What Is Dollar Cost Averaging_1

Post on: 29 Апрель, 2015 No Comment

When you dollar cost average (DCA) you take a fixed amount of money and invest it at set intervals. Usually that means you take the same amount of money and invest it each week, month or quarter. If you have a 401k or 403B – you are already using a form of dollar cost averaging because you invest a little bit each time you get paid. Didn’t know how smart you were…did you?

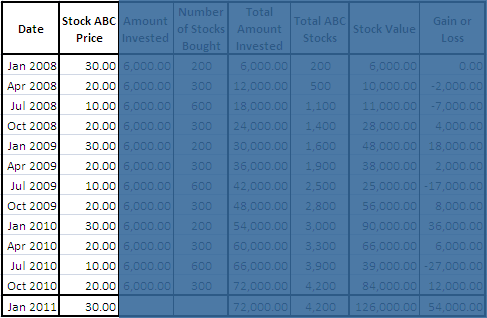

If you are worried about whats in store for the stock market. this can be a good approach. If the market takes some dips during the investment period youll get more shares for every dollar you invest as youll see. If the market goes up in a more or less linear fashion over that time you would have been better off had you invested as a lump sum at the very start. If the market sinks like a lead pipe, dollar cost averaging will help you but obviously you’d have been better off had you not invested in the first place.

Does It Work?

Consider the following example. Joe Investor invests $100 per month for 8 months. The price of the fund starts out at $10 per share but Joe isn’t very lucky. The share price drops $.50 every month. You can see that by the end of 8 months, Joe has invested a total of $800. The good news is that as the share price drops his $100 buys more shares each month.

At the start of the period, his $100 only bought 10 shares. But by the end of the period, his $100 buys 15.38 shares. (Yes…you can buy fractional shares if you buy mutual funds and ETFs ). You can see that because Joe used dollar cost averaging his average cost is $8.09 per share. Had he dumped all his money into the market in the first month his average cost would have been $10 per share. Because his cost is lower, it will be easier for Joe to make a profit on this investment. This is one huge benefit of using the dollar cost average investment technique.

But it helps investors in other ways too. Namely, it allows people to slowly put their feet in the water rather than jump in with both feet. This gives many people the opportunity to invest without worrying if this is the best time to invest or not. That fear keeps a lot of investors sidelined. Dollar cost averaging neutralizes that fear and gets them into the game.

Another advantage of this approach is that it takes all your emotion out of the investment equation and gets you to invest systematically. I’m all for anything that does that. This is just a huge psychological benefit that it’s hard to overestimate its value for the right person.

If you are interesting in putting Dollar Cost Averaging to work for you, consider checking out Betterment. They offer an inexpensive and automated way to implement this strategy and they also provide some great tools to help you plan for the future.

Is Dollar Cost Averaging For You?

If you are conservative and risk-averse, DCA can be a wonderful technique as I explained above. If you are not overly risk-averse, it’s really a coin toss. If you look back over the last 3 or 4 year, dollar cost averaging would have been a mistake from a financial standpoint. The market has done really well and it’s been fairly consistent. That means the investor who put his or her money in earliest is the biggest winner.

But if somebody evaluates DCA this way, they miss the point I believe. Nobody knew what the market was going to do over the last several years and nobody knows what the market is going to do in the next several years. That being the case, the best way for you to decide about dollar cost averaging is to consider how much risk you are comfortable taking and move ahead accordingly.

An Interesting Twist On Dollar Cost Averaging

You can also use this technique if you are withdrawing funds from your account too and it can be powerful. I’ll give you a real-life example of someone who didn’t use this and should have. It illustrates how cool dollar cost averaging can be on the withdrawal side as well.

In the mid-90s a good friend of mine was working for a small software company and on top of his meager salary he was given share options to entice him to stay. After several years, the options were worth about $1 million. My friend decided he wanted to go to law school at that time. He cashed in all his shares in one fell swoop and used the money as he needed it to support his family and pay for school. Was it a mistake?

At the time, tech stocks were going crazy and his account values were growing every day. I suggested that he sell off just enough to pay for his expenses over the next 12 months and to repeat that process each year. Nobody knew what the value of those was going to be and it seemed like selling them all at one time was a big risk.

It’s true that he’d take some risk if he used dollar cost averaging to sell. But we figured that the risk didn’t jeopardize his ability to complete law school or care for his family.

As it turns out, the small company he worked for was ultimately bought out by Cisco and his $1 million would have been worth several million dollars even after he made his annual withdrawals. So in this case I ended up looking like a genius and my buddy ended up a lawyer.

The truth is I wasn’t a genius. Nobody knew this was going to happen to the value of those shares. I gave my pal intellectual advice but he had to live with the consequences. That’s why he took all the risk off the table and I really can’t fault him for it. I’m not sure I would have had the grit to hold on to those shares either – even though it worked out to be intellectually sound.

If you need a large amount of money over an extended period of time, you can dollar cost average out of the market just as you can to get into the market. This approach takes away the pressure of needing to know the best time to invest or withdraw your money. I like it but do you?

Have you ever used this approach to investing or taking withdrawals? As an alternative, are you more a fan of market timing ?How did either work out for you?