What is your real investment risk tolerance level The Nation

Post on: 16 Март, 2015 No Comment

THE NATION March 21, 2013 1:00 am

Discussions about investment risk generally revolve around two questions and they are often used interchangeably.

Question 1: How much investment risk can you take?

Question 2: How much investment risk should you take?

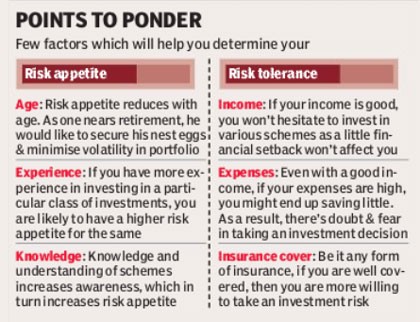

Question 1 is about risk tolerance — how comfortable you are watching your investment portfolios take a hit. But, just because you want to take a risk, that doesn’t mean you should. That’s where question 2 comes in. Ideally, a blend of two factors should be considered when creating a long-term investment strategy: risk tolerance and the financial capacity for risk.

Risk tolerance is a measure of your willingness to accept higher risk or volatility in exchange for higher potential returns. Those with high tolerance are aggressive investors, willing to accept losing their capital in search for higher returns. Those with a low tolerance, also called risk averse, are conservative investors who are more concerned with capital preservation. Neither one is ideal.

For example, consider two people with exactly same age, same wage and same job with same career options for the future. However, one is an aggressive investor who likes to bet on anything he can get his hands on, while the other one is a conservative investor who keeps her earnings and spend frugally.

Despite having identical financial circumstances, they have very different risk tolerances. A portfolio based solely on the aggressive investor might steer to risky ventures even though he can’t actually afford heavy losses. Meanwhile, a portfolio based on the conservative investor would likely only invest in government bonds.

If they invested according to their risk tolerance, the net result would be less than satisfactory for both. Your risk tolerance is a measure of how much risk you can handle, but that is not necessarily the same as the appropriate amount of risk you should take. That brings us to the second risk assessment that deals with financial capacity to tolerate risk.

Let’s consider the fate of three investors who each see a 50 per cent drop in the value of their portfolios.

lJohn is 76-years-old and has made billions as a leader of industry. His estimated net worth is Bt100 million.

lDon is in his late 40s and he has a family to support and is slowly nearing retirement. His portfolio is around Bt 3 million.

lSam is 30-years-old, is just beginning his investment career with a current net worth of Bt500,000.

A loss of 50 per cent would drop John’s net worth down to Bt50 million. While he would surely be angry at the loss, but Bt50 million is still a substantial amount of wealth. Sam, too, has the capacity to absorb a financial hit of 50 per cent. He has many years to continue saving and investing before he needs to think about retirement. Don, however, does not have the financial capacity to tolerate risk, even though he might be willing to bet on risky investments. He has a family to support and less than two decades left until retirement, hence a 50 per cent drop would be crippling.

Evaluating your own risk tolerance is actually harder than what most people realise. Quite often, the tool to use is a risk tolerance questionnaire. There are challenges with this approach. First, the questions are all hypothetical — in real life investors often act differently than they assume they will act when faced with adversity. Second, a risk-tolerance-based portfolio may not meet financial objectives. For example, a risk-averse investor might end up with a portfolio that won’t be enough to support him or her during retirement. Third, risk tolerance may not align with financial reality — what you can psychologically tolerate might be greater than what you can afford.

When developing a long-term investment strategy and strategic asset mix, two things must be considered together- the risk tolerance of the investor and the financial capacity for risk.

Understanding the differences between the two can help you to develop a portfolio with the risk that is most appropriate to your circumstances.

VIRA-ANONG C PHUTRAKUL is |managing director and retail banking head, Citibank, NA.