What Every EndUser Needs to Know About the ISDA August 2012 DoddFrank Protocol Finance and

Post on: 13 Июнь, 2015 No Comment

Eileen Bannon is a Partner in our New York office

Overview

Prior to October 15, 2012, all counterparties under existing ISDA Master Agreements or other swap agreements with swap dealers will be required to supplement such swap agreements so that the swap dealers can comply with certain requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Act or Dodd-Frank). If a counterparty does not effect such supplement, the swap dealer will no longer be legally permitted to effect new trades under the swap agreement or enter into modifications of the swap agreement. ISDA has prepared a protocol which will be the mechanism preferred by swap dealers to effect supplements to existing swap documents. This alert is designed to provide guidance as to the process, background and substance of the ISDA protocol.

Supplements to Swaps Required by October 15, 2012

During the two years since the enactment of Dodd-Frank, on July 21, 2010, the Commodity Futures Trading Commission (CFTC) has promulgated final rules (the Final Rules) 1 imposing requirements effective on October 15, 2012, 2 on swap dealers and major swap participants under swap documentation.

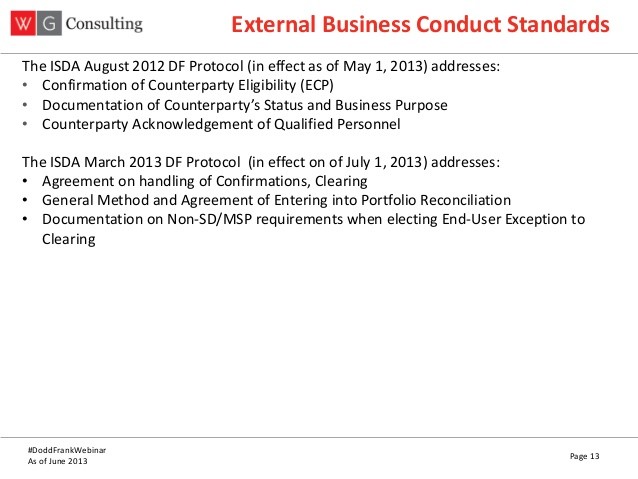

The requirements necessitate supplement of previously existing swap documentation before the execution of new swaps or the modification of existing swaps under that documentation can occur. Such amendments and supplements can be accomplished on a one-by-one, bilaterally negotiated basis. However, the International Swaps and Derivatives Association (ISDA), has developed a protocol (the DF Protocol) by means of which swap dealers and their counterparties who elect to adhere to the protocol will agree to certain contractual supplements published by ISDA to the swap documents specified by the parties. 3

Importance of the DF Protocol

The purpose of this alert is to assist counterparties who are not swap dealers or major swap participants (i.e. end-users) to understand the process, informational requirements of, and commitments under the DF Protocol. It deserves close attention because, among other things, the DF Protocol: (1) requires detailed representations, (2) obligates end-users to ongoing informational requirements, (3) provides one-time notifications of substantive rights, (4) constitutes agreement to disclosure of material confidential information, and (5) provides for the election of certain safe harbors which swap dealers may require as a condition of future trades. In addition, the terms of the DF Protocol are likely to be included in new swap documentation on a going-forward basis.

The DF Protocol is scheduled to open for adherence on August 13, 2012 (and will end upon 30 days prior notice from ISDA). To avoid trading disruption, all data must be entered analyzed and matched on or before October 14, 2012.

1. The Adherence Process

Pursuant to the terms of the DF Protocol, an end-user (or its agent, in the case of swap agreements executed by an agent on behalf of the counterparty) will use the DF Protocol to supplement one or more swap agreements designated by the end-user which it has previously executed with a swap dealer (each, a Protocol Covered Agreement).

Adherence to the DF Protocol is a two-step process, involving both adherence to the Protocol Agreement and delivery of questionnaires (each, a Questionnaire) to each counterparty under a Protocol Covered Agreement.

