Why Is The Biotech Sector Down Two Possible Reasons

Post on: 13 Сентябрь, 2015 No Comment

This article was originally posted on the Buzz & Banter where subscribers can follow over 30 professional traders as they share their ideas in real time. Want access to the Buzz plus unlimited market commentary? Click here to learn more about MVPRO+ .

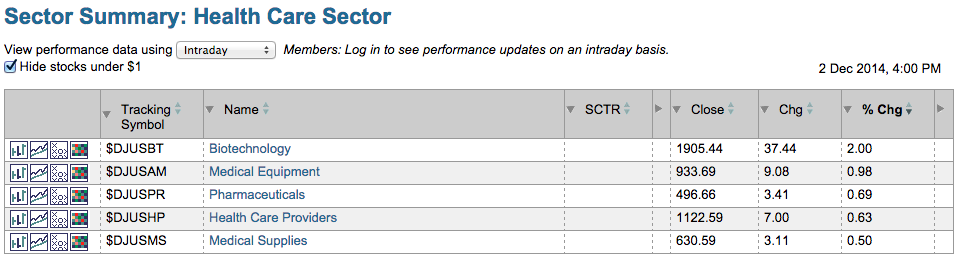

Biotech is getting whacked today with the (weighted) Nasdaq Biotech Index ETF (NASDAQ:IBB ) down about 3% (off its lows) and the equal-weighted version, the SPDR S&P Biotech ETF (NYSEARCA:XBI ) down about the same. The selling is quite broad-based, but investors also have to remember that it is a triple-witching day (when stock index futures, stock index options, and stock options expire on the same day), and mornings are always volatile on such days. That said, here are two of views on why the sector is down.

The first is the simplest. Biotech ran huge without any meaningful pullback since November of 2012. An astonishing amount of supply has hit the market in the first quarter with additional financings and more IPOs. The sector is due for a pullback. The sector is about 10% off the highs, so the bigger part of a pullback is probably already here.

The second is more complex. Gilead (NASDAQ:GILD ) received a letter from a House Congressional committee asking for information about how Gilead priced its hepatitis drug Solvaldi very aggressively. Advocates for hepatitis patients have picketed meetings where Gilead management is speaking, reminiscent of the 1980s AIDS movement.

The one persistent bear thesis during the multiyear biotech rally accuses management teams of being too aggressive about pricing. At some point, the bear thesis goes, one of these companies will get so aggressive that it will kill the golden goose that companies have in the US, which is the only major health-care market remaining without any meaningful drug price controls. This Congressional letter has spooked some folks, leading to selling in Gilead. Since Gilead is 7% of the IBB, it’s no surprise that pressure in Gilead also pressures the IBB, which pressures the entire sector.

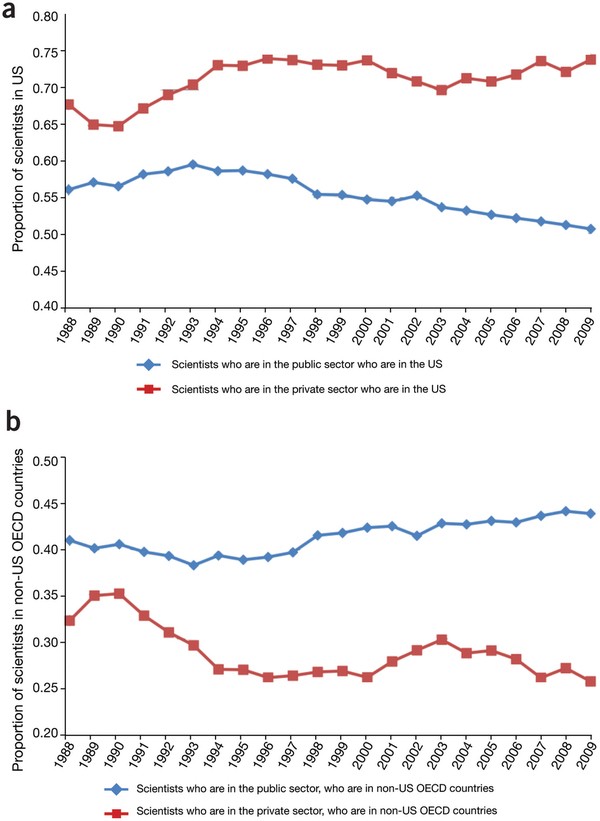

Years ago, I wrote a piece for Minyanville about how drug costs can be controlled without US-based price controls. What other countries are doing is shifting the cost of drug R&D onto American rate payers and taxpayers. Drug makers are complicit in this because they’ll lay down to ex-US pricing demands because they know they can make it up in the US market. While that’s not today’s business, one thing hasn’t changed since I wrote that article in 2010: The US needs to get a handle on drug costs or the costs will eat the economy alive.

There is lots of red out there in biotech-land. If you’re looking for a hedge, I’ve mentioned the ProShares UltraShort Nasdaq Biotech Fund (NASDAQ:BIS ) previously on the Buzz & Banter. This ETF is designed to be 2x short the IBB. If the IBB is down 3%, the BIS should be up 6%. There are lots of ways to hedge biotech, including put options and simply shorting the IBB, but consider adding the BIS to your radar as one potential tool.