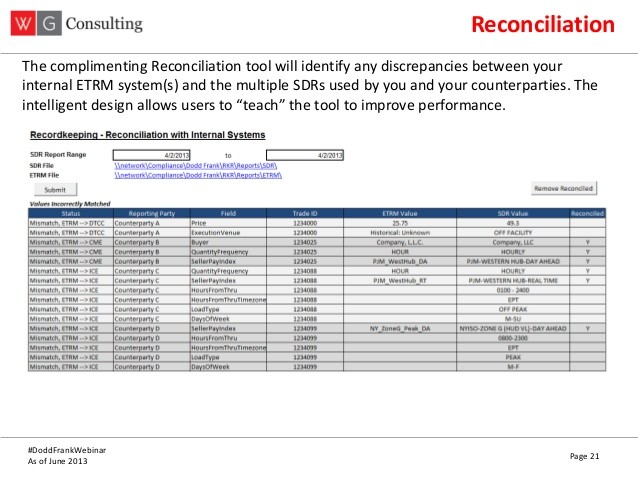

Dodd-Frank also imposes a number of new reporting and recordkeeping requirements, and companies face the administrative expenses involved in preparing to comply with those. Theres documentation that has to be completed to continue hedging, and theres costs associated with that, said Glenn Crotty, managing director and head of corporate FX sales at Bank of America.

At this point, U.S. regulators are still writing and implementing many of the rules required by Dodd-Frank, making it hard to assess the final state of play for corporate end users or how much costs might rise on OTC derivatives.

Theres a lack of certainty in the market as to how a lot of the rules will evolve, especially as it relates to the capital and margining rules. There is also a lack of clarity around how those costs will actually affect the banks and how that could translate to higher costs for the client, said B of As Hart. That uncertainty has been the biggest driver impacting clients decisions, he said, suggesting that customers are being a little more conservative about implementing hedging plans.

Collateral

Corporate end users have many alternatives to consider in the face of rising swap spreads, said Edward Heitin, a partner at PwC. While they can certainly continue to trade over-the-counter bilaterally with their swap dealers, if the increased spreads are too great, they can explore trading their derivatives on exchanges and swap execution facilities (SEFs), and clearing their derivatives through clearing organizations as ways to keep their costs down, he said.

Heitin expects that some end users will decide posting collateral is the way to go, in part because it will get them better pricing from their swap dealer. And while its possible to post collateral on a bilateral trade, if an end user were to go that route, they should strongly consider clearing through a clearing organization, which has the added benefit of reducing credit risk, he said.

Posting collateral wouldnt seem to pose a problem for the large U.S. companies currently holding sizable amounts of short-term cash.

There may be certain end users, cash-rich corporates, who look and say, I dont care about margin requirements, I have lots of cash sitting there, why not put it into a margin account and lower my transaction costs on derivatives, Chathams Zubrod said.

Heitin notes that for all of the high-profile companies who are sitting on a lot of cash, there are many more companies that are not. Furthermore, he said that the companies without a lot of cash tend to also be the companies that dont regularly use the full spectrum of services their banks offer, which in turn may have an impact on how their banks both evaluate the overall relationship and price the services the company does use. That means the spread differential between a collateralized and a non-collateralized swap could end up being greater for companies that do not have a lot of cash. These same companies that may notice a significantly wider spread, Heitin said, frequently dont have the liquidity, infrastructure and systems that allow them to simply say, OK, Ill post collateral. Accordingly they will have to explore all of the execution and clearing options available to them.

With the prospect of higher costs and possible margin requirements for OTC trades, there has been talk that users might switch to exchange-traded futures products, a concept known as futurization. Some exchanges have rolled out new products that target corporate end users and their needs.

Eris Exchange offers a flexible version of its interest-rate swap futures contracts that Kevin Wolf, the exchanges chief business and product development officer, said can provide companies with the customization they get with over-the-counter derivatives. You can set the dates on your Eris contract to be as flexible as an OTC contract, Wolf said, adding the other important element is that our contracts can be held to maturity.

