What is Diversified Portfolio and how to create it

Post on: 24 Апрель, 2015 No Comment

by Manish Chauhan 12 comments

Today we will discuss How to build a Diversified Portfolio and hence and strong portfolio and why we need it. If you dont understand a lot of terms and terminologies related to investing and finance. have a quick look at terms and terminologies page to quickly understand the terms. it will take 5 minutes.

What is Portfolio.

Your investments all together is your portfolio. as simple as that .So. if i have

- 10,000 in shares

- 20,000 in real estate

- 1000 cash

thats my portfolio

What is an Asset Class.

An Asset class is something where we can invest and build assets. If i buy a Home or land. i build an asset in real estate category. if i buy anything in shares or mutual funds (equity). i create assets in Equity asset class .

(Dont know what is mutual fund. click here)

They are just categories. Following are some asset classes:

- Equity. Shares. Equity Mutual funds. Derivatives (Future and Options)

- Debt. Fixed Deposits. PPF. NSC. FMP (How to find the best Fixed Deposit )

- Real Estate. Land. Flat. Commercial Plots. Home

- Commodities. trading in commodities. leave it if you dont understand

- Gold or Silver. Recently these are also counted as Asset classes

- Cash. thats the hottest thing

Now what is a Diversified Portfolio.

As the heading says, Diversified portfolio is a portfolio which is not heavily invested in some asset class. but has balance over every asset class. There is no thumb rule that what percentage of your portfolio shall go in which asset class. It depends purely on.

- What is your Risk appetite

- Goals (short. medium and long term)

- Economy and Political atmosphere

- Current market over long term

Why Diversification.

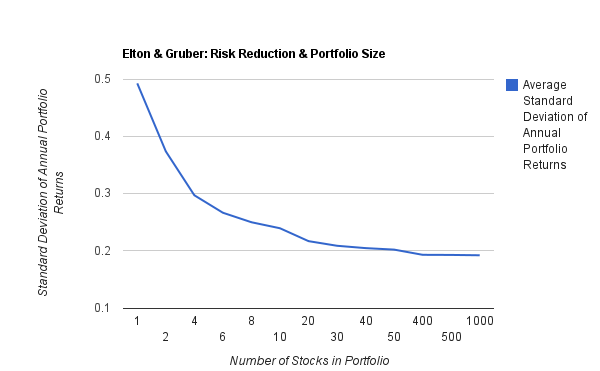

When you diversify you investments over different asset class. not only your money gets diversified. but also risk. so if some particular asset class is not performing well. it will affect only that part of your portfolio and not whole of it.

Obviously it also effects the returns. you returns are collection of returns from all the asset class. so even if some asset class did not perform over a period. it doesnt affect you hardly.

Every asset class provides some thing like.

- Equity. Very High returns. Volatility. Liquidity

- Debt. Low but Secure returns. No liquidity

- Real Estate. Good returns. stability. No liquidity

- Gold. Hedge against inflation. Stability

- Cash. High liquidity

Every asset class provides some thing good and some thing bad. Diversification helps in getting all benefits in some or the other way and being at the centre of all. With diversified portfolio you get all the elements of. Good returns. Stable returns. Liquidity. Security

Lets see some examples.

1. Anyone who was heavily invested in Debt around 2003-2004 didnt get high returns from the zooming stock markets (equity) for 4-5 yrs

2. Anyone who was heavily invested in Equity around start of 2008. saw his investments go down by 40-60% .

3. Anyone who is totally invested in Debt cant get instant money if required, either he has to take some loan over those investments or break his PF or FD etc.

That does not mean. non-diversification always hits

1. Anyone heavily invested in Equities before the bull run of stock markets in 2003 onwards made fortunes (but at their risk) .

