Who is to Blame for the Financial Crisis and Ensuing Economic Crisis

Post on: 16 Март, 2015 No Comment

Research Findings:

Who contributed to the creation to the financial crisis and the ensuing economic crisis?

The following is a general answer followed by a section naming the key players:

- Regulators who relaxed risk management regulations required by the banks and for not regulating derivative investments (please, see more specific details below)

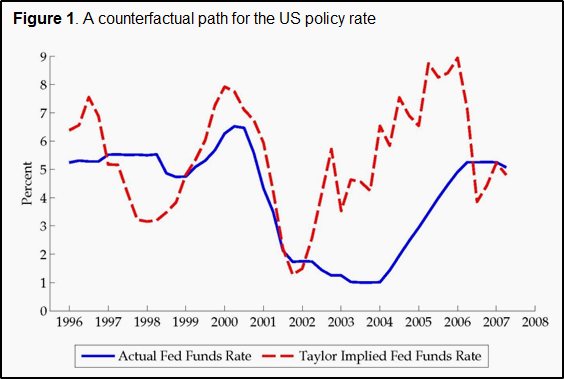

- The Federal Reserve Chairmen who dismissed the build-up of the housing bubble from 2002 to 2007 until it was too late. They did not take actions to regulate mortgage companies or control the housing bubble

- World Central Bankers who blindly copied the US Federal Reserve Bank policies

- World Financial Regulators who blindly copied US financial market models and regulations

- World Investment Banks who sold subprime (high risk) mortgage backed securities to their customers without fully understanding them and who hired credit rating agencies to rate them as high quality investment when in fact they included high risk loans. The same banks who sold the subprime investments later bet against their own clients without disclosing the conflict of interest to their clients

- Credit Rating Agencies who overrated junk securities as investment-grade quality and misled investors about the risk and the value of these investments

- Academic and Financial Economists who ignored the warnings and misjudged macroeconomic and financial market indicators

- Award-winning Economists who designed flawed risk pricing models

- Investment Analysts who used flawed risk pricing models and asset portfolio theories

- Wall Street Banking Executives who ignored internal risk management policies out of greed to increase revenues and their bonuses in the short term at the expense of long term stability of their companies

- Wall Street Boards of Directors who did not protect their shareholders against excessive executive compensation and ignored prudent risk management strategies

- Wall Street Advisors who did not do their homework before advising their clients on bad investments

- Investment Fund Managers who lost billions of dollars investing without adequate due diligence

- Mortgage Brokers who sold loans to unqualified borrowers in order to collect more commissions

- Homebuyers who took loans they could not afford to pay back and blamed the banks for predatory lending

- US Presidents for hiring former Wall Street lobbyists as government policy makers who bailed out the banks without regard to the moral hazard. By doing so, they shifted the burden on the taxpayers and risked the future of the national economy

- US Supreme Court Justices who ruled that the government may not ban political spending by corporations in candidate elections thus tightening the grip of Wall Street on government officials and skewing the balance of power in favor of Wall Street and big companies.

- The Financial Media who took no responsibility for promoting the illusions of a healthy housing sector and for not asking the right questions. Media outlets that favored a promotional business model at the expense of investigative journalism. In our research, we found a prevalent bias in allocating airwaves and print space to brand name experts. Most journalists and editors seem to ignore voices that are not well-known or those who have a story that do not fit their narrative or preconception. All we had to do is Google simple phrases like US Economic Risks to find a wealth of information that would raise so many critical questions. If equal media exposure was given to the voices that warned us about the housing bubble, the damage could have been mitigated.

We also recommend reading three interesting articles about the subject on FactCheck.Org. TIME magazine and US News Report

Who are the key people and companies to blame for the financial crisis?

The blame is shared between a Wall Street Cabal and some government officials who unwittingly or knowingly executed the Cabal’s agenda and continue to empower them and protect them.

The Wall Street Cabal dominates the US government, treasury, congress, and federal reserve banks through their lobbying arm the Financial Services Roundtable ( www.fsround.org ) The cabal consist of the largest investment banks and financial conglomerates, including Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, Bear Stearns, Citibank and JP Morgan. Securities insurance companies like AIG, MBIA, AMBAC and the top three credit rating agencies including Moody’s, Standard & Poor’s and Fitch .

