What is Hedging Forex Hedging explained

Post on: 6 Август, 2015 No Comment

Hedging is nothing but a fancy term for insurance, often used in the financial markets despite most traders misreading this term as trying to make a profit from both rising and falling markets. The reason behind this gross misunderstanding of the term has largely to do with the term hedge funds. As one might already know, hedge funds are expected to perform regardless of the market direction; ie. Rising or falling markets. Therefore it is easy to see where this concept of hedging which is primarily all about minimizing losses by way of insurance had transformed itself into a misunderstood concept of making a profit irrespective of the market rising or falling.

So what exactly is insurance? It is those small monthly premiums you pay towards either protecting your home against any theft or fire or insuring your car, where you pay a premium to insure you against any damages in an accident. The funny thing about insurance and premiums is that we pay the premiums in hopes that we don’t ever expect the insurance policy to pay back. There aren’t many people who take out a home insurance policy in hopes that their house gets burned down (there a few who do though). So to recap, hedging is similar to buying an insurance policy. You pay a small premium with the hope that in case of adverse losses you can be compensated by the insurance or hedge policy. One doesnt hedge or take an insurance policy to make a profit.

It is surprising to see how many forex strategies are shared under the guise of hedging where a buy and sell orders are placed a few pips away with 10 or 20 pips in profits. The sooner a trader understands what hedging is all about, the wiser they will be in terms of properly using this strategy.

Hedging Example Stocks and Futures

The easiest and simplest example to define hedging can be done by giving examples of the stocks and futures markets.

Let’s take an example where trader John has bought 1000 shares of Microsoft at $40. John is of the view that the upcoming earnings release of Microsoft will be bullish and expects to book profits when shares rise to $45, thus making a fair profit of $500. A few days ahead of the earnings, John notices some mixed views on Microsoft with a few analysts changing their view from Buy to Hold. This alarms John because Microsoft is only trading at $42 with just three days to go for earnings call. So what does John do?

Does he sell his shares at the market price of $42 and book profits of $200? Or does he tell his broker to limit his losses to $40 so he can exit at break-even?

While limiting his losses to just commissions paid by moving his stops to $40 is one way to do it, John could very well hedge his long position.

The way John hedges his trade is by purchasing a Put option at a strike price of $37. Because the Put options would be Out-of-the-money at the time of purchase, they can be bought at a discount (assume each option contract is worth $0.5). Therefore, John would have to pay $0.50 x 1000 contracts = $500. So by doing this, John hedge his $40000 investment with $500.

If, after the earnings call, Microsoft share price soared above $45, John would have made a total gross profit of $5000 or net profit of $4500 (minus $500 hedged in options). But if the earnings call was bad and Microsoft’s share price decline, John’s Put option hedge would pay him ($40 $37 $0.5 = $2.5 per contract) $2500. So despite Microsoft’s shares dropping, John’s stock position would be stopped out at $40, pocketing $200 + $2500, a total of $2700.

By doing so, John is simply hedging his risk in the long position held in Microsoft shares by purchasing a Put option which guarantees a profit if the price indeed falls. Of course, if the price rallies all the way to $45, John only loses his premium paid for the option.

This above example is just one of the many ways traders can hedge their risks. Other common methods include buying futures or forward contract to hedge against an anticipated price hike in a commodity or a security.

Hedging in Forex

Now that we have an idea of what hedging really means, do you still want to place a random buy and sell order some pips away because you read it on some forum with the author of that strategy claiming it made them a lot of money?

Hedging in forex can be done in many ways, but we point out some simple methods.

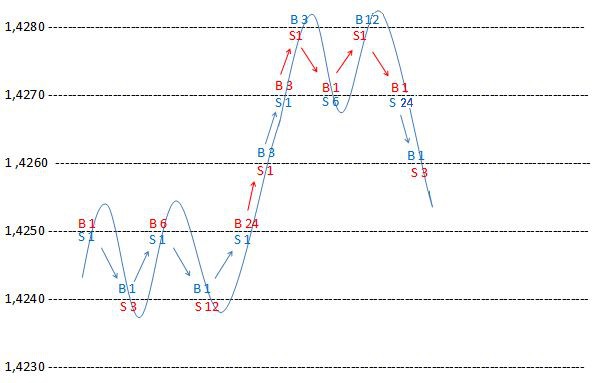

Compensate your exposure: Say you have too many long side positions on the Australian dollar. Example you are short EURAUD, GBPAUD. In order to protect yourself against market reversing, the best way to hedge the Aussie long positions would be to look for a pair where you can short the AUD, or look for pairs where you can long the Euro or the Pound. So you would be looking at AUDUSD, AUDCAD shorts or GBPUSD, EURUSD, GBPCAD, EURCAD long positions. The trick here is not to blindly take up opposite positions but to ensure that the risks from one pair is offset by the hedged position in another pair while ensuring you make at least a little bit of profit in the process.

Correlations: Correlations are commonly used in forex trading where pairs that exhibit the same directional bias can be used to trade in the same direction. For example, currently USDCHF and EURUSD are inversely correlated; meaning that you buy one pair and short the other or vice versa. This method of correlation trading although is not hedging in actual terms can help in minimizing losses.

Other hedging methods include purchasing Call and Put options or even trading in stocks that tend to be impacted by the exchange rate namely export and import driven companies and even commodities.

Why hedge?

Before you start to implement any of the above methods, the first question to ask yourself is whether there is a reason to hedge. Hedging as you can see is not all that simple and when used incorrectly can be more damaging to your equity as compared to leaving this simple. In this context, hedging is therefore more suited for long term trades that are just been triggered. Swing trading often carries the risk of wider stops and this risk can be easily offset by hedging in another appropriate currency pair.