What the Stock Market Has to Do With Racial Inequality

Post on: 28 Апрель, 2015 No Comment

Photographer: Getty Images

The end of 2014 was marked by several harsh reminders that black Americans don’t enjoy the same safety, security, and prosperity as other groups. In his yearend news conference. President Obama mentioned a particular racial disparity that receives less attention and has measurably worsened on his watch: the white-black wealth gap. Here’s how the president framed the issue:

Like the rest of America, black America is better off in the aggregate than it was when I came into office. … The gap between the income and wealth of white and black America persists. This is a legacy of a troubled racial past. Jim Crow. Slavery. That is not an excuse for black folks, and I think the overwhelming majority of black people understand it is not an excuse.

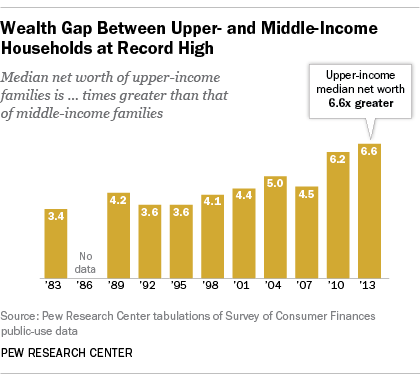

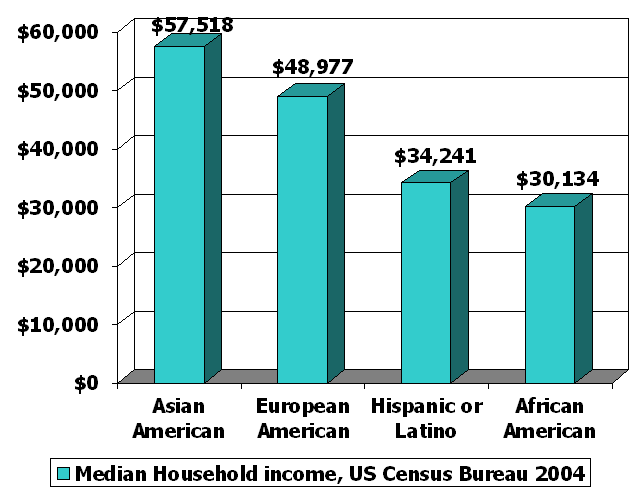

In 2013 median white family wealth totaled about $134,000, more than 10 times the median black family wealth of $11,000. Most of the wealth gap exists because black families in the U.S. tend to earn less. Among white working-age adults, median income is around $48,000, double the $24,000 median income for working-age blacks. Marriage is also associated with more wealth, and blacks are more likely to be single.

But studies estimate income and demographics can only explain at most 67 percent of the black-white wealth gap among married couples. The rest may be attributed to what each group does with its wealth, and the differences may explain why the gap widened during the recession.

Relative to whites, blacks own less stock and more housing in their portfolios. Going into the recession in 2007, housing made up 62 percent of net worth for black homeowners and only 46 percent for whites. By 2013 about 57 percent of whites owned stock (either directly or through a mutual fund or retirement account), but only 30 percent of blacks did. These trends persist even when you control for financial education and stock market access. The figure below shows stock allocation in retirement accounts by race and ethnicity.

Retirement account holders tend to be relatively affluent, educated, and have equal market access, and even among this population blacks still own less stock than everyone else. Stock makes up just 37.5 percent of their portfolios, compared with more than 50 percent for whites and other non-Hispanic groups.

Stock ownership has historically been integral to wealth accumulation, and there’s no reason to think that long-term trend has changed. The good news is more people are now automatically invested in well-diversified investment options in their workplace retirement accounts. In addition to helping people prepare for retirement, this change will also go a small way toward sharing the wealth.

Schrager is an economist and writer in New York City. Follow her on Twitter: @AllisonSchrager.