In interest rate-swaps, we expect the market to migrate to futures because cleared trades are going to be unwieldy given all of the new regulations, Wolf said. Though many corporate treasurers are not familiar with futures, its a very large, well-tested framework and its not going to be hard to migrate to that environment.

Chicagos CME Group rolled out deliverable interest-rate swap futures. The contracts are available in two-, five-, 10- and 30-year maturities, and upon expiration, they deliver a cleared interest-rate swap. It looks just like the bond futures except the underlying instrument isnt the off-the-run Treasury, its an interest-rate swap, said Sean Owens, director of fixed-income research and consulting at Woodbine Associates, a capital markets research and consulting company.

What the exchanges and swap execution facilities (SEF) are basically trying to do is to create sufficient liquidity so you can get what are effectively tailored derivatives, but available on an exchange or SEF, says PwCs Heitin. I believe that over time, even the exchange and SEF environment will become liquid enough so that many swaps will be available that match the risks that our end users are looking to hedge. The question is whether the exchanges and SEFs have sufficient liquidity in those swaps today.

Chatham Financials Zubrod said the new futures products are more likely to be used by financial firms that employ derivatives to speculate than corporate end users, noting that financial firms are already posting margin, which might be one of the key drawbacks for nonfinancial users in using futures. He pointed to hedge accounting considerations as a barrier that will discourage many companies from using exchange-traded derivatives. Futures are generally not going to perfectly match the risk the corporate is hedging, and that may result in accounting ineffectiveness, said Zubrod.

Fine-tuning OTC trades

Rather than struggle with the accounting implications of exchange-traded products, companies might try to fine-tune the way they use OTC products to lessen the impact of price changes.

Basel III capital requirements are more onerous for longer-term trades, so users may shorten the term of their transactions, Zubrod said. Every year you add on increases the capital charge, so as you get out to 10 years, youre going to really be feeling it.

Sean Owens of Woodbine predicted that some companies might use a combination of cleared and uncleared swaps to try to meet hedge accounting requirements while minimizing their costs.

You could take a customized swap and replicate it with a cleared swap and a basis swap, Owens said. The two together would give you that customized set of dates to hedge the risk you want to hedge.

PwCs Heitin said he thinks many corporate treasurers would be receptive to exploring alternative transactions that can accomplish the same thing as the more routine hedges they have historically put on. But substituting a combination of exchange-traded and OTC swaps for a single OTC swap may lead to operational, administrative and hedge accounting complexities and costs.

Tom Deas of NACT argued that if manufacturers face higher hedging costs, some might decide to relocate their production. If entering into currency swaps or derivatives that it has traditionally entered into to hedge a stream of exports to a foreign country would no longer be economic, unfortunately the U.S.-based manufacturer might have to consider moving its production overseas to match its costs with its revenues, he said.

Companies may find a friendlier version of the derivatives regulations in other countries, said Deas, pictured at right, The extraterritoriality reach of these rules is still to be worked out. It may be that multinational [companies] would find a way to locate their derivative activities in respect of their foreign operations in a jurisdiction thats more favorable to them. [For example] Europeans have been much more clear about the end-user exemption for margining, he said.

Theres also the possibility that companies simply pull back from hedging. I think youre going to find that margin requirements and pricing requirements are going to pressure end users into considering how much they need to consume the service, said Donald Lamson, a partner and head of the financial institutions advisory and financial regulatory group at the law firm of Shearman & Sterling. At an increased price, how do you maintain volumes?

Banking Relationships

Deloittes Sinha pointed out that because companies generally transact OTC derivatives with their banks, the trades are part of a broader relationship that includes the companys credit facilities, which could influence way both end users and their banks respond to changing regulations and higher costs.