First, an end-user wishing to adhere to the DF Protocol will submit, using an online form, a single letter (an Adherence Letter) to ISDA. ISDA will publish the letter so it can be viewed by all other participants in the DF Protocol (each, a Protocol Participant). The letter will contain the agreement of the end-user to the DF Protocol and delivery instructions as to where matching information may be sent to it by its swap dealer counterparties (whether through the Markit platform, as discussed below, or to the address specified by the end-user). Similarly, the end-user will be required to deliver matching information to each swap dealer counterparty in accordance with the delivery instructions of the swap dealer which is expected to be the Markit platform.

Second, an end-user will offer to supplement a Protocol Covered Agreement by executing a Questionnaire in respect of each Protocol Covered Agreement and delivery of a Questionnaire to each relevant counterparty. The offer to supplement a Protocol Covered Agreement by an end-user will be deemed to be accepted upon receipt by an end-user of a Questionnaire from its swap dealer in respect of the relevant Protocol Covered Agreement (which receipt may occur prior to delivery of a Questionnaire by the end-user). A Protocol Covered Agreement where the Questionnaires have been mutually exchanged is referred in to the DF Protocol as a Matched PCA.

As discussed below, the Questionnaire incorporates schedules to be included by all counterparties in all cases, and other schedules which are particular to different counterparty relationships. An end-user may elect to send different Questionnaires to different swap dealers reflecting different elections as to the choice of inclusion of schedules. Each Matched PCA will be deemed supplemented by the schedules which have been mutually exchanged. The DF Protocol does not permit individual negotiation, or additions to or variance from its terms. However, if parties to the DF Protocol wish to vary the terms of their agreement effected through the DF Protocol, they are free to do so outside of the terms of the DF Protocol. 4

2. Information to Be Provided

The Protocol Agreement

Pursuant to the Protocol Agreement, each Protocol Participant will make basic representations as to status, power, lack of conflict, consents and the legal, valid and binding nature of its obligations under the DF Protocol.

The Questionnaire

The Questionnaire is designed generally to enable swap dealers to comply with their requirements under the Final Rules. The format for response to the Questionnaire is a grid style answer sheet which is designed to be answered online.

Know Your Counterparty Requirements

Under the Business Conduct Standards, swap dealers and major swap participants have know your counterparty requirements, which require obtaining certain facts prior to offering to effect new swaps or to amending existing swap documentation. Pursuant to the DF Protocol, end-users are required to provide such information in the Questionnaire, or by virtue of omitting the information, to represent that the information has already been provided to each counterparty receiving the Questionnaire, and that the information previously provided to the counterparty is true, correct and complete as of the date of delivery of the Questionnaire to the counterparty.

The know your counterparty information to be provided is: (1) the end-users name, address, principal occupation, (2) the identity of any guarantor of the end-user s performance under the Protocol Covered

Agreement, and (3) the identity of any person exercising control with respect to the positions of the end-user. In addition, the Questionnaire requires each Protocol Participant to disclose its entity identifier. 5 Note that since the existence or identity of a guarantor may differ with different Protocol Covered Agreements, different Questionnaires may need to be prepared for different counterparties.

Eligible Contract Participant Verification

The Commodity Exchange Act (CEA) makes it unlawful for any person, other than an eligible contract participant (ECP) to enter into a swap unless it is executed on or subject to the rules of a regulated exchange or trading facility. Further, the CEA requires each swap dealer and major swap participant to verify that any counterparty meets the eligibility standards for an ECP before offering to enter or entering into a swap with that counterparty.

The Business Contract Standards provide that a swap dealer or major swap participant may satisfy its verification duty by obtaining written representations from the counterparty (which representation must include the prong of the definition of ECP satisfied by the counterparty). Accordingly, the Questionnaire requires this information from each counterparty.

Inquiry as to Special Entity Status

A swap dealer or major swap participant has special duties when acting as a counterparty to a Special Entity. The Business Conduct Standards require a swap dealer or major swap participant to verify whether a counterparty is eligible to be a Special Entity, and provides that such verification may be satisfied by obtaining a written representation (which representation must include the prong of the definition of Special Entity satisfied by the counterparty). Accordingly, the Questionnaire requires this information from each counterparty. Under the DF Protocol, to the extent that a counterparty fails to respond to the inquiry as to whether or not it is a Special Entity, it will be deemed not to be a Special Entity.

