What is gamma hedging

Post on: 16 Май, 2015 No Comment

To understand gamma hedging it is important to understand delta hedging first. Delta hedging eliminates the risk to an option owing to a change in the price of the underlying. Gamma hedging basically refers to a re-adjustment of a delta hedge. In this article we will work through a basic example to show how gamma and delta take effect and how delta hedging and gamma hedging are related.

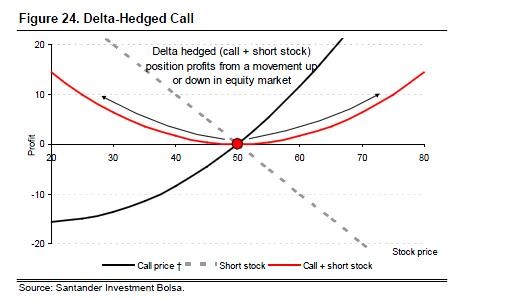

Any option or portfolio of options can be delta hedged (see What is delta hedging? for details). Typically however this hedge is only precise and fully effective against a single price in the underlying. For example, if we buy an at-the-money call option and delta hedge by selling the spot product at the current price then this hedge will generally only be 100% effective versus the current spot price.

Why is this? Consider the two elements to a delta-hedged option portfolio; the option(s) and the spot trades. The delta of the spot is 100% and constant by definition. (Remember that delta means the change in an instruments value for a change in the price of the underlying product; so for the underlying product the delta must be 100% because its value must change one for one when its own value changes!). However the delta of an option may not be constant; it can vary for changes in the spot price. This is due to the gamma of the option which determines by how much the options delta will change for a change in the spot price.

Option Gamma Trading (Volcube, 2013) An accessible ebook guide to option gamma trading, from basic definitions to more advanced gamma hedging and gamma trading techniques as practised by professional option traders. Starting from first principles, option gamma is explained in straightforward English before separate sections on gamma hedging, gamma trading and advanced gamma trading []

Order Volcube Advanced Option Trading Guides — Volume I I — Option Gamma Trading @ $9.99

Consider again the delta-hedged at-the-money call option. This option has a 50% delta (being at-the-money), so we need to sell half as many lots of the underlying as we own call options in order to delta-hedge. Let us assume we own 100 calls and delta hedge this by selling 50 lots of the spot. Finally, let us assume the call option has a gamma of 10. Now, suppose the spot price falls suddenly to $99. We know from the option gamma that for a $1 price change in the spot, the delta will change by about 10 cents. (In reality, the change is likely to be less than 10 because the gamma is not constant and typically in this case will be lower than 10 when the call option is not precisely at-the-money; but for now let us assume it is always 10). So the spot price fall is accompanied by a fall in the delta of the call option to 40%. Here then we can see that our original delta-hedge is now too big; we sold 50 lots of the spot, but now only need to be short 40, given the new call delta. This implies we need to buy back 10 lots of the spot and this is good news because the spot has just fallen in price by $1! This demonstrates the basic idea of gamma hedging. It involves re-hedging an option portfolio due to the change in the portfolio delta, which in turn happens because the portfolio has gamma and the spot price has changed. Note that if the price had risen instead of having fallen, this too would have been profitable. At $101, the call has a delta (again, approximately) of 60%; in this case we are not short enough spot and need to sell more (because we are only short 50 lots of the spot). This is good news because the spot has risen in price (and we now need to sell; in effect we are long the underlying when its price has risen). This shows the benefits of being long gamma; here we are long gamma because we owned the call option.

Gamma trading can be practised in Volcube in several ways. By studying different pricing sheets, you can see how the delta of options vary for differing strikes which is analogous to checking the delta versus differing underlying prices. You can trade in Volcube with a fixed spot price; see how a portfolios delta varies across differing underlying prices in the risk matrix. You can also trade in Volcube with a moving spot and practise gamma hedging as the spot price moves. For Pro users, try playing with one of Volcubes Set Piece Positions; this gives you an inventory from the start of the game and will ensure you have a large gamma exposure. As the spot moves, learn how to gamma hedge your portfolio. Finally, there is more reading material and videos around gamma hedging in the Volcube Learning environment.

Volcube is an options education technology company, used by option traders around the world to practise and learn option trading techniques.