What The Dow Can Tell Us About Past And Present Markets

Post on: 16 Март, 2015 No Comment

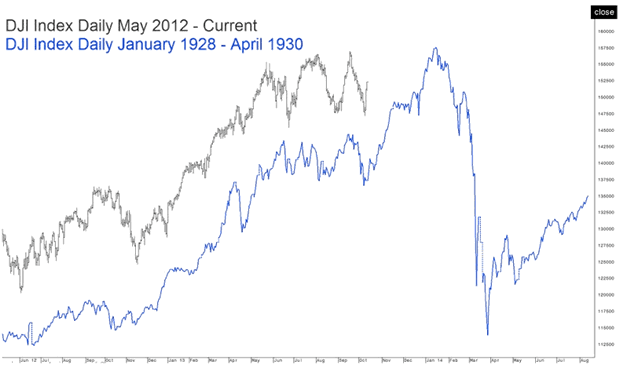

A review of DJIA history provides interesting insights and new thoughts.

DJIA Research

A review of Dow history should provide some interesting insights as well as provoke new thoughts about the markets. Let’s start with the below table.

Inception: The Dow Jones Industrial Average opened at 40.94 on May 26, 1896.

(Sources: Data360; Wikipedia; Yahoo! Finance; Bloomberg)

Observations

- The Dow opened at 40.94 in 1896, and it took more than 58 years for a tenfold advance. Then, from Dow 400, it took another 40 years to complete a similar move, reaching 4,000 in 1995.

Why does this matter?

If it’s concluded that 10,000 is indeed a very meaningful level and the market has displayed a propensity to linger at such levels, then I must focus my research efforts on determining when the index has in fact departed 10,000, or when it will. Would your investment strategy not be different if you knew that the Dow was at 10,000 for the last time last month rather than it being likely to spend another two or 10 years at this level? So, I conduct this type of research to inform investment strategies and manage risk.

Next, let’s explore the Dow’s secular bear markets for additional clues about the market’s behavior.

Secular bull and bear markets since the Dow’s inception:

Observations

- The longest bull market (1896-1929) was followed by the longest bear market (1929-1949). In this case, 33 years of pleasure was followed by 20 years of pain.

I’ll have to dig a little deeper for more clues.

Bear market lows

Observations

I’m less interested in when the bear will end; I want to know when we’re leaving Dow 10,000 behind because there’s a lot of money to be made on the way back up and out of this bear market.

What we know is that in the 20-year bear market, it was 10 years after the low that the milestone level was finally conquered. In the 15-year bear market, the Dow pulled away from the key level eight years after putting in a low. Based on this, would it be fair to suggest that in a 10-year bear market like we have today, it would take five years from the low to finally leave the 10,000 level? If so, that translates to early 2014.