What is Portfolio Rebalancing

Post on: 16 Март, 2015 No Comment

2Bin%2BBalance.jpg /%

Are Your Investments In Balance?

Investors construct their portfolios based on investment goals and risk tolerance by assigning appropriate weights to different asset classes and categories (or how much dough should go to each class). Over time, as market conditions change, investment performances among asset classes change but not in the same amount at the same time. Some assets may grow faster and become over weighted, while others fall behind and become under weighted. As a result, the risk profile of the portfolio is altered (you have too much invested in certain classes). Without proper adjustment, the current portfolio would have a higher or lower risk depending on the relative values of over weighted assets and under weighted assets. Portfolio rebalancing brings a portfolio’s current asset allocation back to the original mix so that investments can be realigned to initial investment goals to maintain an appropriate risk level.

The Importance of Portfolio Rebalancing

The purpose of portfolio rebalancing is to keep the integrity of the original asset allocation. Asset allocation of an investment portfolio is important to wealth creation as it reduces volatility of investment performances and helps achieve a more certain rate of return over long period of time. Changing the set mix of asset allocation, intentional or not, would cause the portfolio to perform under a different level of risk incompatible with an investor’s stated investment goals and could hinder his or her wealth growth. The way to prevent that is through periodic portfolio rebalancing to control portfolio risk, which in turn ensures a steady growth of wealth over time.

Methods of Portfolio Rebalancing

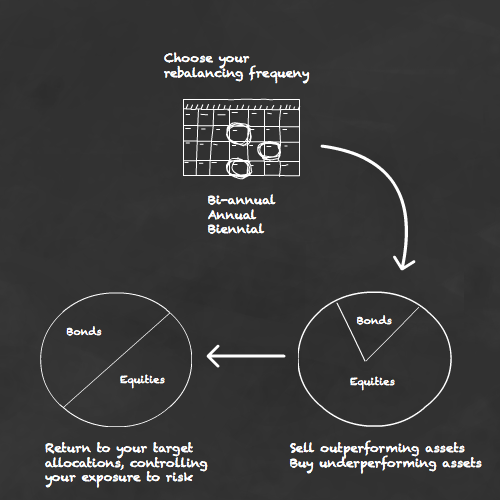

Portfolio rebalancing is done through reducing the percentage of over weighted assets and increasing the percentage of under weighted assets. Some over weighted assets can be sold and proceeds can be used to purchase under weighted assets. Investors may also use additional funds to buy more under weighted assets while keeping the total amount of over weighted assets unchanged. Or new funds can be used to add both assets but with more money allocated to under weighted assets. Compared to other asset allocation strategies, such as buy and hold, portfolio rebalancing, also known as constant mix, is most effective in volatile market conditions. While the buy-and-hold strategy may incur a loss in the value of the under weighted assets and miss out on realized gains from over weighted assets, portfolio rebalancing is able to sell over weighted assets at higher prices and buy under weighted assets at lower prices.

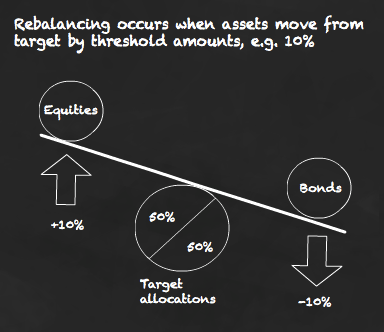

Timing of Portfolio Rebalancing

One of the negative effects of portfolio rebalancing is that buying and selling from time to time subjects investors to transaction fees. As a general rule, portfolio rebalancing should be done on a relatively infrequent basis. The timing of portfolio rebalancing can be based on either a calendar date or a set target about the changing weights of the current asset allocation from those of the original mix (for example, if an asset class differs by more than 5% of the original allocation). Be aware that if the holding period of an asset being sold does not qualify for capital gain treatment, the investor would have to pay more tax on an gain as ordinary income.

Portfolio Rebalancing Is For All Accounts

Keep in mind, rebalancing isnt only for your taxable account (like you might have with an online broker ). You want to take a look at accounts like 401ks. 529 plans, and Roth and Traditional IRAs as well. Make sure your asset goals for all accounts are in line with your original intentions.

So you can see, rebalancing your portfolio is an important task for an investor. By keeping your portfolio in balance, you help make sure your asset goals are kept and you keep your portfolio on track to minimize risk and grow your investments.

Free Newsletter to Keep you Free From Broke!Name: Email: We respect your email privacyPowered by AWeber email marketing