Under the Business Conduct Rules, different safe harbors are available to swap dealers with respect to Special Entities if they are ERISA Special Entities (i.e. employee benefit plans subject to Title I of ERISA), or non-ERISA Special Entities. If an entity is an ERISA Special Entity and wishes to have Schedule 5 and/or Schedule 6 to the DF Supplement incorporated into Matched PCAs then each of such persons applicable ERISA fiduciaries (each, a Designated Fiduciary), as that term is defined in Section 3 of ERISA, must also provide identifying information, and sign the Questionnaire agreeing to perform the duties specified in such Schedules. If an entity is a non-ERISA Special Entity, and wishes to have Schedule 4 to the DF Supplement incorporated into Matched PCAs, then each designated qualified independent representatives (each, a Designated QIR) 6 with respect to such person must also provide indentifying information, and sign the Questionnaire agreeing to perform the duties specified in Schedule 4.

Designated Evaluation Agent Information

If an end-user wishes to have Schedule 3 to the DF Supplement incorporated into its Matched PCAs, and if the representations in Schedule 3 are to be made by one or more designated evaluation agents (each a Designated Evaluation Agent), the end-user must give identifying information with respect to the Designated Evaluation Agents, and each such person must execute the Questionnaire agreeing to perform the duties specified in Schedule 3.

Inquiry as to Financial Entity Status

A financial entity is defined as a person predominantly engaged in activities that are financial in nature, as defined in section 4(k) of the Bank Holding Company Act of 1956. The term financial in nature is quite broad, and it may be difficult for some end-users to make this determination. The Questionnaire permits an end-user to specify whether it is or is not a financial entity or to specify no answer. If an end-user specifies no answer, the swap dealer may elect to treat the end-user as a financial entity until the end-user provides sufficient evidence to the contrary. Mandatory margin and clearing requirements depend upon whether an entity is a financial end-user.

Consent to Oral Disclosure of Pre-Trade Marks

Each end-user is given the option of agreeing to receive oral disclosure (with written disclosure to follow post-trade) of pre-trade marks. This provision has been added to facilitate the execution of flow products for which time constraints may make delivery of written pre-trade marks difficult.

3. The Schedules

The DF Supplement consists of six Schedules:

- Schedule 1: Defined Terms

- Schedule 2: Agreements between a Swap Dealer and Any Other Party

- Schedule 3: Institutional Suitability Safe Harbors for Non-Special Entities

- Schedule 4: Safe Harbors for Non-ERISA Special Entities

- Schedule 5: Safe Harbors for ERISA Special Entities (Option 1)

- Schedule 6: Safe Harbors for ERISA Special Entities (Option 2)

All parties adhering to the DF Protocol will be deemed to incorporate Schedules 1 and 2, which contain representations and covenants designed to facilitate compliance with the Final Rules by swap dealers.

Schedules 3-6 relate to safe harbors available to swap dealers when they provide recommendations to end-users (Schedule 3), or act as advisors to non-ERISA Special Entities (Schedule 4), or act as advisors to ERISA Special Entities (Schedules 5 and/or 6).

End-users may be inclined to elect not to include the applicable Schedule(s) because the beneficiary of the safe harbor is the swap dealer and the burden of the Schedule falls on the end-user. However, swap dealers may not be willing to continue to do business with the end-user without the benefit of the safe harbor, or only on the basis of a diligence review which the counterparty would find overly burdensome. End-users may want to have this conversation with their counterparties before adhering to the DF Protocol.

Schedule 2

Further Know Your Counterparty Provisions

The know your counterparty provisions require a swap dealer to implement policies and procedures reasonably designed to obtain and retain essential facts concerning each counterparty. Such essential facts are defined broadly to include facts required to comply with applicable laws regulations and rules. Schedule 2 establishes such a policy and procedure for each swap counterparty in that pursuant to Schedule 2, each party agrees promptly to provide each other party any information reasonably required for that party to comply with Title VII of Dodd-Frank and the Final Rules.

