Why is the concept of price elasticity of demand of importance to the firm

Post on: 31 Март, 2015 No Comment

Confidence votes 292

The concept of Price Elasticity of Demand helps companies maximise their profit and decide whether a particular market can be profitable.

If a company’s product has a high elasticity of demand, the more the price goes up, the fewer consumers will buy.

Sometimes, the relationship of price and demand is complicated:

- If consumers (and this includes businesses) feel they can’t afford a price rise, they will try to economise.

- ** They will cut out unnecessary journeys, they will turn down the heating in their home. This is Income Price Elasticity of Demand.

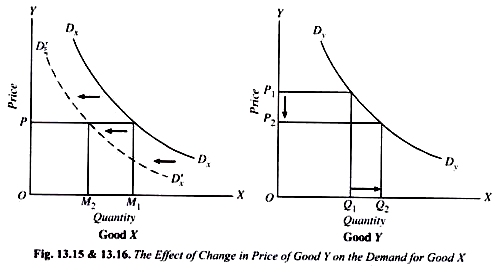

- They may try to find an alternative product to oil. That may be using public transport or a bicycle instead of cars, telecommuting or teleconferencing instead of travelling. In the longer term, it could involve buying an electric car or fitting solar panels to their house. This is Cross Price Elasticity of Demand.

You’ve seen that there is a difference between short an long term. If consumers (or whole industries or governments) invest in different technologies, that particular demand for oil will reduce for a long time or for ever.

So, how does it affect companies?

- Consumers in the highlands of Scotland probably have few public transport alternatives, may have to travel further to work and shops, probably have less choice of petrol station; and the price will be less elastic; and that’s one of the reasons petrol prices are much higher than in big cities where there are more options. But suppose a petrol station hikes its prices too much: people may feel they can’t afford to live there any more and move; or another petrol station may open; or a community bus service may be started; and the vendor may suffer in the long term.

There are certain products that are inverse price elastic — where consumers are more likely to buy if the price is high (perhaps because it gives them a safe feeling about quality or because they want to impress their friends with the price of the product. A decorator may get less business charging half price in a market where consumers feel a more expensive decorator would do a better job.

Following from this, companies may also find they have to use price elasticity realities for marketing reasons. Comapnies who exploit this situation will probably have regular and massive sales. For example, shops selling trainers (sneekers) now realise that the market is inverse-elastic unless consumers are happy they are buying a quality product, but will buy at the lowest possible price if they feel it’s discounted.

Companies may try to make manufacture inverse price elasticity (for example, by brand-builling): in some markets, people will pay more for a brand which makes them feel safe or confident.