Companies rely on these banks not just for hedgingthey rely on these banks for foreign exchange services, payments services, letters of credit, Sinha said. Its more relationship-oriented. If costs go up, is that going to be a sufficient disincentive for the entire relationship?

And for the banks, trading OTC derivatives with customers is a high-margin business, Sinha said. Banks may come up with their own response if they see the market moving away from them.

But theres another provision of Dodd-Frank that may end up separating derivatives trades from the rest of the business that a company does with its banks in coming years. Shearman & Sterlings Lamson points to Section 716 of Dodd-Frank, which says banks cant transact equity and commodity swaps but have to do such trades in an affiliate, a provision known as the swaps push out. Earlier this year, banks won more time to deal with this provision of Dodd-Frank, with the deadline pushed back to mid-2015.

The swaps push out provision doesnt apply to interest-rate and foreign-exchange swaps, which make up the bulk of banks derivatives business. But Lamson said that once the swaps push out takes effect, it may make sense for banks to put all their swaps transactions in a subsidiary. The cost of funding the transactions in a subsidiary would be higher, but from a management perspective, there are advantages to having all the derivatives business in a single place. He notes that after Reg R mandated a securities push out, a lot of banks moved their securities operations into subsidiaries.

If the swaps business ends up in a subsidiary, that will be another factor boosting the cost of transactions for corporate end users, Lamson said, because the bank customer is now a customer of a registered swap dealer that is separately capitalized.

It would also sever the swaps transactions from the rest of a companys relationship with the bank. So the price that swap dealer offers cannot take into account that customers other relationship with the bank, Lamson said. You have to price it on a standalone basis instead of taking into account the multiple other relationships that exist with the bank.

As the regulatory landscape around derivatives trading changes, companies need to reassess many aspects of their use of derivatives.

One challenge will be how do [companies] evaluate those choices, particularly when the pros and cons compete with each other, said Chathams Zubrod. They may need to invest in new technology tools or just re-envision their analytical processes for the merits of examining the new choices that will emerge.

If companies are thinking about using exchange-traded swaps or clearing their trades with a clearinghouse, PwCs Heitin says, they have to make sure as an end user they have the infrastructure, systems and liquidity available in order to effectively execute and clear in these alternative environments.

Of course, companies may already need certain upgrades to their infrastructure and systems in response to the Dodd-Frank recordkeeping and reporting requirements that will directly affect end users, he says. So when evaluating the costs and benefits of trading on an exchange and clearing through a clearing organization, end users needs to consider which of the incremental costs are truly incremental, versus which are costs the end user was going to incur anyway, even if they were going to trade bilaterally the way they always have.

Reporting on Inter-affiliate Trades

Among the issues that remain cloudy for companies that trade over-the-counter (OTC) derivatives is the extent to which they must comply with new reporting requirements when it comes to trades that occur between different units of the company.

Some large corporates have their business units put on OTC derivatives trades with a subsidiary of the company, perhaps the treasury or an in-house bank. That unit consolidates the inter-affiliate trades and then transacts with the market, thus saving on transaction costs. Dodd-Frank ramps up reporting and recordkeeping on derivative trades, but its assumed that when companies are trading with their dealers, the reporting responsibility will fall on the dealers. Will companies have to follow the real-time reporting rules for those trades done within the company?

This is a major issue, said Tom Deas, chairman of the National Association of Corporate Treasurers and vice president and treasurer at FMC, a Philadelphia-based chemical company. He argues that requiring corporate end users to report on inter-affiliate trades is inconsistent with the overall intent of exempting end users from some of these more onerous requirements. Companies have been discussing the need for an exemption with the CFTCs Division of Clearing and Risk and were hopeful well be heard by them, he said.

Jiro Okochi, CEO of Reval, said that the noise level on inter-affiliate swaps is picking up. A Fortune 100 company recently told him that it was going to stop grouping its subsidiaries swaps to avoid the headache of reporting, said Okochi, pictured at right.

That decision would mean more transaction costs, but less reporting costs, he said.

Related: