What Is a Cash Flow Hedge (with picture)

Post on: 4 Июль, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

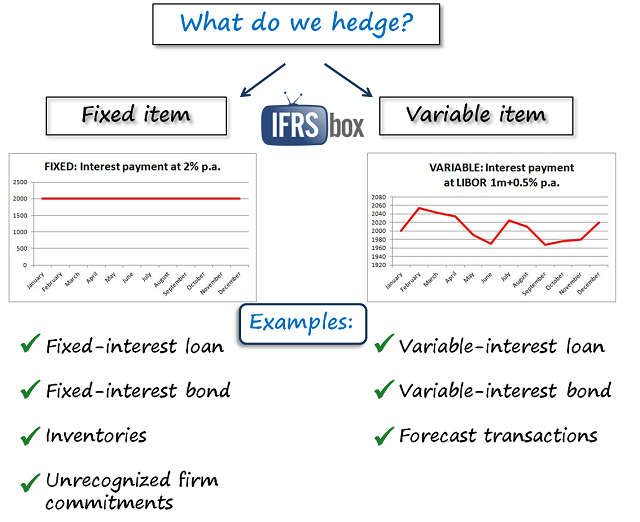

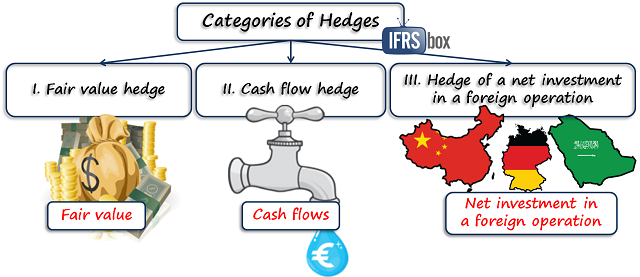

Types of Risks

In general, a cash flow hedge is put in place in to help protect against currency risks, price risks, or exposure to cash flow effects of financial instruments. Currency risks include those associated with a future transaction in a foreign currency or a debt denominated in a foreign currency. Price risks refer to the possibility of the purchase price of non-financial goods increasing or the sale price of non-financial goods decreasing. Fluctuating revenue of financial instruments could be due to price changes, benchmark interest rate changes, changes in the credit spread between the interest rate of the hedged item and the benchmark interest rate, and defaults or changes in creditworthiness .

Call Versus Put Options

Two common instruments used to create a cash flow hedge are call and put options. Both options are legal agreements between two parties, the buyer and the seller, and both allow for a transaction to occur, without requiring it. A call option allows the investor to buy a predetermined amount of assets during a specific time period from the seller, but a purchase is not mandatory. Put options are the opposite in that the buyer of a put option may sell assets to the seller, in which case the seller is required to purchase them, but the buyer is not required to sell if he so chooses.

For example, a farmer suspects that wheat prices might drop in the near future, reducing the sales price of his next harvest. The farmer sets up a cash flow hedge by buying put options on wheat futures. which would produce profits if wheat prices drop. This way, the profits from the put options would offset the losses from the reduced sales price if the price of wheat indeed drops. If the price of wheat increases, the farmer would lose the amount of money he used to buy the options, but he would profit from the higher wheat price.

Qualifying Investments

To qualify for cash flow hedge accounting treatment, a hedge fund must meet certain criteria. At the start of the original hedge fund process, the individual who sets up the investment must prepare documents stating both their objective and strategy, as well as the method that will be used to determine the effectiveness of the investment. Investors must also provide details regarding the risk and the date, or period of time, in which the cash flow would occur. The cash flow hedge has to sufficiently offset the revenue changes related to the hedged item. The transaction needs to be probable and is required to be conducted with another entity besides that of the original hedge.