What Is a 529 Plan

Post on: 21 Июль, 2015 No Comment

What is a 529?

529 Plans, also known as Qualified Tuition Programs, are tax-advantaged college savings plans, designed to encourage saving for the future higher educations costs of a designated beneficiary, such as one’s grandchild or child.

The plan’s name, 529, derives from Section 529 of the Internal Revenue Code, which created these kinds of saving plans in 1996. 529 plans are operated by a state or state agencies, and the details of 529 plans differ from state to state. Every state offers a 529 plan, and depending on your preferences and interests, you may want to invest in a 529 plan of a different state, for example, a California resident can invest in a Vermont plan. With the money saved from that plan, you can send your beneficiary to most colleges.

There are some limitations to which institutions are eligible and covered by 529 plans. Most two- and four-year colleges and universities, U.S. vocational-technical schools, and certain eligible foreign institutions will be covered under the 529 plan. Savings within 529 plans can be used for tuition, books, and other education-related costs. There are two different types of 529 plans, each with their own unique advantages.

Prepaid Tuition Plans

Two states offer just prepaid tuition plans, and seventeen states offer both prepaid tuition plans and college savings plans. This type of plan allows the person paying into the plan to lock in future tuition rates at in-state public colleges at current prices, and are typically guaranteed by the state.

Prepaid tuition plans are a great value, because regardless of whether inflation or tuition rates increase with time, prepaid tuition plans will always be worth the same amount of education. For example, if a someone purchases shares worth a year of tuition at a state college, the shares purchased will always be worth a year’s tuition, even a decade later when tuition rates may have tripled. Essentially, you’re spending less money to finance the higher education expenses of your beneficiary ahead of time, whereas others who wait until the time comes will pay much more for the same value.

So how does it work? The tuition guarantee is based on an enrollment-weighted average of in-state public college tuition rates. Some prepaid tuition plans have separate plans for two and four year colleges, and for housing expenses. If the beneficiary chooses to attend an in-state public college, the tuition and fees are covered by the plan. However, if the beneficiary chooses to attend a private or out-of-state college, the plan will typically pay the average of in-state public college tuition and the family will be responsible for paying the difference.

Beginning 2004, certain individual education institutions have offered their prepaid tuition plans, such as The Independent 529 Plan. offered by several hundred private college institutions. Most prepaid tuition plans mandate that either the account or the beneficiary be a state resident of the state whose plan they have chosen. Anyone can contribute to a prepaid tuition plan, from grandparents to family friends.

Setting money aside for a loved one’s future tuition expenses through a prepaid tuition plan is a great option because the plans are exempt from federal income tax, and often, state and local income taxes as well. Certain states offer either a full or partial tax deduction for contributions to the state’s plan as well.

If the beneficiary dies or chooses not to go to college, the plans can be transferred to a different member of the family. Regardless of the beneficiary’s actions, the money saved in the plan is controlled by the owner of the account, not the child.

Effective July 1, 2006 prepaid tuition plans were given the same financial aid impact as section 529 college savings plans, meaning that the plan is treated as an asset, with asset valuation equal to the refund value of the plan. Prior to the Higher Education Reconciliation Act of 2005, prepaid tuition plans were treated as a resource, which meant that a beneficiary’s need-based financial aid potential was much lower as a result. (Continued on page 2)

Section 529 College Savings Plans

Thirty-two states offer just section 529 college savings plans, and seventeen states offer both savings and prepaid tuition plans. Section 529 college saving plans are tax-exempt investment plans in which the account owner can save for future higher education costs with a low impact on need-based financial aid eligibility. Prepaid tuition plans used to impact financial aid eligibility on a much bigger scale, however of the Higher Education Reconciliation Act of 2005, its impact is now equal to that of a college savings plan. This plan differs from a prepaid tuition plan because there is no lock on current tuition rates, and no guarantee of costs covered. The investment is subject to market conditions, and however much is saved may not be enough to cover all college expenses.

The added flexibility of a section 529 plan, as well as an adaptive asset allocation strategy added to most plans, makes it desirable. The strategy offered in most plans are based on the age of the beneficiary, or the number of years until enrollment in college. These investment plans start off aggressively when the beneficiary is young, and gradually becomes more conservative as college approaches. There are four to five age ranges within this strategy, including newborn-6, 7-9, 10-12, 13-15, and 16-18+.

