What’s at Risk The Use of Sensitivity Analysis to Measure Your Portfolio’s Risk

Post on: 2 Апрель, 2015 No Comment

by Gurpreet Banwait, Senior Global Product Manager, FINCAD

‘Risk a four letter word that has gained increased prominence since the financial crisis hit. More appropriately the lack of risk management is being blamed for helping to deepen the financial crisis. Companies are now focusing on the various types of risk management techniques available to them and the list is extensive: Liquidity, collateral, counterparty, market, etc. As part of their risk management policy, companies need to decide how they are going to determine their portfolios exposure to the various types of risk. What happens if interest rates go up? What if we have another crash what will be the impact on my company? The true cost of risk management comes in not having a properly defined risk management process. The consequence of having an ill-conceived or inadequate process means that your organisation has no visibility into how even the simplest changes will impact the bottom line. And using a method that is insufficient is detrimental. How do you decide where to begin? This article will examine sensitivity analysis methods in more detail and discuss some of issues you need to think about when incorporating Value-at-Risk (VaR) into your risk management process.

FAS and IFRS regulatory pressures for better risk management

Risk calculations, such as sensitivity analysis and VaR, have been around for many years and are important components of a good risk management policy. But beyond just best practices, regulations are also requiring treasuries and finance departments to perform some kind of risk measurement in disclosures in the financial statements. In the Quantitative and Qualitative Disclosures about Market Risk section 7a under Financial Accounting Standards Board (FASB) and under International Financial Reporting Standards 7 (IFRS 7), paragraph 40 states that financial statements need to explicitly state the potential impact of market movements companies are principally exposed to:

Financial Instruments Disclosures: a requirement exists to calculate the potential impact of each market risk variable or conduct a value-at-risk analysis.

With the regulations requiring some form of risk analysis, treasurers need to find a method that fits with their resources and overall risk management policy. As evidenced in a survey of corporate treasuries,over 40% of respondents reported adjusting their risk management strategy after the crisis to include sensitivity analysis and/or VaR1. Corporations are recognising the importance and starting to make risk measurement a priority.

Interest rate risk in general, can be lowered by including some fixed and/or floating rate debt.

Sensitivity analysis and VaR

Whether you manage the treasury of a $100m company or a billion-dollar company, the different types of risks can have a significant impact on your bottom line. Subtle swings in FX or interest rates could affect your financial statements and without proper risk management analysis, you could be in for an unpleasant surprise. With proper analysis you can determine the risk and then hedge appropriately against it.

Well first examine in-depth the different types of risk a company can face and the ways to analyse them using sensitivity analysis.

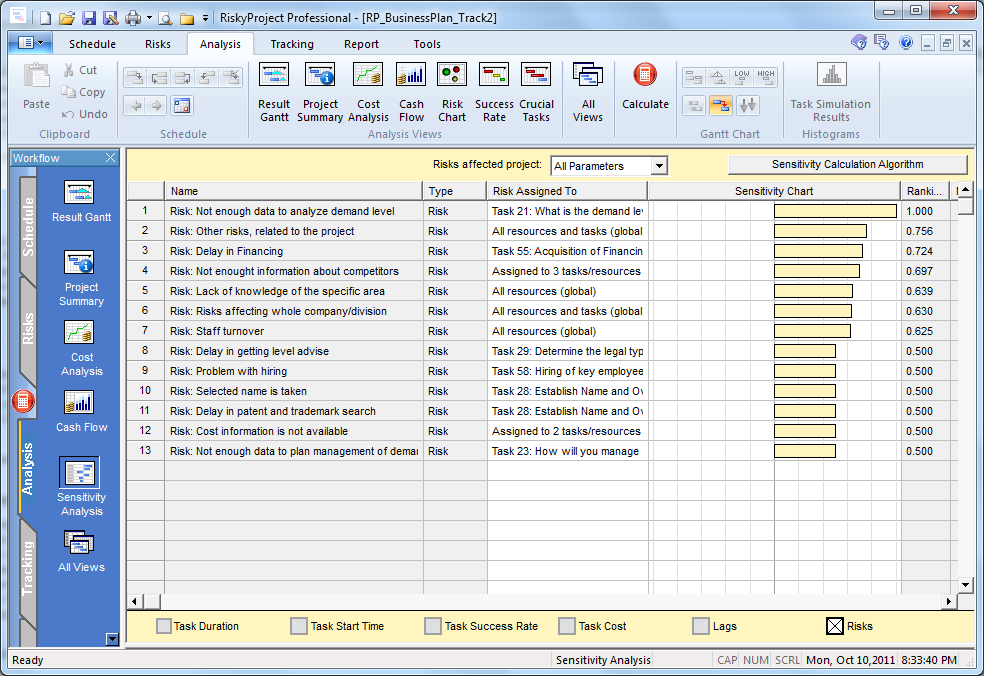

Sensitivity analysis, or a what-if analysis as it is sometimes called, is used to determine how much the valuation of an individual trade, and ultimately your portfolio, changes by varying an independent input. This type of analysis is very common and has been in use for the past few decades. The advantage of sensitivity analysis is that it is a relatively simple risk measure to calculate, and is an important output for people that review the results. In fact, many mathematical models output sensitivities directly. For example, the term Greeks is used to define the sensitivities that can be calculated based on your option portfolio. The Greeks, sometimes specifically referred to as delta, gamma, vega, theta and rho, are sensitivities to certain inputs used to determine the change in the resulting output. These can then be used to determine hedging strategies.

Every company needs to perform some kind of sensitivity analysis on its risk portfolio. It is an important part of your overall risk management strategy. Whether the company is public or private, a manufacturer importing raw materials or a service-based company dealing in foreign currencies, almost every company will experience some sort of risk be it interest rate, foreign exchange, and/or commodity risk. It is very likely that companies will be exposed to multiple risks. These risks require corporations to review how changes will impact their business. Having the visibility into the risk your organisation faces is important information that can be passed to internal people with a vested interest in the results, such as the CEO, COO and CFO and also is important for external reviewers including your board of directors, auditors and, of course, investors. A few common sensitivity analyses that are particularly applicable to a corporate treasury include analysing the impact of changes in interest rates, foreign exchange and commodity prices. Some companies even extend the analysis to their employee stock options.

Interest rate risk

Interest rate sensitivity analysis is very important for most corporations. Interest rate risk in general, can be lowered by including some fixed and/or floating rate debt. The corresponding debt and interest costs could also be managed by entering into a derivative contract such as an interest rate swap or a treasury lock. With respect to sensitivity analysis, the treasury department should ensure that the portfolio is subjected to rigorous testing to determine what the change in value might be given a change in interest rates.

A key rate risk analysis is one of the most commonly used methods of evaluating interest rate risk. This analysis is essentially completing a more rigorous sensitivity analysis by varying each data input that is used in building the yield curve. A sample analysis could include individually adjusting the 3, 6 and 12 month points of the yield curve along with the 5, 10, or 20 year point. The adjusted yield curves are then used to re-value the portfolio with the new result being compared with the original value. By doing this type of analysis, a risk profile can be created to determine which part of the yield curve they are most exposed to risk. The treasury department can then make a decision as to how it wants to manage this risk. The key rate analysis is also important for cash flow management and will allow for better forecasting.