What Is Dollar Cost Averaging and Is It a Good Idea Mom and Dad Money

Post on: 5 Май, 2015 No Comment

By Matt Becker

Posted July 14, 2014

Lets say you have a big chunk of money that youd like to invest, maybe a $3,000 tax refund. You have two basic options for how to do it:

- Invest all of the money all at once, or

- Invest just a little bit at a time.

That second approach is called dollar cost averaging . Instead of investing all $3,000 right away, maybe you invest $500 per month over a period of 6 months, or whatever dollar amount and interval works for you. Youll still invest all of it eventually, its just done a little more slowly.

Keep in mind that this is different than setting up regular monthly contributions when you receive your paycheck. In that case youre actually doing #1, its just that you have to wait for your paycheck each month to have the money available.

What Im really talking about is situations where you have a bigger chunk of money that isnt part of your regular monthly savings. Think things like:

- Tax refunds

- Bonuses

- Gift money

- Inheritance

In these kinds of situations, dollar cost averaging can be a good tool. But there are also some misconceptions about exactly how useful it is, so lets take a look at the benefits and downsides so we can figure out whether its a good idea for you.

The benefits of dollar cost averaging

The benefits of dollar cost averaging are mostly psychological. By putting your money in slowly, youre reducing the amount of risk youre taking with that money until its all been invested. Its reducing the chance that youll put your money in and immediately lose a big chunk of it, which can help reduce the amount of anxiety you have about investing it.

This is not a small thing. One of the most important things you can do as investor is to simply get started. and anything that helps you do that is a big plus.

And once youve gotten started, the next most important thing is to keep going and to stay consistent. If youre nervous about investing all that money at once but you do it anyways, a market drop is likely to make you even more nervous and potentially scare you away from investing altogether.

The emotional part of investing is very real and definitely shouldnt be ignored. A big part of being successful is understanding what kinds of risks youre comfortable with and what kinds you arent. If dollar cost averaging helps you feel more comfortable, then its likely to help you be a better investor.

The downsides to dollar cost averaging

The thing that a lot of articles talking about dollar cost averaging get wrong is whether it provides better returns. It might, but its more likely that it wont.

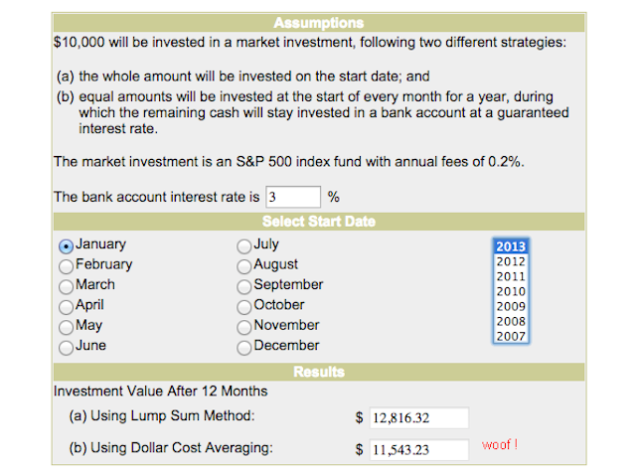

The research backs it up. showing that investing all of the money at once will give you better returns about 2/3 of the time. And it makes sense if you think about it too. The stock market generally provides better returns than a savings account. So by keeping some of that money in a savings account instead of putting it into the stock market, youre missing out on some potential for better returns.

The other big downside is that by dollar cost averaging, youre temporarily deviating from your investment plan. A big part of your investment plan is choosing your asset allocation, which is basically just choosing how much money you want to put into stocks vs. bonds vs. any other type of investment. If you were 100% sticking to your plan, any money you wanted to invest would immediately get invested according to your chosen asset allocation. After all, you chose it for a reason. But by dollar cost averaging, youre temporarily keeping some of your money out of that plan, which means youre temporarily straying from your chosen path.

One other downside: it adds a little bit of complication. You have to set up some kind of reminder or automatic contribution to make sure that the money all eventually gets invested, which certainly isnt the most taxing thing in the world but does put more on your plate than simply investing it all right away.

None of these things should necessarily be deal breakers, but theyre worth knowing before you make a decision.

What should you do?

My personal approach in these kinds of situations is to invest all of the money all at once, basically for all the reasons mentioned in the “downsides” section. I like that its more closely sticking to my original plan. that its likely (though certainly not guaranteed) to work out better, and that its a little simpler. Plus, I really dont even pay attention to what the stock market is doing. so the ups and downs dont really bother me.

With that said, you should really take whichever approach feels right to you. If youre nervous about it, dont force yourself to invest it all at once just because the odds say youll be better off. You can learn to change your emotions towards investing over time, but forcefully pushing yourself off the cliff when you dont feel ready usually isnt a good idea.

I would think first and foremost about how you would feel if you invested the money all at once and the next day there was a 30% drop in the stock market. If that happened, would you hate yourself? Would you want to immediately pull that money out so you didnt lose more?

If the answer is yes, then you should probably dollar cost average. If you wouldnt really care, then maybe you should invest it all at once.

Either route will be good enough. so feel free to follow your gut.