What Is a SPAN Margin (with picture)

Post on: 24 Июль, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

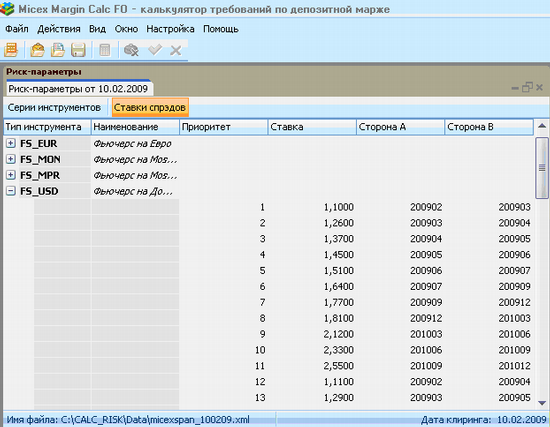

SPAN margin is the leading system of margin management used by most leading futures and options markets. Short for standard portfolio analysis of risk, the SPAN margin system uses a series of complicated algorithms to determine the minimum amount of margin that holders of stock options or futures must have to cover the risk of a maximum one-day loss. There are many advantages of this system, including the fact that it allows for excess margin on one position to be transferred to other positions within a portfolio. In addition, SPAN also takes into account the entirety of a portfolio’s transactions rather than just the most recent position taken.

Trading of options and futures requires different determinations of margin than does the trading of stocks. When a person makes a stock trade, he or she essentially gets a loan from a broker to purchase larger amounts of stock than the trader initially gives up in capital. An options margin, which is the amount of money that must be put into an account to trade options, comes in the form of a performance bond deposit. The SPAN margin system, first developed by the Chicago Mercantile Exchange and now adopted by most leading futures and options exchanges worldwide, analyzes a specific portfolio and determines the amount of margin the trader must initially put up.

The SPAN model takes into effect some of the variables that effect options trading. such as the price of the underlying commodity, the time the option has until expiration, and the volatility of the underlying asset. It then puts the different options through 16 possible market scenarios of gains or losses. This system then yields an amount that the trader must have in order to trade options on that particular market, a number that can change daily due to market volatility.

This allows the trader to put down less money to carry more options, which helps the markets as well in that it encourages more trading. An exchange that did not use the SPAN margin system would require the trader to put up a certain amount of margin for each position that they hold. By combining all of the positions within a portfolio and allowing more solid positions to balance out riskier options, the system is beneficial to the option trader.

Some other advantages exist for traders who use an exchange that utilizes the SPAN margin system. Since the performance bonds used to margin options usually come in the form of short-term treasury bills, these bonds can actually gain interest. Traders can use this interest to pay for transaction costs incurred during trading. In addition, the SPAN system allows for benefits to those who write both call and put options, since they partially balance out the level of risk when the entire portfolio is analyzed.