Their partners were prominent academics and ex-Wall Street executives who worked for the government and protected their agenda. These people were appointed by US Presidents including Reagan, Bush Senior, Clinton, Bush and Obama to top government positions, in part as a payback for campaign contribution by some of these Wall Street firms. Some of these government officials unwittingly empowered the cabal and some took deliberate actions to bailout Wall Street and later protected them from prosecution.

The complex Wall Street fraud scheme and the key players behind the financial crisis

Home, car and other loans were packaged by top Wall Street investment banks (like Goldman Sachs, Morgan Stanley, Merrill Lynch and others) and called them CDOs (Collateralized Debt Obligations) then was sold to investors. These types of investments are called derivative securities.

These investment banks paid the supposedly independent rating agencies (Moody’s, S&P and Fitch) to rate CDOs as high-grade investments when in fact many of them included high risk mortgage loans (called subprime).

This is a clear conflict of interest by the rating agencies and a suspected effort by banks to defraud their clients to get more money for these CDOs. After the CDOs received A-ratings, they created the impression that they are secure investments. These CDOs, then became popular with investors and many retirement funds that held the life savings of millions of people who bought them.

To make things worse, large insurance companies like AIG sold insurance for investors who bought CDOs to protect against potential losses (in case some borrowers did not pay their loans). AIG called these types of insurance policies Credit Default Swaps (CDS) making them even more popular with global investors and reinforcing the illusion that their investments is highly secure and if they fail they will be covered by the insurance policies.

What is unusual is that AIG allowed other investors to buy insurance on CDOs that they do not even own. So an investor can pay small insurance fee for a CDO that someone else owns. If that CDO investment went bad, the investors who paid the insurance (can be the actual owners and others) would collect the full value of that CDO.

This allowed few investors who knew that these investment were bad to buy insurance as a bet against the failure of the CDOs. John Paulson is one of the investors who knew that these CDOs were bad, so he bought the insurance betting that they will fail. He made $12B betting against mortgage securities. When he ran out of CDO investments, he worked with Goldman Sachs and Deutsche Bank to create more of them so he can bet against them. Goldman Sachs that sold CDOs to investors, later bet against CDO type investments that they sold to their clients without disclosing the conflict of interest. Other Hedge Funds like Tricadia and Magnetar, made billions betting against CDOs they designed with Merrill Lynch, JP Morgan and Lehman Brothers. (Source: Inside Job Documentary)

Thanks to Wall Street Cabal, their lobbyists, hired senators, and people inside the government (see list of names below), who opposed the regulations of Wall Street, AIG did not need to have money to cover the losses by the CDOs if the borrowers did not pay their loans. They also did not prosecute the credit rating agencies who mis-rated the CDOs. The defense of Wall Street executives is that the markets are not regulated and they were the ones who pushed for deregulations in the first place.

It seems to us, even if the markets are not regulated, the common law punishes fraud activities and misleading clients by knowingly selling bad securities and loans to clients without disclosing the risks. They misled clients by having them believe they are high quality investments where in fact they were junk-rated investments.

Some key regulators, policy makers, and influencers in the government are former Wall Street executives and lobbyists who have strong ties to the investment banks and who later got compensated generously by Wall Street firms, thus raising serious question about a conflict of interest in their decisions and policies.

The US government ended up paying taxpayers money to bailout the Wall Street Cabal. Henry Paulson the former Treasury Secretary was the CEO of Goldman Sachs and during his tenure sold many of the subprime investments. He was one of the main architects of Wall Street bailout. He bailed out the banks and later AIG on the condition not to sue Goldman Sachs or other companies involved in CDOs.

Key government officials to blame (A partial list)

Martin Fieldstien. a Harvard Professor and former Chief Economic Advisor who championed the deregulation initiatives of the financial markets during Regan’s Administration and later severed on the board of AIG and AIG financial products that insured CDOs. — A key player causing the global financial crisis.

