What Is Stock Market Volatility

Post on: 20 Июнь, 2015 No Comment

History

Astute stock market observers have long taken note of the movement patterns of individual stocks, but it was only in the 1970s that an indicator was created to measure the volatility of the market as a whole. Today, almost every professional trader makes sure he is aware of the present volatility situation, as this usually has a large impact on the future price movement of stocks and options.

Features

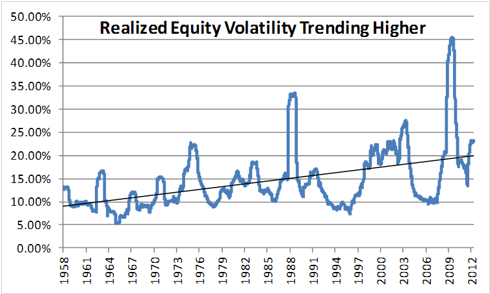

Stock market volatility is determined by calculating how far a particular stock or index has moved over a set period of time. The more a stock has moved, the more volatile it is. Stock market volatility is an especially critical statistic for options traders because volatility has a huge effect on the price of options. The more volatile a stock is, the more expensive its options are likely to be, and vice versa.

Types

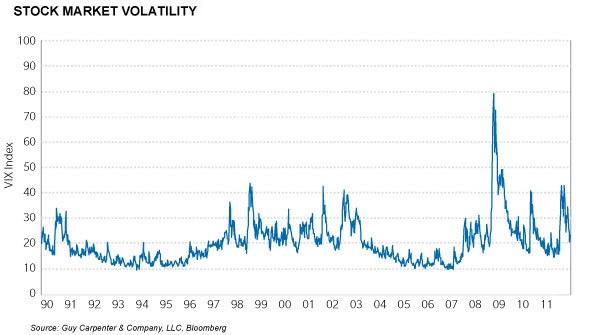

There are several types of indicators for measuring stock market volatility. The most famous is the S&P 500 Volatility Index (VIX), which is derived by calculating the value of a series of put options on the S&P 500. Put options are used because investors tend to purchase these contracts during times of fear and uncertainty to hedge their portfolios. So, when investors are nervous, they buy puts, driving contract prices, and thereby the VIX, higher. Just the inverse happens during stable periods when investors see less of a need to buy put protection. A similar volatility index exists for the Nasdaq, called the Nasdaq Volatility Index (VXN).

Theories/Speculation

Many traders use volatility indexes like the VIX and VXN as contrary indicators. They will buy the market if the VIX is high and sell the market if the VIX is low. The reason for this is that a high VIX indicates that fear is the predominant mood in the marketplace, meaning many investors have panic-sold their shares, driving prices down. This creates opportunities to buy at a discount. A low VIX, conversely, indicates that investors are complacent, expecting smooth sailing ahead. This usually precedes a downward correction.

More Like This

How to Interpret the VIX

You May Also Like

Interest rate volatility is a subject that is explained by both mathematical and fundamental reasons. Interest rates reflect the risks of rising.

In its simplest form, volatility refers to the variation in a stock price. Measuring stock-price volatility is particularly useful for an option.