Why You Should Invest in Consumer Staples Stocks in 2014

Post on: 13 Июль, 2015 No Comment

Consumer staple stocks are always considered as a boring sector and most of the investors disregard them completely. However, the average investors who are trying to play safe while earning decent returns should focus on these stocks. The past few years have seen most of the sectors giving fair share of money to the investors and so does the consumer staple industry.

According to Investopedia.com, consumer staple stocks are,

“Essential products such as food, beverages, tobacco and household items. Consumer staples are goods that people are unable or unwilling to cut out of their budgets regardless of their financial situation. Consumer staples stocks are considered non-cyclical, meaning that they are always in demand, no matter how well the economy is performing. Also, people tend to demand consumer staples at a relatively constant level, regardless of their price.”

In 2013, consumer staples stocks performed well and offered excellent returns to their investors. In addition to it, the consumer spending in 2013 was 1.9% as per the records of the Bank of America. These figures are expected to grow up to 2.6% in 2014 indicating a potential growth in this sector.

The market experts are expecting better returns from the soft drink companies and household product in 2014. Here are some excellent options for investing in the consumer staple industry.

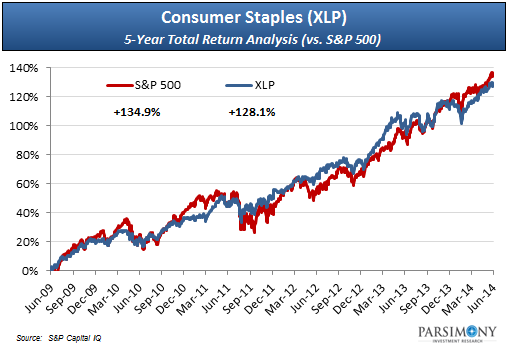

- Consumer Staples Select Sector SPDR (XLP): For individuals with minimum knowledge of the consumer staples stock, Consumer Staples Select Sector SPDR is the best option. It can be difficult for average investors to monitor different staple stocks and XLP does it for them. This stock has net assets worth $6.73 billion and it has an YTD return of 26.30%. You can start investing with a smaller amount and gain smart returns for your investment.

Consumer Staples Select Sector SPDR (XLP)

- Vanguard Consumer Staples ETF (VDC): Vanguard Consumer Staples ETF is an excellent choice for investors looking for steady returns. It tracks more than 111 different staple stocks making it highly diversified. With the net assets of $1.88 billion, this fund has offered year-to-date returns of 28.01% which is better than most of the other passive sectors. The average yield for VDC stands at 2.21% ensuring proper returns. Further, this fund has grown by 14.10% in the past one year with the current NAV of 105.90.