2. And people who had most of there money in GOLD in 2007 got the highest returns compared to any asset class.

3. It totally depends on person to person. I hope this point is cleared. Also. inside every asset class. another level of diversification is important. Like in Equity there are different categories like Large Cap. Mid Cap. Small Cap. Read Magic of SIP

In Mutual funds there are sectoral funds. equity diversified. balanced funds. debt funds. liquid funds etc. Another level of diversification is also necessary to achieve high level of diversification .

Case study

Ajay a software engineer earning Rs 35,000 monthly (post tax) with a Family of 3 (1 wife and 1 kid) has following portfolio

Expenditure. 20,000 per month

Portfolio.

- Tax savers Mutual funds. 1 lacs (locked for another 2 years)

- Real Estate (a land in his native place. pahari in UP). 3.75 lacs

- Fixed Deposits (for 5 years). 2 lacs

- PPF. 3 lacs

- Cash (in bank). Rs 25,000

- Insurance Payout. He pay 55,000 per year as life insurance premium for an endowment policy. for which he is insured for 12.5 lacs for 20 years. he started this policy before 4 years.

His Future plans

1. His goals are to buy a home in another 5 years for which he need down payment of 3-4 lacs

2. Want to save 10 lacs for his son education in 10 years

3. He want to retire early with monthly income of 45,000 at least. Read 6 steps of retirement Planning .

This Portfolio looks like diversified, and yes it is, but not in a well mannered way.

The asset wise allocation is

* Equity. 10%

* Debt. 37.5%

* Real Estate. 50%

* Cash. 2.5%

His overall Portfolio Shortcoming

- His exposure to different asset class is not well balanced according to his over all situation

- His Life insurance is very less and and not at all enough. For this he is paying a hefty amount every year which adds a lot to his burden.

- His Equity Allocation needs to go up

- His Debt allocation needs to go down

- His cash needs to go up for liquidity. none of his investments in any asset class provide liquidity or near term liquidity. If he needs 1 lacs suddenly he cant get it. or will get it after breaking his FD.

Suggestions.

The first thing he must do is to restructure his portfolio.

- He shall surrender his existing Endowment policy and take a Term Insurance 35-40 lacs for 20 years for which he will pay around 13000-14000 per Annam. he will save surplus of 40,000 per year because of this.Also when he surrenders the policy he will get back around Rs. 2.4 lacs back.

- He must invest more in Shares and Mutual funds (as his risk taking capabilities is more because of his less age and less dependents)

- The land in his native place is not appreciating in value much faster unlike other places like other real-estate hot spots. He shall consider buying his home sooner and sell his land at native place. if he sells his land he will get around 4 lacs.

- With the money he gets from surrendering policy (2.4 lacs) and selling his land (4 lacs). he will get around 6.4 lacs and he should utilize this money as the down payment for new flat and rest he can take as Home Loan. (Want to know how EMI on home loan is calculated. click here ) He can do it later if he wants (when he can afford the monthly EMI)

- He shall consider increasing his Cash to a level which can meet his contingent needs if any arised. He shall have at least 2 to 3 times of his monthly expenses as contingency fund. which is totally liquid.

- Also apart from Cash and investing in Tax saver mutual funds. he shall consider investing in some non-tax saver mutual funds which also gives him near liquidity.

- He may leave the debt investments as it is. If he wants he can break his FD in case he is going for the Home loan. he can increase the down payment part from this money.

- In case he is going to take home loan after 1 year. he can also take some loan on his PPF. at least for some part he will pay less interest than the home loan.

- Also he shall invest some money in GOLD. to give more stability and security to his portfolio.

- At last he shall consider taking a Family floater Health Insurance plan. which helps him to secure his Family from and health problems or illness.

Recommended Portfolio

Apart from His Home (considering he takes Home soon)

- Equity 65% ( Direct shares 20%. Equity Funds 60%. Balanced Funds 20%)

- Debt 20%

- Gold (ETF) 10%

- Cash 5%

Conclusion

Diversification does not say that you have to invest in some money in every asset class for sure. the idea behind it is just that the risk is minimized by diversification and the portfolio is more stable.Happy diversifying and Leave comments