Acknowledgment of Disclosure of Certain Information

Pursuant to the Public Reporting Rule, a swap that is executed over-the-counter between an end-user and a swap dealer or major swap participant is required to be reported in real time (with exception for block trades) by the swap dealer or major swap participant (the Reporting Party) to a registered swap data repository (SDR) (unless the parties agree otherwise as to the identity of the reporting party). The information reported will include swap transaction and pricing data. The SDR, in turn, is required to publicly disseminate swap transaction 7 and pricing data as soon as technologically practicable after receipt from the Reporting Party. However, the SDR is required not to identify parties to a swap or facilitate the identity of parties to a swap.

In light of such disclosure requirement, Schedule 2 provides for an override of any non-disclosure, confidentiality or similar agreement between the parties, to the extent necessary to comply with applicable law mandating reporting of transactions, including the Final Rules. Each party is required to acknowledge that disclosures required to comply with the Final Rules may include, without limitation disclosures to a SDR and that such disclosures could result in certain swap transaction and pricing data becoming available to the public.

Obligation to Update Information

Each party agrees to notify the other (pursuant to the terms of each underlying Matched PCA) of any material change in the information made or included in the DF Protocol, or if any representation made therein has become incorrect or misleading in any material respect. Notwithstanding reliance on the mutual representations,

Schedule 2 provides that neither a failure of the representations provided in the DF Protocol to be true and correct in all material respects, nor a breach of a covenant will give rise to an event of default, termination event or similar event under an underlying Matched PCA. However, such provision does not preclude the existence of an event of default or termination event under the Matched PCA arising out of a breach not set forth in the DF Supplement.

Obligation to Report Life Cycle Events

Pursuant to Schedule 2, each end-user is required, as soon as practicable, but in no event later than the first business day after the occurrence thereof, to report the occurrence of any life cycle event (as that term is defined in CFTC Rule 45.1) relating to a corporate event in respect of the end-user. Life cycle events include any event that changes the primary economic terms of the swap or the primary economic terms data previously reported to a SDR. Life cycle events include corporate actions affecting a security or securities on which a swap is based. A life cycle event would not include a corporate action affecting a security of the end-user, or an event otherwise affecting the credit of the end-user, unless in each case such event related to a term of the swap. 8

Further Representations, Agreements and Acknowledgments of End-Users

- Certain Notifications and Acknowledgments . Pursuant to the Business Conduct Rules, if a swap is not made available for trading, the swap dealer is required prior to entering into the swap (or material amendment of the swap) to notify the end-user that it can request and consult on the design of scenario analysis to assess its potential exposure in connection with the swap. Schedule 2 provides notice to end-users of such entitlement with respect to any swap.

Pursuant to the Business Conduct Standards, a swap dealer is also required to give notice of certain other entitlements to an end-user under the relevant swap counterparty documentation. The Business Conduct Standards permit such notifications to be given once at the on-set of the relationship (substantially diluting the benefit of such notifications). The notifications which the end-user represents it has received, reviewed and understand include: the right to receive daily marks, to request voluntary clearance, if applicable, and the applicable clearing house, and the right, if applicable, to be treated as a Special Entity.

Each end-user is also required to represent that it has received, reviewed and understood the generalized disclosure statements provided by ISDA (which may be posting on a website) relating to the following types of derivatives: equity, commodity, FX, interest rate and credit.

Schedule 2 provides that if the swap dealer and the end-user have entered into a written non-disclosure agreement under a Protocol Covered Agreement, any material confidential information may be used in any manner not prohibited by the terms of that non-disclosure agreement included in the Protocol Covered Agreement. This language is designed to provide that a swap counterpartys use of material confidential information is not limited as described in clause (1) of the previous paragraph, if permitted by the earlier non-disclosure agreement.

However, if parties have not previously entered a non-disclosure agreement, end-users are required by virtue of Schedule 2 to agree that material confidential information may be disclosed to any affiliate, third-party service provider (subject to disclosure limitations no less restrictive than the limitations applicable to the swap dealer) and any other person acting for or on behalf of a swap dealer for the purpose of complying with the swap dealers internal legal risk, compliance, accounting, operational risk, market risk, liquidity risk or credit risk policies or those of its affiliates.

