What Is Slippage And How Does It Impact Our Trading Success

Post on: 28 Июль, 2015 No Comment

When studying investment basics, the term slippage has two applications. In general, it means having a trade executed at a price less favorable to the trader. Let’s look at the two areas where we may see this term used:

An order is executed at a worse-than-expected price

Stock and options

Slippage occurs when there is an unexpected change in the bid-ask spread. If we place a market order to buy a stock at the “ask” it may get executed at a higher price. This is usually the result of a period of higher volatility, low trading liquidity or unexpected bad news. Let’s say the bid-ask spread for Company BCI was $31 $31.25. If we placed a market order to buy 100 shares we would expect to pay $3125 + commissions. However, in a highly volatile market environment or if some bad news is reported about the company the spread may change against us and we pay $3200 + commissions or more. On the other side of the spread, if we placed a market order to sell 100 shares of BCI for $31 (the “bid”) we may end up generating $30.50 – commissions or less.

Stop loss order

Let’s say we purchased BCI for $32 and placed a stop loss order @ 10% or $28.80. This means that if the price reaches the stop price, the order will become a market order and sold at the best price of $28.80 or less. What if unexpected news came out regarding a disappointing earnings report and the share price gapped down to $26? The stop order is now a market order (unless otherwise specified) and our shares are sold for $2.80 less than we anticipated.

An order is executed at the published bid-ask spread

The difference between the bid and ask prices is a normal aspect of trading. If the spread is $30-$30.50, the moment we buy the shares for $30.50 we can only sell for $30. That $0.50 difference is also called slippage as you are immediately at a 1.6% deficit. This is true of both stocks and options.

How to minimize the impact of slippage in our accounts

1- Favor stocks that have a significant daily trading volume. In my covered call writing accounts, my guideline is to require equities trading at 250,000 shares per day or more. In my longer term accounts, I favor equities trading at 500,000 shares per day or more (I will be introducing a long-term trading strategy for high school and college students in my upcoming 4th book).

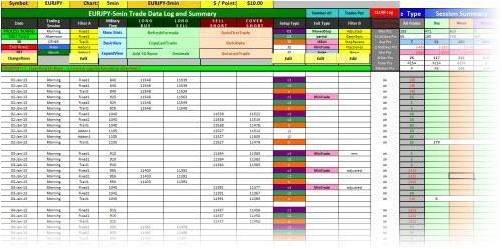

2- Favor options that have an “open interest” of 100 contracts or more and/or a bid-ask spread of $0.30 or less . In the chart below, we see that the January $50 calls for EBAY does meet our system requirements with 145 contracts of open interest and a bid-ask spread of $0.03:

Open interest and bid-ask spread

3- Avoid trading during volatile market hours. I avoid early morning and late afternoon trading. My favorite hours are between 12PM EST and 3PM EST.

4- Negotiate your trade order price. I call it ‘playing the bid-ask spread ” Place the limit order slightly below or above the midpoint of the spread (depending on if you are buying or selling), favoring the market maker. You’ll be amazed at how many orders will get filled at the better price. For tight bid-ask spreads ($0.10 or less) there is no room for negotiation.

Conclusion

Slippage is a normal part of trading stocks and options. To maximize our returns we must execute all measures that will minimize the impact slippage has on our trading success.

The last week of the year is typically a light trading volume week with few economic reports and this year was no exception:

- The Conference Boards index of consumer confidence (a gauge of consumers attitudes about the present economic situation as well as their expectations regarding future conditions. Consumer confidence tends to have a strong correlation with consumer spending patterns) came in @ 65.1 well below the 70.0 expected. However, perceptions of current economic conditions rose for the 5th straight month and stands at its highest level in 5 years

- Sales of new residential homes rose 4.4% in November (from October) and stands @ 15.3% higher than a year ago

- New home sales is at its highest level since early, 2010 when tax credit enhanced demand

- The median price of homes rose to $246,200, a 15% increase from a year ago

- Initial jobless claims for the week ending 12/22 came in @ 350,000 below the 360,000 expected

For the week, the S&P 500 dropped by 0.5% for a year-to-date return of 15.5%, including dividends.

IBD. Uptrend under pressure

BCI. President Obama and Congress are negotiating for a last minute budget deal and that should determine the short-term performance of the market. This site is extremely bullish long-term but remains in a rare high-cash position, selling only in-the-money strikes with cash invested and using low beta stocks with ETFs.

Wishing you a happy, healthy and lucrative 2013,