What is an IPO New Issues & Flotations The Share Centre

Post on: 16 Март, 2015 No Comment

Our quick explanation about IPOs can help you make more informed investment decisions

What is an IPO?

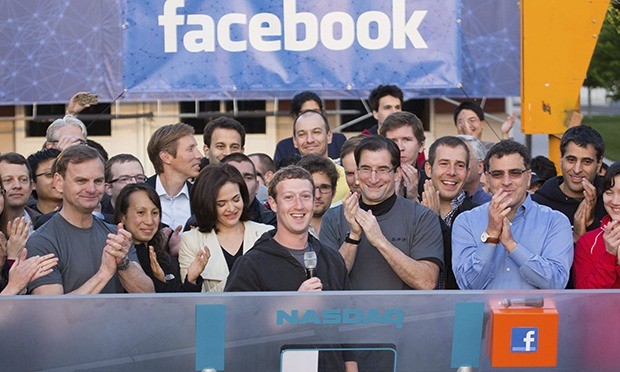

Also referred to as a flotation or new issue, an IPO is the first offering of a company’s shares on a stock market. Companies use IPOs typically to raise capital to expand or to reward founder investors. An IPO is not a loan to the company by investors so the company is not required to repay the capital raised via the stock market. The company is moving from a private company to a public company.

The IPO is underwritten by investment banks which, among other functions, will determine a market value for the company, and consequently a price investors will pay.

In recent times, IPOs have typically been offered exclusively to institutions and The Share Centre continues to lobby issuers to include private investors.

What should investors research before investing in an IPO?

Without doubt the starting point for researching an IPO is the company prospectus.

This is a document produced by the company at the start of the application process and contains the crucial information required to help investors make a fully informed investment decision. It is similar to a company’s Report & Accounts and is signed off by its legal, tax and banking advisers.

In addition to reading the prospectus, investors should familiarise themselves with the sector the company will operate in, its competitors and broader economic factors. It is important to look at the track record of the executive team and research how the company intends to use the funds it raises through the IPO; will it open a series of production plants to bring an exciting new product to market or does the company plan to expand into new geographies?

It now comes down to whether the IPO is fairly priced and examining the stock market conditions when the IPO is announced. If the market looks weak and the IPO appears overpriced, it’s probably worth staying out of the offering.

The greatest risk is that a company is overpriced at the IPO and falls sharply away after launching. However, there are many examples of successful IPOs where the initial investments have returned excellent profits.

As with any investment, the share price can increase and decrease on a variety of factors and you could lose some or all of your investment, so if there is any uncertainty you should hold off to see how the company performs once it has had time in the open market.