Alan Greenspan who championed Savings and Loans deregulations allowing these banks to speculate with consumer deposit. Alan Greenspan refused to regulate the mortgage industry, despite several warnings and allowed the formation of housing bubble during his tenure as Federal Reserve Chairman. Alan Greenspan was later hired by John Paulson who made billions betting on subprime mortgages that he refused to regulate. (Source: New York Magazine )

Larry Summers and Robert Rubin. former Treasury Secretaries (Rubin is also a former CEO of Goldman Sachs) championed Gramm–Leach–Bliley (GLB) Act, effectively repealing Glass–Steagall Act, thus allowing the mergers of consumer banks with investment banks furthering the risk of speculation of with people’s money. Larry summers later made $20M as a consultant for banks and funds that sold derivatives ( Source: Panderer to Power: The Untold Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession — By Frederick J. Sheehan)

In 2000 Senator Phil Gramm, Alan Greenspan, Robert Rubin and Arthur Levitt (former SEC Chairman) lobbied against an effort to regulate the derivative markets that later turned to be at the heart of the crisis. After leading the senate effort to prevent the regulation of derivatives, Phil Gramm became the Vice Chairman of UBS and Rubin Became the Vice Chairman of Citibank earning more than $127 million (Source: SourceWatch ) Senator Phil’s wife Wendy Gramm served on the board of Enron — infamous for its fraud and collapse (Source: Alternet )

Current and former Federal Reserve Board members including Ben Bernanke, Donald Kophn, Kevin Warsh, Randall Krozner, Frederic Mishkin, Janet L. Yellen, Elizabeth A. Duke, Daniel K. Tarullo, and Sarah Bloom Raskin. In July 2005 in an Interview with Maria Bartiromo. Federal Reserve Chairman denied there is a housing bubble and its impact on the economy, saying It is pretty unlikely possibility, we never had a decline in housing prices on a nation wide basis In Feb of 2006, he became the Federal Reserve Chairman and despite several later warning he did nothing to control the housing bubble (Source: CNBC Interview. Transcript at Freedom Works ).

In 2004 Henry Paulson who is during his tenure as the CEO of Goldman Sachs was the highest paid CEO on Wall Street and sold most numbers of subprime mortgages (part of the CDOs), later he was appointed by President George W Bush as the Treasury Secretary and helped in bailing out the banks, including Goldman Sachs — his former employer. He also helped lobby the Security and Exchange Commission to relax limits on banking leverage, allowing banks to loan more money in ratio to actual deposits. The leverage ration became 40-1. That is for every 1 dollar they had in their banks, they could make loans up to 40 dollars. This resulted in the creation of the banking debt crisis and housing bubble. Goldman Sachs that sold CDOs to investors, later bet against CDO type investments, that they sold to their investors. Henry Paulson bailed out AIG on the condition not to sue Goldman Sachs or other companies involved in CDOs.

Research Comments:

Can investors trust Wall Street investment advice? Can they be trusted with their money and lifesavings? You be the judge.

Can US politicians including senators, regulators, and economic advisors be trusted with protecting the citizens and the US economy?

The lack of protection against conflict of interest in policy making, the incompetence of most economists and regulators and the consorted efforts by few Wall Street insiders allowed this fraudulent CDO investment scheme to crash the US and global financial markets. If the Wall Street cabal is not held accountable for their actions, they will lead to the collapse of the US economy.

According to Med Jones. the president of International Institute of Management, Despite all the events that led to the economic crisis of 2008 and 2009, last year (2010), the US Supreme Court ruled that the government cannot limit financial contributions of corporations to the election campaigns of political candidates. This decision will enforce special interest groups and Wall Street’s grip on the government. This imbalance of power will likely allow a few powerful groups to bring the US economy down in a series of financial, economic and political crises. Throughout history, every empire was disintegrated from inside first by similar abuses of power structures. The US is not immune to socioeconomic laws

Was there a conspiracy by some Wall Street executives and government officials? Can they be held responsible for their actions or inactions? Do investors have legal cause to seek compensation for damages caused by Wall Street firms?

To answer these question, we have to list the legal definition of the activities that appear to be illegal

Definition of Torts

Tort is the French word for “wrong.” The legal definition of Tort is an act that injures someone in some way, and for which the injured person may sue the wrongdoer for damages. Legally, torts are called civil wrongs. A tort can be negligent or intentional civil wrong.

Tort law imposes a duty on persons and business agents not to intentionally or negligently injure others in society.

