What is degree of financial leverage Questions & Answers

Post on: 1 Июль, 2015 No Comment

What is degree of financial leverage?

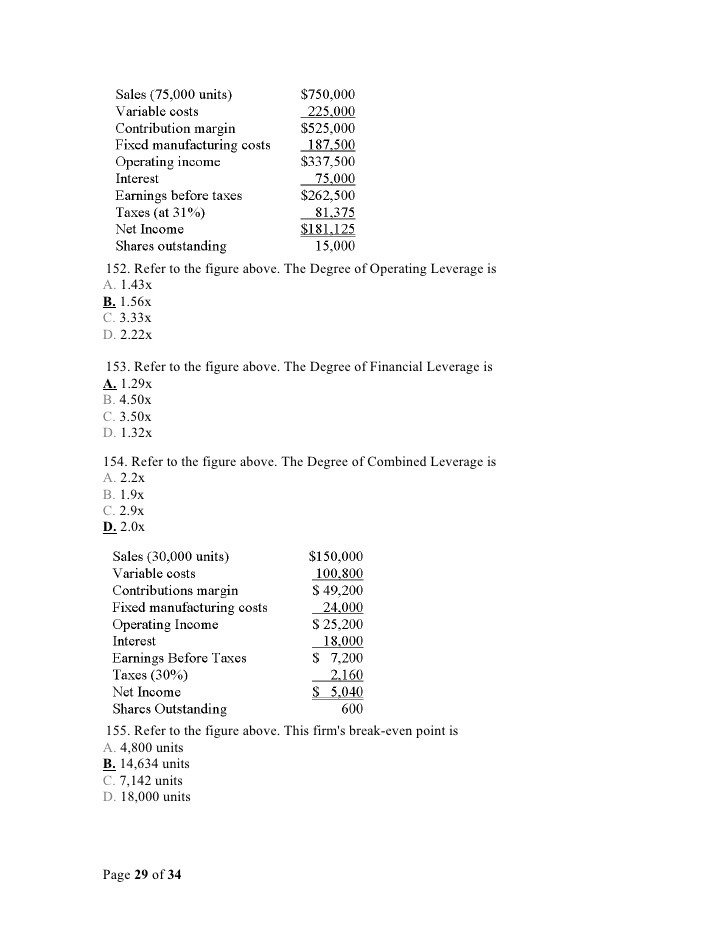

The degree of financial leverage calculates the proportional change in net income that is caused by a change in the capital structure of a business to either increase or decrease the amount of debt for which the company is liable. The calculation is earnings before interest and taxes, divided by earnings before taxes. The formula is:

Earnings before interest and taxes / Earnings before taxes

This measurement can also be used to model the proportional change in net income caused by a change in the interest rate (even if the baseline amount of debt remains the same).

The degree of financial leverage is useful for modeling what may happen to the net income of a business in the future, based on changes in its operating income, interest rates, and/or amount of debt burden. In particular, when debt is added to a business, this introduces interest expense, which is a fixed cost. Since interest cost is a fixed cost, it increases the breakeven point at which a business begins to turn a profit. The result is usually a higher level of risk, where a company can earn a great deal more money above its breakeven level from the funds provided by the additional debt, but the higher breakeven level also means that the company will lose more money if sales dip below the higher breakeven point.

When a company has a high degree of financial leverage, the volatility of its stock price will likely increase the reflect the volatility of its earnings. When a company has a high level of stock price volatility, it must record a higher expense associated with any stock options it has granted. This constitutes an additional cost of taking on more debt.

The metric can also be used to compare the results of several businesses to see which ones have more financial risk built into their capital structures. This information might lead an investor to buy the shares of a company with a higher degree of financial risk during an expanding economy, since he should earn outsized profits on higher sales volume. Conversely, the same information would lead an investor to buy the shares of a company with a lower degree of financial risk during a contracting economy, since its lower breakeven point should mitigate its losses. Thus, this type of analysis can be used to compare and contrast the likely financial performance of companies within a single industry, and reapportion investments among them, depending on the economic environment.

For example, in Year 1, ABC International has no debt and earns $40,000 before interest and taxes. Since there is no debt, the earnings before taxes is the same number. Therefore, the degree of financial leverage is 1.00, which is quite conservative. In Year 2, the management of ABC takes on debt in order to expand the business. The result is earnings before interest and taxes of $70,000, while $20,000 of interest expense reduces the earnings before taxes to $50,000. This means that the degree of financial leverage has increased to $70,000 / $50,000, or 1.4. Thus, for every $1 change in earnings before taxes, there is a 1.4x change in earnings before interest and taxes.

In short, a higher number indicates a higher degree of financial leverage, which can be considered a higher degree of risk, especially if earnings from operations decline while the interest expense remains.

The formula for the degree of financial leverage can also be expressed as:

Earnings per share / Earnings before interest and taxes

Related Topics