What Do You Do as a Venture Capitalist

Post on: 5 Апрель, 2015 No Comment

Last time around we talked at length about how you break into venture capital. what VCs and headhunters look for, and how resumes, networking, and interviews differ when you apply to VC jobs.

Now we’re going to jump into all the questions youre really curious about:

- What you actually do each day as a venture capitalist

- How you advance to the Partner-level

- How much you work and how much you get paid

- The economics of VC firms and why your pay is so dependent on the firm’s size

- Trade-offs of venture capital vs. investment banking, private equity, and entrepreneurship

So let’s dive right in.

A Day in the Life

Q: So what’s an average day in the life of a VC like? I’m assuming that you don’t have to fix printers or run to Starbucks quite as much.

A: A lot of meetings. Most days are dominated by meetings with entrepreneurs and portfolio companies and networking at conferences and other events.

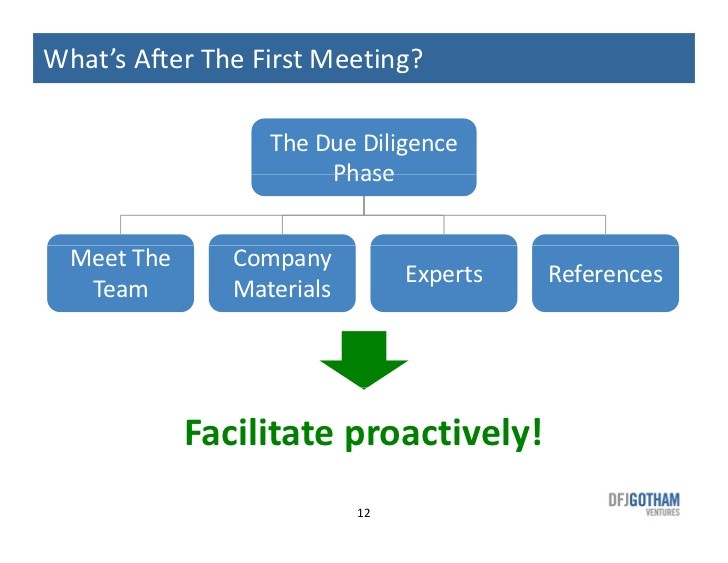

You do spend some time on research and due diligence for active deals, but most of my days were spent meeting people and networking.

After the close of business each day, you might go home early or you might stay late depending on whats going on – just like investment banking, you’re busiest when youre working on a deal and its close to the finish line.

Q: When you say “meeting people,” are you talking about tagging along with Partners, or going out and setting up meetings yourself? How much independence do you have?

A: At my old firm, the pre-MBA Associates contacted companies and set up everything by themselves. Sometimes Partners and Associates would go to the same meeting, but more often than not I did everything by myself.

Associates are the “front-line filter” – they meet with companies initially and figure out which ones are interesting, which ones might be good investments, and so on.

Once I pre-qualified the company, I would bring it to the Partners and say, “This company might be interesting – we should take a closer look at them” and then the Partners would become more involved and start meeting with them as well.

Q: So it sounds like your firm was very sourcing-heavy. How much of your time was spent on sourcing vs. deal execution?

A: I don’t have an exact split for you, but early-stage firms tend to do more sourcing and late-stage firms do more due diligence, modeling, and deal execution work.

Although my firm was late-stage, they still focused on sourcing and the majority of my time was spent meeting with companies we might invest in.

Even when deals came along, 99% of them would never go anywhere – we might start doing due diligence, find something we didn’t like, and cut off the investment process right there.

On the buy-side you spend a lot of time saying “no” to people.

Q: On a similar note, I’m assuming that you didnt do much modeling?

A: For truly early-stage companies – pre-revenue – we didnt do much modeling.

For later-stage companies with revenue and profit, we did the usual modeling and valuation exercises.

It’s not as intense as what you see in investment banking because we don’t spend time trying to make everything perfect and adjust for every last non-recurring charge.

All About Advancement

Q: So that’s what you do as a junior VC: find interesting companies, filter the best ones, and bring them to the Partners who make the actual investment decisions.

