What is the difference between nonparticipating preferred stock and participating preferred stock

Post on: 16 Март, 2015 No Comment

June 15, 2007

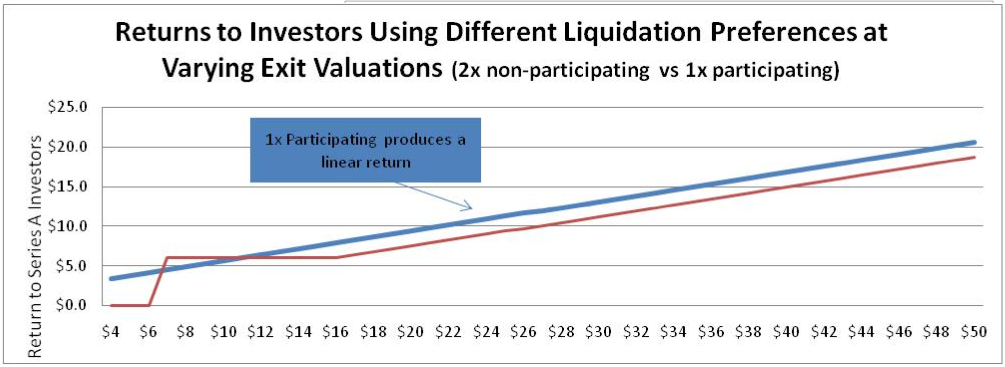

There are two basic types of liquidation preferences: non-participating and participating.

Non-participating preferred typically receives an amount equal to the initial investment plus accrued and unpaid dividends upon a liquidation event. Holders of common stock then receive the remaining assets. If holders of common stock would receive more per share than holders of preferred stock upon a sale or liquidation (typically where the company is being sold at a high valuation), then holders of preferred stock should convert their shares into common stock and give up their preference in exchange for the right to share pro rata in the total liquidation proceeds. Non-participating preferred stock is favored by holders of common stock (i.e. founders, management and employees) because the liquidation preference will become meaningless after a certain transaction value.

Please note that each series of preferred stock may be economically incentivized to convert to common stock at different transaction values due to different preference amounts per share for the different series. This necessitates creating complex spreadsheets to model what happens upon a sale of company at different transaction values. The most sophisticated spreadsheets will also take into account whether options and warrants are in the money at certain transaction values, which will affect whether or not they are exercised, which will then affect the price per share. These circular formulas are best left to CFOs with strong math skills or attorneys that deal with these spreadsheets all the time.

Participating preferred also typically receives an amount equal to the initial investment plus accrued and unpaid dividends upon a liquidation event. However, participating preferred then participates on an as converted to common stock basis with the common stock in the distribution of the remaining assets.

Participating preferred stock is favored by investors because they will receive a preferential return over both low and high exit transaction values. An argument in favor of participating preferred stock is that if a company is sold shortly after the investment, the founders may receive a significant return on their investment (since they have typically paid a much lower price than holders of preferred stock) while the holders of preferred stock may receive little or no return on their investment, particularly where the liquidation preference is 1x. A counter-argument is that if a company is sold for a high price, the holders of preferred stock have no incentive to convert their shares into common stock and, as a result, are able to double-dip into the proceeds by receiving both the preference amount and the participation proceeds. Thus, one compromise is a participating preferred with a cap, which will be covered in the next post.

Written by Yokum Filed Under Series A

Mitch22

Participating Preferred I believe is rather like leasing an automobile. Theres zip wrong with leasing a vehicle and its some advantages but leasing can truly be a bad deal for the ignorant.

Participating preferred permits VCs to give founders a valuation that seems higher than it in reality iskind of like the low standard payment on an auto lease vs. But if you are classy, participating preferred could be a way for founders and VCs to split the difference on an argument of how snappy / how successful a company will be. If the founders sell for a higher price than the preferences clear at ( presuming theres a cap ) then maybe they were given a touch better valuation that otherwise.

But in my experience, like leasing an automobile, most of us and most times folk will come out better sticking to the straight and easy deal. Stock Investments Blog

Mitch22

Participating Preferred I believe is rather like leasing an automobile. Theres zip wrong with leasing a vehicle and its some advantages but leasing can truly be a bad deal for the ignorant.

Participating preferred permits VCs to give founders a valuation that seems higher than it in reality iskind of like the low standard payment on an auto lease vs. But if you are classy, participating preferred could be a way for founders and VCs to split the difference on an argument of how snappy / how successful a company will be. If the founders sell for a higher price than the preferences clear at ( presuming theres a cap ) then maybe they were given a touch better valuation that otherwise.

But in my experience, like leasing an automobile, most of us and most times folk will come out better sticking to the straight and easy deal. Stock Investments Blog