Under tort law, an injured party can bring a civil lawsuit to seek monetary compensation for a wrong done to the party or the party’s property from the offending party. Negligence is a ‘legal cause’ of damage if it directly and in natural and continuous sequence produces or contributes substantially to producing such damage, so it can reasonably be said that if not for the negligence, the loss, injury or damage would not have occurred.

For example, Negligent Mismanagement arises when the injury suffered by the tort victim (such as investors who lost money) can be attributed to carelessness in the oversight of some aspect of the corporation’s operations. It relates to situations where the board of directors knew of, or ought to have foreseen, a systemic problem and failed to address it.

Directors who breach any of their duties to the corporation and their shareholders may be liable if the corporation suffers a loss that can be directly attributed to their actions or omissions. To protect themselves from such liability, directors should always consider whether the decisions or actions being taken are in the best interests of the corporation. They must discharge their duties of skill and diligence, as well their duty of loyalty, including acting honestly and in good faith, not improperly delegating their responsibilities, and avoiding conflicts of interest

Definition of Crimes

Crime is any act done by an individual in violation of those duties that he or she owes to society and for the breach of the law, the wrongdoer shall make amends to the public.

Inchoate (inko-wet) crimes are incomplete crimes and crimes committed by non-participants such as criminal conspiracy, attempt to commit a crime, and aiding and abetting the commission of a crime.

Fraud is considered a crime.

The legal definition of Fraud:

Fraud is generally defined in the law as an intentional misrepresentation of material existing fact made by one person to another with knowledge of its falsity and for the purpose of inducing the other person to act, and upon which the other person relies with resulting injury or damage. Fraud may also be made by an omission or purposeful failure to state material facts, which nondisclosure makes other statements misleading.

For example, if a business or a person knowingly rate an investment as high quality when in fact they knew it is not, that person is committing criminal fraud. Even if someone did not sell the investment but knowingly aided in the commission of the crime. That person is also criminally liable.

Research Conclusions:

Our research did not find evidence of conspiracy in designing the financial crisis. This does not mean that there was no conspiracy. Such determination requires substantial investigative resources that we do not have.

However, our research found several actions and decisions by top government officials and Wall Street executives that may fall under the definition of torts or crimes. Whether in fact there are crimes committed or not, we will leave that determination to the justice system.

It is in our opinion that most of the people who contributed to the financial crisis were simply incompetent or driven by a blind belief in the ideology of free markets. However, few people standout and appear to have acted intentionally and with total disregard to risk management and their fiduciary duties to protect their clients, investors and other stakeholders. Whether there is a legal cause to sue them or not we will leave that to the American public, attorneys and the investors who lost their lifesavings.

As for the the impact of the subprime and housing bubble on the economy, we can honestly say very few experts properly estimated the impact of certain government policies on the economy. Also, we believe very few economists knew the inner workings of the financial investments that was sold on Wall Street.

Can Wall Street activities can be considered criminal. You be the judge. If you have some additional information, please email us at research

Other research questions and findings:

- Why did the world’s top economists fail to predict the financial crisis? (Others who missed the crisis, include government leaders, award-winning scientists, market analysts and investors). Was the crisis predictable or was it a Black Swan (unpredictable) event? Are government policy makers competent enough to manage the nation’s financial freedom and security? Are economists and their policies helping or hurting our economic growth? Do we need to re-define the education of economic science and the role that economists play in our financial markets, government policies and business regulations?

- Who is to blame for the financial crisis? Who contributed to the creation of the crisis? Can they be held responsible for their actions or inactions? Was there a conspiracy by some Wall Street executives and government officials? Do investors have legal cause to seek compensation for damages caused by Wall Street firms?

- Who predicted the financial crisis and the ensuing economic crisis? Is there a documented evidence supporting their claims? Were those who warned about the crisis lucky or did they have a clear logic behind their predictions? Can we use their knowledge to predict future crises? What are their future predictions? How do their predictions compare with each other? Where do the experts agree and where do they disagree? How accurate are their economic predictions? Can they be relied on for investment decisions?

- Who are the top winners and losers of the financial crisis? Top investors, economists, intellectuals, government officials, think tanks, and universities that lost or won because of the crisis.

- What are the lessons we can learn to avoid future crises. What the the economic policy lessons? What are the investor’s lessons? Do we need more or less financial regulations?

Economic predictions from the world’s top experts on the financial crisis