Schedule 3

Pursuant to the Business Conduct Standards, if a swap dealer or major swap participant recommends a swap or a trading strategy to an end-user it must have a reasonable basis to believe that the swap or trading strategy is suitable for the end-user. The Business Conduct Standards provide a safe harbor for a swap dealers suitability determination if the swap dealer reasonably believes that the end-user, or an agent to which the agent has delegated decision-making authority, is capable of independently evaluating the investment risks of the recommended swap or trading strategy. Pursuant to the safe harbor, the reasonable belief of the swap dealer may be established by representations made by the end-user or its Designated Evaluation Agent, as applicable.

Schedule 3 tracks the safe harbor applicable to recommendations to end-users that are not Special Entities. Pursuant to Schedule 3, either (1) the end-user represents that it has complied with written policies and procedures that are reasonably designed to ensure that each of its Designated Evaluation Agents is capable of evaluating swap recommendations; each Designated Evaluation Agent represents that it is exercising independent judgment in evaluating recommendations from the swap dealer; and the end-user represents that it will exercise independent judgment in consultation with a Designated Evaluation Agent in evaluating swap recommendations, or (2) the end-user represents that it has complied with the written policies and procedures that are reasonably designed to ensure that the persons evaluating swap recommendations on behalf of the end-user are capable of doing so, and that such persons are exercising independent judgment. The swap dealer represents that it is acting in its capacity as counterparty, and is not undertaking to assess the suitability of any swap or trading strategy involving a swap for the end-user. Under the Business Conduct Rules, this set of representations constitutes a safe harbor as to the suitability to the end-user of any swap which the swap dealer has recommended.

End-users should note that the availability of the safe harbor reflected in Schedule 3 depends upon the end-user being able to represent that it has in place and complies with certain written policies and procedures. Therefore, an end-user who does not have such written policies and procedures may wish to put them in place in preparation for adherence to the DF Protocol.

Schedules 4-6

Section 4s(h)(4)(C) of the CEA requires a swap dealer that acts as an advisor to a Special Entity to make reasonable efforts to obtain such information as is necessary to make a reasonable determination that any swap recommended by the swap dealer is in the best interests of the Special Entity. The Business Conduct Rules define acts as an advisor to a Special Entity to mean where the swap dealer recommends a swap or trading strategy involving a swap that is tailored to the particular needs or characteristics of the Special Entity. The Business Conduct Rule provides for two safe harbors for a swap dealer who acts as an advisor to a Special Entity: (1) communications between a swap dealer and an ERISA Special Entity that has a Designated Fiduciary, and (2) communications by a swap dealer to any Special Entity or its representative that does not express an opinion as to whether a Swap Entity should enter into a recommended swap or trading strategy involving a swap that is tailored to the particular needs or characteristics of the Special Entity.

The first safe harbor provides that a swap dealer will not be acting as an advisor to an ERISA Special Entity if: (1) the ERISA Special Entity represents in writing that (a) it has a Designated Fiduciary, (b) it will comply with written policies and procedures designed to ensure that any recommendation from a swap dealer is evaluated by a Designated Fiduciary before the transaction occurs, or that any such recommendation will be evaluated by a Designated Fiduciary before the transaction occurs; and (2) the Designated Fiduciary represents in writing that it will not rely on recommendations from the swap dealer.

Under the second safe harbor, a swap dealer will not be acting as an advisor to a Special Entity (including an ERISA Special Entity) if: (1) the swap dealer does not express an opinion as to whether the Special Entity should enter into a recommended swap or trading strategy involving a swap that is tailored to the particular needs or characteristics of the Special Entity, (2) the Special Entity represents in writing that it will not be relying on the recommendation from the swap dealer, but instead will rely on advice from a Designated Qualified Independent Representative, and (3) the swap dealer discloses that it is not undertaking to act in the best interest of the Special Entity.

Schedule 4 sets forth the second safe harbor for non-ERISA Special Entities. Schedule 5 sets forth the first safe harbor for ERISA Special Entities; and Schedule 6 sets forth the second safe harbor for ERISA Special Entities. ERISA Special Entities may elect one or both of the safe harbors set forth in Schedules 5 and 6 if it has a Designated Fiduciary that will agree to the safe harbors.