How do you advance to the Partner-level? Is it just a matter of finding the next YouTube, getting a 41x return on investment in a year. and then moving to the Bahamas?

A: It depends on the firm youre at and how their partnership works, but you need to find good investments and generate solid returns for the firm in order to advance.

You don’t need to find the next YouTube to advance to the Partner-level – that only happens once a decade. It’s more about getting consistent base hits rather than the elusive grand slam .

You need to build a track record over time and become genuinely involved with your portfolio companies – source the deal, sit on the Board, advise the company and help with strategic issues, and then achieve a solid exit.

You dont need to wait for the actual distribution of proceeds from your exited investment to advance – an acquisition, IPO, or even a situation like Facebook where theyve grown an incredible amount and are clearly going to have a huge exit – are good enough to prove yourself.

Q: Right. But what about making the move from junior Associate to more senior levels at a VC firm? How does that happen?

A: First off, 90% of the time if you come in as a pre-MBA Associate you won’t be able to advance to the Partner-level at all .

Youre not on Partner-track and no matter what companies you find, you’ll be expected to stick around for a few years and then go to business school or do something else.

Most of the time you need to come in at the post-MBA level to have a chance at advancing to Partner.

The exact process is tricky to describe, but the more interesting companies you source and the more work you do, the more the VC firm will trust you to start making decisions on your own.

Until youre an official Partner, you cant make investment decisions but you can present your case to the Partners, argue for investment, and become actively involved with the company itself.

So as you start finding better investments, the Partners will give you more responsibility, then you can use that added responsibility to find even better companies, and that process repeats until you reach the top.

Q: Ok. Now let’s play devil’s advocate and assume that you’re just not a good investor no matter how long youve been in the game, and that you cant find any quality companies.

What happens if you cant make the investments you need to reach the Partner-level?

Instead, they might just pull you aside and say, Youve been here 5 years but havent built up much of a track record and were not sure you can get to the Partner-level. We can keep you on awhile longer, but you need to get some good results soon.

Other times, they might just reduce the economics for you and pay you less if youre at the Principal-level (just before reaching Partner) and use that as a signal for you to leave.

Theres no formal layoff process – VCs are far more subtle about hiring and firing than bankers.

Q: So let’s say you’ve been working in VC for a few years but can’t advance, so you get asked to leave. Whats your next move?

A: Common paths are to join a portfolio company, start your own firm, or go into business development.

As you move up in venture capital, you focus 100% on developing your network, making lots of contacts, and getting to know your industry well – all of which are useful for business development or working at a portfolio company.

Starting your own VC firm is tougher to pull off and you need more of a track record to do that – if youre a junior Associate with no investments behind you, you wont be able to raise capital at all.

Experienced investors can struggle to raise even small amounts of capital, so starting your own investment firm is the most difficult of these options.

Pay, Hours & Likes and Dislikes

Q: Let’s talk about money – specifically, how much money did you make?

A: Do I need to give you an exact number?

Q: I like numbers. But estimates are fine if you don’t feel comfortable with that.

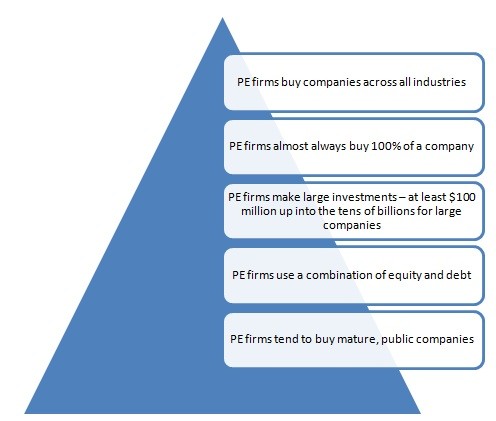

A: Your base salary in VC will be higher than what you earn as an investment banking analyst – similar to how your base salary generally increases when you move into private equity.

Bonuses are lower at early-stage firms because theres not as much money to go around and the fees are not high enough to pay everyone millions of dollars.

At late-stage VCs and more PE-like firms, bonuses are higher and are closer to what youd make in banking or traditional PE.

Pre-MBA Associates usually wont get carry. whereas post-MBA Associates may or may not depending on the firm.

