What Is a K1 Tax Form

Post on: 16 Март, 2015 No Comment

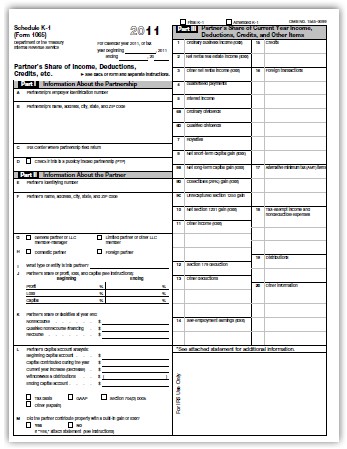

What is a K-1?

Businesses that operate as partnerships are considered to be pass-through entities for tax purposes. That means that all profits and losses flow through to owners. At the end of the year, partnerships, S corporations, and LLCs taxed as partnerships calculate their total profit and loss for the year. They then divide the profits and losses according to each partner’s interest and complete a Form K-1 tax form for each partner.

Next Steps

References

More Like This

How is K1 Income Taxed?

What Is a K-1 Tax Form in Relation to Inheritance?

How to Understand K-1 Taxes

You May Also Like

Schedule K-1 is a listing of income that has passed through an entity, generally a partnership, to individual investors. If you invest.

Many people will be a beneficiary of an estate or trust at some time in their life. Estates and trusts which file.

Form K-1 is an Internal Revenue Service form that is used to report partnership, S corporation or trust income. Form K-1 is.

Tax relief provisions can include increasing deductions that are available to affected taxpayers. IRS 1099 Forms Instructions. About Unclaimed IRS Funds.

Schedule K-1 is used as an appendix to several different types of business tax returns to report the proportionate share of the.

The Internal Revenue Service (IRS) requires a Schedule K-1 from any partnership in the United States. The IRS requires a Schedule K-1.

People involved in a partnership business share income, credits and deductions that may be reported to the Internal Revenue Service for tax.

What Is a K-1 Tax Form? The K-1 tax form, officially called Schedule K-1, is a three-part Internal Revenue Service (IRS).

If you invest in a partnership, at the end of the year you should receive a Schedule K-1 from the partnership administrator.

Form 1041 Schedule K-1 is a part of Form 1041. Form 1041 is the tax return for estates and trusts. The estate.

When a person passes away, his property is placed into an estate and undergoes probate, which is the legal process of dividing.

The Internal Revenue Service requires business partners to enter financial information regarding each partner's respective share of business income, credits and.

If you're involved in a partnership, an S-corporation or have a certain type of trust, you receive a K-1. The Schedule K-1.

Employers must provide employees W-2 forms. The employer then uses Form W-2 to complete their individual income taxes. Other People Are Reading.