4. The Markit Process

Markit has developed an automated execution facility whereby counterpartying can input Protocol data online and Markit will deliver each completed Questionnaire (including Schedule elections) to each relevant counterparty. Markit will provide reports as to the status of matched and unmatched Questionnaires. Markit expects that Protocol Participants will use its automated execution facility for future ISDA standard industry protocols necessary to implement Dodd-Frank rulemaking.

5. Extraterritorial Reach

No final guidance has been provided with respect to the extraterritorial application of the Business Conduct Rules. However, proposed interpretive guidance provides that such rules will apply to swaps between: (1) U.S. swap dealers and all counterparties, and (2) non-U.S. swap dealers and U.S. counterparties. The Business Conduct Rules would not apply between non-U.S. swap dealers and non-U.S. counterparties.

6. The Bottom Line

Adherence to the DF Protocol involves many regulatorily complex considerations on the part of end-users. End-users should consider whether or not they have in place the policies and procedures, and are otherwise prepared, to make the representations and comply with the covenants under the DF Protocol. End-users may also want to consider whether they want to request bilateral amendment of any of the terms of the DF Protocol with any of their swap dealer counterparties.

Notes

1 The ISDA August 2012 Dodd-Frank Protocol is intended to address the requirements of the following CFTC final rules: Business Conduct Standards for Swap Dealers and Major Swap Participants, 77 Fed. Reg. 9734 (Feb. 17, 2012) (the Business Conduct Standards); Large Trader Reporting for Physical Commodity Swaps, 76 Fed. Reg. 43851 (July 22, 2011); Position Limits for Futures and Swaps, 76 Fed. Reg. 71626 (Nov. 18, 2011); Real-Time Public Reporting of Swap Transaction Data, 77 Fed. Reg. 1182 (Jan. 9, 2012) (the Public Reporting Rule); Swap Data Recordkeeping and Reporting Requirements, 77 Fed. Reg. 2136 (Jan. 13, 2012) (the Swap Data Rule); Swap Dealer and Major Swap Participant Recordkeeping and Reporting, Duties, and Conflicts of Interest Policies and Procedures; Futures Commission Merchant and Introducing Broker Conflicts of Interest Policies and Procedures; Swap Dealer, Major Swap Participant and Futures Commission Merchant Chief Compliance Officer, 77 Fed. Reg. 20128 (Apr. 3, 2012) and Swap Data Recordkeeping and Reporting Requirements: Pre-Enactment and Transition Swaps, 77 Fed. Reg. 35200 (June 12, 2012).

2 October 15, 2012, is the date as of which swap dealers and major swap participants must comply with the Business Conduct Standards.

3 This alert references the July 30 version of the DF Protocol documents. The DF Protocol is part of a broader initiative on the part of ISDA to respond to Dodd-Frank implementation and compliance. A second part of this current initiative is to develop standardized disclosure documentation (risks, product characteristics, conflicts and other disclosures).

4 The DF Protocol is intended to supplement existing swap relationship documentation. If parties wish to have the DF Protocol apply to the pre-execution phase of their swap trading relationship, or in any circumstance in which written documentation of the swap trading relationship does not exist, they may do so by electing in the Questionnaire to have the DF Terms Agreement apply. The DF Terms Agreement supplies a bare-bones agreement between the parties to which the DF Protocol will become a supplement.

5 The Swap Data Rule requires each counterparty to a swap to be identified in all record keeping and swap data reporting by a single legal entity identifier.

6 A Designated QIR is a representative of the Special Entity that satisfies the requirements of CFTC Rule 23.450(b)(1), which includes among other things: (1) has sufficient knowledge to evaluate the transaction and risks, (2) undertakes to act in the best interests of the Special Entity, and (3) and evaluates, consistent with any guidelines provided by the Special Entity, fair pricing and the appropriateness of the swap.

7 The Public Reporting Rule contains the data fields that will be disseminated by SDRs as swap transaction information.

8 In addition, pursuant to Schedule 2, each end-user (as the Non-Reporting Party) if it has caused the swap to be reported to a non-U.S. trade repository in accordance with the laws of another jurisdiction, is also required to provide to its counterparty the identity of such non-U.S. trade repository.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

To print this article, all you need is to be registered on Mondaq.com.

Click to Login as an existing user or Register so you can print this article.