What are the Different Types of Investment Funds

Post on: 21 Май, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

Investment funds, also known as collective investment schemes or managed funds, are group funds of money where people pool their assets together to allow them to access investment opportunities that otherwise would not be available to them. Since many investments have minimum buy-ins, often a single buyer at the consumer level would be unable to purchase even the minimum amount, but by pooling funds together with many other investors, the money can be invested and the profits or losses shared among the group. Since investments may have costs associated with them, as well, investment funds allow these costs to be reduced by being spread out over many people, rather than borne by each individual. There are two main types of investment funds in the United States: mutual funds and exchange-traded funds (ETFs).

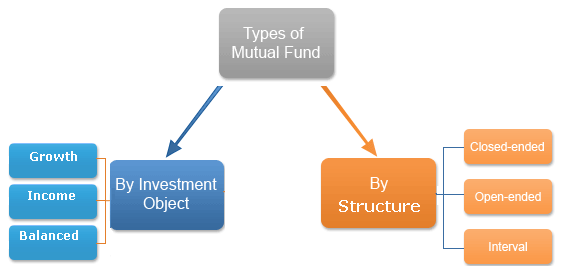

Mutual funds are the backbone of the collective investment scheme in both the United States and Canada, although the term is more generally in other parts of the world to simply refer to all types of investment funds. Mutual funds take money from the collective group, pooling it together to invest in securities like stocks and bonds. Mutual funds are managed by a fund manager. who handles all of the money in the fund, choosing the investments themselves, usually based on certain criteria.

Worldwide, mutual funds make up an enormous block of investment capital, representing some $26 trillion US Dollars (USD) in value. As their value has grown in the past few year, fund managers have become some of the highest paid individuals on the planet, with the most successful fund managers making billions of dollars annually. There are many different types of mutual funds, each with their own focus and strategy.

Growth investment funds, for example, assume a growth market, buying low and selling high, and can yield considerable gains. The point of their investment is not in receiving dividends, so their short-term yield is not optimal. They do very well in bullish markets, outperforming the S&P during these times, but conversely can be hit quite hard during bear markets. For this reason, they carry a fair amount of risk as well as the potential for reward, and so are not ideal for risk averse investors. Aggressive growth funds are a subclass of aggressive funds, but they may borrow funds or trade stock options in order to further leverage the money held in the fund.

On the other end of the spectrum, growth-income investment funds are fairly conservative, specializing in blue chip stocks. They buy things like the Dow industrials, utilities, and other stocks that are generally non-volatile. Investing in a growth-income fund is similar to investing conservatively in the stock market directly, but with the benefits of pooling resources under a fund manager.

An exchange-traded fund (ETF ) is similar to a mutual fund. in that it is a vehicle for holding other securities, but it is publicly traded on the stock market, much like a stock itself. One can invest in an ETF as though one were buying a stock, but instead one is buying a collection of stocks and bonds, helping to immediately diversify one’s portfolio.