Q: Let me stop you right there because some readers may not be familiar with carry. Can you explain what it is and how you get paid in VC?

A: Sure. There are 3 ways you make money as a venture capitalist:

- Base Salary

- Year-End Bonus

- Carry

Carry refers to money you invest alongside the firm when they invest in a company.

Lets say that your firm is making a $5 million investment in an early-stage company – if you have carry, you might be allowed to invest $50,000 of your own money along with the firm.

Then when they exit, youd also reap the profits – or losses – on your investment.

Carry is seen as a big perk because of the potential to make a lot of money, but its quite rare to find the next YouTube that gets you a 41x return on investment.

More often than not youll get a small bonus but you wont become a billionaire with these investments – to benefit from carry, you need to be at the firm a long time and invest in dozens of companies.

Q: You mentioned how bonuses are lower at early-stage firms because theres not as much money to go around – can you explain the economics of VC firms?

A: Sure. Lets say the firm has $100 million under management – they might charge investors a 2% management fee each year and 20% of their return on investment (the carry ).

That 2% management fee – $2 million each year – is used to pay base salaries and bonuses.

So a fund like this with $100 million under management would not be able to hire that many people – maybe 1-2 Partners and a few Associates.

Everyone wants to make millions, but if you have less than $2 million to go around thats not possible unless you consistently find winning investments.

Thats why larger firms pay bigger bonuses: if you have $1 billion under management rather than $100 million, 2% now represents $20 million each year.

And just because they have 10x as much capital doesnt mean they’ll hire 10x the number of people – so theres more bonus money to go around.

Smaller firms dont want people who are in it only for the money .

Its not Work 100 hours a week for me right now and youll be rich at the end of the year – it’s more about long-term incentives and being genuinely excited about what you do.

Q: Speaking of hours, how much did you work as a junior VC?

A: Less than in banking. Weekends were free most of the time, but sometimes I stayed late at work if we were busy with deals.

On average I put in 60-hour weeks. though that dropped when we were in sourcing mode and rose when we were in deal execution mode.

Off the Record

Q: A lot of people hype up exit opportunities because they view the end game as superior to banking itself.

Having worked in investment banking, then at a late-stage VC firm, and now at an early-stage firm, what did you honestly like and dislike about the industry?

A: One of the hardest points to assess when youre recruiting is cultural fit – you can chat with Partners all day long, but its hard to say how well youll fit until you actually work there.

VC firms are more like family businesses than rigid conglomerates – sometimes they treat you like a temp, and other times they treat you as a peer.

But its difficult to ask them about this directly and get good answers – so joining any VC firm is riskier than moving to a bank, where there are lots of people and many sources of information.

If you compare venture capital to investment banking, obviously the work/life balance is much better – but on the flip-side, you also lose a lot of the camaraderie you find in banking .

You work alone 90% of the time, and youre going out there and making things happen on your own.

That gives you a sense of empowerment, but its also lonelier than banking because youre always meeting new people but rarely getting to know anyone well – and you dont hang out with your co-workers.

VC is similar to being a mini-entrepreneur because you have to make decisions without following specific orders – completely the opposite of banking.

Q: Right. When I explain to people what I do I give the same type of summary and they look at me like I’m crazy because they don’t understand how there are downsides to everything.

What are your future plans now that youve done banking, VC, and returned to VC?

A: Once you work in venture capital, it gets more difficult to become an entrepreneur – you cant beat the lifestyle, and you can bet on companies without taking nearly as much risk as the founders themselves.

I was thinking of going the startup route, but I decided to go back to VC and work at an early-stage firm after I graduated from business school.

I had planned to pursue startups while at b-school, but it was impossible to fit in – you have a lot of work, and unless youre also networking constantly its a waste of time and money.

So Im planning to stay at my current firm for the near future, and then pursue my own projects on the side in my free time.

Everyone interested in venture capital wrestles with the investor vs. startup founder choice, and thats what Im debating right now.

Q: Yup, I know how that goes. Thanks for your time – that was a great interview and I learned a ton about venture capital.

A: No problem. Let me know if your company is looking for investors!