Which Order to Use StopLoss or StopLimit Orders Differences

Post on: 16 Март, 2015 No Comment

Which Order to Use? Stop-Loss or Stop-Limit Orders Differences

Which Order to Use? Stop-Loss or Stop-Limit Orders Differences 5.00 / 5 (100.00%) 1 vote

Learning about different orders and how they can help diversify your options are important things that all traders should learn to work with. Which order to use? Stop-loss or stop-limit orders, are important considerations that you need to make, especially if you are planning on diversifying your trading options. Understanding the difference between the two can help you be more specific about how you would like for your broker to make your trades. In a simple understanding, when you place stop or limit orders, you tell your broker that you do not want the market price, but rather a stock price, to move in certain directions before the expiry period of your order. As such, learning how to place these orders is a crucial part of the investment process. Beginning traders are strongly urged to understand how these orders work and why some traders may choose to make certain decisions in regards to the orders themselves.

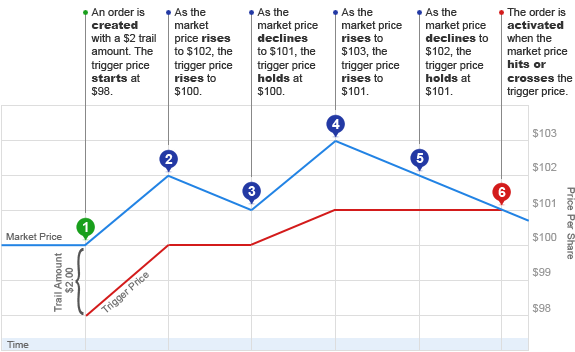

Stop orders function by allowing your trade to only be executed when a certain security that you have your eye on reaches a certain price. After the stock has reached the desired price, the stop order will turn into a market order, which is then filled by your broker. These are also known as stop loss orders, and they can help you limit your losses as they appear in certain situations. In addition to helping you stop certain loss movements, the order can also help you guarantee profits. These orders can be very advantageous to investors who are expecting a period of time where they will not be able to monitor their investments. However, a disadvantage that comes with stop orders is the fact that they are not always guaranteed to be completed at the preferred price. After it turns into a market order, it will then try to be filled at the best available price, which can end up causing problems in some fast paced situations.

On the other half of the which order to use? Stop-loss or stop-limit orders question, individuals should become familiar with limit orders as well. These orders act like stop orders, but they are typically set with minimums or maximums in accordance to the traders desires. This can be a very useful way to specify a certain range that you want your orders filled at, which can help you get more specific gains in certain situations. The biggest advantages of limit orders is the fact that your trades will always be completed within particular prices. However, while this is guaranteed, the brokerages will most likely charge you a higher commission, so as to better keep up with the limit orders. It is possible that your order may not be executed at all if it does not reach the limit price, which can cause problems in particularly bad market turnouts, something that traders should always take into account.