What is Bear Call Ladder Strategy

Post on: 8 Апрель, 2015 No Comment

Description:

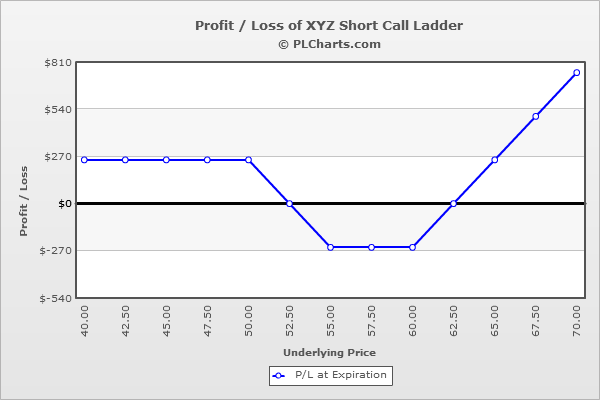

The Bear Call Ladder also known as the Short Call Ladder is an extension to the Bear Call Spread. By buying another call at a higher strike, the position assumes uncapped reward potential if the stock soars. Maximum gain for the short call ladder strategy is limited when the underlying stock price goes down. In this scenario, maximum profit is limited to the initial credit received since all the long and short calls will expire worthless. However, if the underlying stock price rallies explosively, potential profit is unlimited due to the extra long call.

Example

XYZ is trading at $48.00 on May 17, 2004.

Sell the August 2004 50 strike call for $4.20.

Buy the August 2004 55 strike call for $2.40.

Buy the August 2004 60 strike call for $0.80.

Net Credit = Premium sold — premiums bought

$4.20 — $2.40 — $0.80 = $1.00

Maximum Risk = Middle strike — lower strike + net debit (or — net credit)

$55.00 — $50.00 — $1.00 = $4.00

Maximum Reward = Unlimited

Breakeven (Downside) = Lower strike + net debit (or + net credit)

$50.00 + $1.00 = $51.00

Breakeven (Upside) = Higher strike + maximum risk

$60.00 + $4.00 = $64.00

Effect of Time Decay

Time decay is generally harmful when the position is losing money and helpful when the position is profitable.

Appropriate Time Period to Trade

Depending on the reasons for the trade, it is safest to choose a medium to long term to expiration, enough time to allow the underlying asset to move and make the position profitable without time decay destroying the long options.

Stock Selection

Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

Try to ensure you understand the direction of the trend and identify a clear area of both support and resistance

Options Selection

Choose options with good liquidity; open interest should be at least 100, preferably 500.

Lower Strike — Slightly OTM, just above resistance for the stock.

Middle Strike — One or two strikes above the lower strike, i.e. further OTM.

Higher Strike — Above the middle strike, i.e. even further OTM.

Expiration- medium term to expiration (say around six months) would be safer. Use same expiration date for all legs.

P/L Profile