Many 529 college savings plans offer a few ways of minimizing risk, including a myriad of risk-based asset allocation portfolios, which can differ between 100% equity funds, to more conservative balanced funds, to money market funds. Additionally, some plans offer a fund that protects the principal from inflation, and guarantees a minimum fixed rate of return, usually 3%. In many ways, section 529 college saving plans are similar to retirement plans, like a 401(k) and IRA, except for its higher contribution limits and favorable tax status. Anyone can contribute to a section 529 plan, and the gift tax treatment of the plans make them ideal for grandparents due to the fact that it serves as a good estate planning tool.

Federal law mandates that a 529 college saving plan must have safeguards against investing excessively in providing for the beneficiary’s qualified higher education expenses. The typical limit is based on the amount of money per state required to provide seven years of education (both undergraduate and graduate school). The median limit for the typical plan is $235,000.

What are advantages of a 529 vs. saving for college on my own?

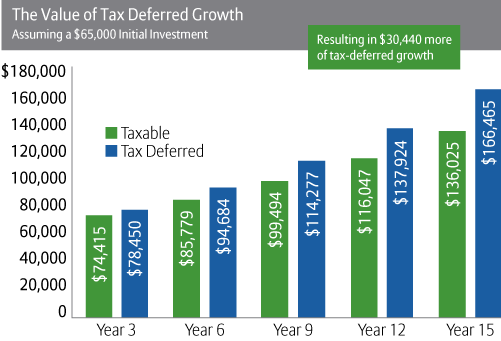

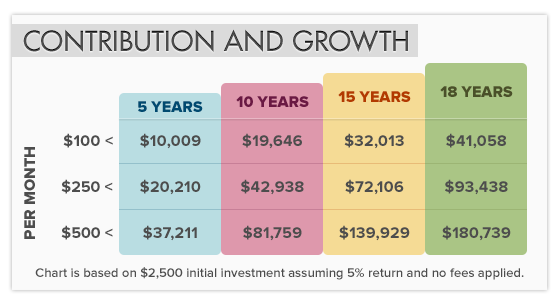

529 plans are advantageous, largely because of the unsurpassed income tax breaks that come with them. Your investment grows tax-deferred, and the distributions to pay for the beneficiary’s college expenses are federally tax- free. Your own state may also offer tax breaks, such as an upfront deduction for your contributions into the plan, or income exemption on withdrawals. There are typically federal benefits, and state benefits, so it’s important to research both and can compare various plan features.

You as the account owner would stay in control of the account, so the beneficiary has no say over what happens to the funds. The plans are low maintenance, and once you pick a plan, you fill out a basic enrollment form, and make your contribution (you may choose to sign up for automatic deposits). It’s as simple as that. The ongoing investment of the account is dealt with the program manager, which will either be an outside investment company hired to handle your plan, or the state treasurer’s office.

Also you won’t need to report taxable or nontaxable earnings until the year you begin making withdrawals from the account, in which you will be prompted to fill out a Form 1099. Finally, if you choose to move your investment, you are typically permitted to change to a different option in a 529 savings program each year, or rollover your account to a different state’s program.

How can I get a 529 for my child?

Start by comparing 529 plans by state. so you can pick whichever one fits you and your family best. After deciding on a plan, it’s time to decide whether you will invest in a 529 plan directly or through a financial adviser. Nearly half of all 529 plans are sold by brokers. because many account owners benefit from receiving advice from a professional, which can extend past planning for college.

A professional can help you match the right 529 plan to your personal investment goals and risk preferences, in addition to helping you coordinate your 529 plan with your other financial objectives, like affording a comfortable retirement. However, broker-sold 529 plans have higher yearly costs, including sales charges usually between 1 percent to 5.75 percent of your contributions.

You might want to buy a 529 plan directly if you’re looking to incur lower expenses. However, buying directly will cost you in other ways, because of the time, effort and energy needed to research the alternative options and becoming familiar with tax rules and other investment goals, and tailoring everything to fit your situation. If you buy directly, you may also be entitled to special incentives, such as possibly being eligible for a state income-tax deduction, a matching contribution, a scholarship, or protection of your account from creditors.