What is a warrant price

Post on: 16 Март, 2015 No Comment

2011-12 Men’s Golf Roster

Michael Koronkiewicz

Class: Senior

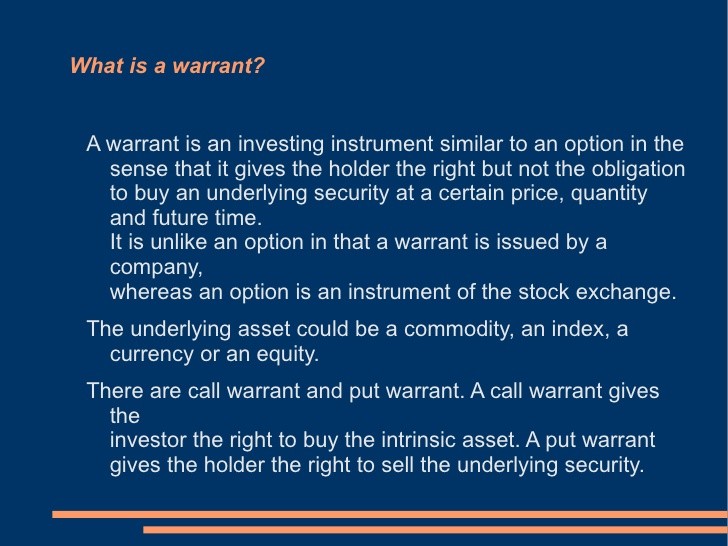

Jun 24, 2010. A warrant is like an option. It gives the holder the right but not the obligation to buy an underlying security at a certain price, quantity and future .

www.investopedia.com/articles/04/021704.asp

High School: Goshen

MAJOR: Marketing

Exercising a warrant means paying the subscription (exercise) price to convert your warrants into shares. If the subscription price of a warrant is 50p, effectively .

Share Price Annual Growth(%), Warrant Price Annual Growth(%), Share Price at maturity, Warrant Price at .

However, it is important to have some understanding of the various influences on warrant prices. The market value of a warrant can be .

en.wikipedia.org/wiki/Warrant_(finance)

Warrants are securities issued by a company (often an investment trust) which give their owners the right to purchase shares in the company at a specific price at .

www.finance-glossary.com/define/warrant/1532

The price at which a warrant holder can purchase the underlying securities is called the exercise price or strike price. The exercise price is usually higher than .

www.investinganswers.com/financial-dictionary/optionsderivatives/warrant-861

Name/Code, RP, B i d, A s k, Move, %Move, Volume, Strike Price, Cover Ratio, Expiry Date, Issuer, Type. ARCMITTAL, 4173, 4120, 4300, 84, 2.05, 403258 .

www.sharenet.co.za/free/war.phtml

For example, the present value of estimated dividends can be deducted from the stock price in the model. Warrant Pricing. Warrants are call options issued by a .

www.quickmba.com/finance/black-scholes/

Dec 5, 2006. FACTORS AFFECTING THE WARRANT PRICE. The value of a warrant is influenced by the supply of and demand for the warrant, and its .

www.hkex.com.hk/eng/prod/secprod/dwrc/dwrc_cal/calculator.htm

Career Statistics

Season Rounds Strokes Lo72 Lo54 Lo36 Lo18 LoRnd Events Top5 Top10 Top20 Avg

A puzzle for investors might be how a warrant price is actually arrived at, because the forces of supply and demand take a back seat. Ordinarily, for equities and .

Warrants are call options issued by firms, which give the holder the right to purchase shares at a fixed price from the firm. The main difference between a warrant .

A warrant is similar to an option in that both give the holder the right (but not an obligation) to purchase/sell a given security at a given strike price before its .

In the case that the price of the security rises to above that of the warrants exercise price, then the investor can buy the security at the warrants exercise price .

www.investorwords.com/5285/warrant.html