What Are Restricted Stocks Restricted Stock Units (RSUs)

Post on: 21 Май, 2015 No Comment

Restricted stock and restricted stock units (RSUs) have become a popular choice for many firms that wish to reward employees with a share of ownership in the company without the administrative complexity of traditional stock option plans . Restricted stock plans have shown themselves to be more beneficial than their traditional counterparts in the sense that it is not possible for the stock to become worthless, as it is for options or rights.

But while restricted stock and RSUs are similar in many respects, most employers tend to favor RSUs. This is because they allow companies to defer the issuance of actual shares to participants for a period of time.

What Is Restricted Stock?

Restricted stock is stock that, as the name implies, comes with certain restrictions on its issuance and sale by the employer. This type of stock should not be confused with the other category of restricted securities that are issued to corporate executives under SEC Rule 144, which prohibits insider trading .

Restricted stock can be issued to any type of employee in a company, and its issuance and administration are not governed by Rule 144, per se. However, restricted stock is a separate entity from qualified retirement plans, such as a 401k. that fall under ERISA regulations. It does not receive tax-advantaged treatment of any kind the way qualified plans do.

Structure and Purpose

Restricted stock is granted to an employee on the grant date in a manner similar to that of traditional stock option plans. However, restricted stock does not have an exercise feature; the stock is usually retained by the company until its vesting schedule is complete. Restricted stock is classified as a full-value grant, which means that the shares carry the full value of the stock at the time it is granted.

Restricted stock resembles traditional non-qualified plans in that there is a substantial risk of forfeiture to the employee. If the requirements of the vesting schedule are not met, then the employee forfeits the stock back to the employer.

Vesting Schedule

Employers issue restricted stock as a means of motivating employees to accomplish certain corporate goals. There are generally three types of vesting conditions used for restricted stock:

- Employee Tenure. Many restricted stock plans simply require the employee to remain employed at the company for a certain period of time, such as three to five years.

- Employee Performance. Some vesting schedules pay out upon the accomplishment of certain company goals, such as the development of a new product or reaching a certain threshold of production.

- Accelerated Vesting. Accelerated vesting can be used if the company becomes insolvent or bankrupt (so that the employee might at least receive something before the stock becomes worthless) or the employee dies or becomes disabled.

Some vesting schedules combine these features. For example, a firm might offer a four-year vesting schedule that will accelerate if the employee were to accomplish certain goals or tasks. The vesting schedules for restricted stock mirror those of qualified profit-sharing plans, and may be either cliff or graded at the employers discretion. Cliff vesting is an arrangement where the employee receives all of the shares at once after a certain period of time, such as five years. Graded vesting periodically removes the restrictions on a portion of the shares over a set period of time for instance, 20% of the shares once per year over a five-year period from the time of grant.

Taxation of Restricted Stock

As with non-qualified stock options. restricted stock is not taxed at the time of grant (or exercise, since there is no exercise feature here). The value of restricted shares becomes fully taxable when they become vested; that is, when there is no further risk of forfeiture and the employee takes constructive receipt of the shares.

The amount that is taxed equals the number of shares that become vested on the vesting date multiplied by the closing price of the stock. This amount is taxed to the employee as compensation at ordinary income rates, regardless of whether the employee immediately sells the shares or holds the stock for a period of time. Payroll taxes including state, local, Social Security, and Medicare taxes are taken out, and the employer may choose to reduce the number of shares paid to the employee by the amount of shares necessary to cover the withholding taxes.

Employees who choose to keep the shares and sell them at a later date report short- or long-term gains or losses accordingly, with the share price or prices on the date (or dates) of vesting becoming the cost basis for the sale.

Example of Taxation at Vesting

Sam becomes vested in 1,000 shares of restricted stock on September 5th. The stock closes at $45 per share that day. He will have to report $45,000 of earned compensation for this. If he is in a graded vesting plan, then the closing share price on each vesting date is used. This income will be added to the rest of his wages on the W-2 form .

Section 83(b) Election

Employees who receive restricted stock must make an important choice once they enter into these plans. They have the option of paying the tax at the time of vesting, or they can pay the tax on the stock at the time of grant. Section 83(b) of the Internal Revenue Code permits this election and allows employees to pay the tax before vesting as a means of possibly paying less tax overall. Of course, whether this strategy works is completely dependent upon the performance of the stock.

Example of 83(b) Election

Joan learns that she will be granted 1,000 shares of restricted stock. The company stock price is $10 on the date of grant. Joan feels that the share price will appreciate substantially in the next five years, so she elects to pay tax now on the stock under Section 83(b). She is taxed on $10,000 of ordinary compensation as a result.

Five years later, she becomes fully vested in the stock under a cliff vesting schedule, and the stock is worth $25 a share. Joan effectively escapes taxation on $15,000 of income under this provision. However, if the stock price was lower than $10 when she became vested, then she would have no way to recoup the taxes she paid based on the higher share price on the grant date.

Advantages of Restricted Stock

Restricted stock offers several advantages over traditional stock option plans. Some of the major benefits that come with this type of stock include:

- Full Value at Grant. Unlike traditional stock options, it is impossible for restricted stock to become worthless if it drops below a certain price (unless, of course, the stock price falls to zero). Employees cannot therefore become underwater on their restricted stock and will not have to repay a portion of the sale proceeds to pay back the amount that was granted.

- Improved Employee Motivation and Tenure. Employees who know that they will immediately come into the full value of the stock once they become vested will be more likely to stay with the company and perform at a high level.

- Voting Rights. Unlike their RSU cousins, holders of restricted stock receive the right to vote for the number of shares that they are given. This privilege exists regardless of whether the vesting schedule is complete.

- Dividends. Restricted stock usually pays either direct dividends (or a cash amount equal to them before they are vested) to the shareholder both before and after vesting.

Disadvantages of Restricted Stock

Some of the drawbacks that come with restricted stock include:

- Vesting Requirements. Employees cannot take immediate possession of the stock, but must wait for certain vesting provisions to be satisfied.

- Excess Tax. Employees may have to make payments of unnecessary taxes under Section 83(b) election if stock price declines.

- Higher Taxation. There is no capital gains treatment available at exercise only for any appreciation between the price at vesting and sale.

- Fewer Shares Issued. Because they have absolute value, companies typically issue fewer shares (perhaps a third to a quarter) of restricted stock compared to stock options.

- Timing of Taxes. Employees must pay withholding tax at time of exercise regardless of when shares are sold no deferral is available until sale.

What Are Restricted Stock Units (RSUs)?

Although restricted stock units are similar to actual restricted stock in many respects, these versatile instruments are often issued by employers in place of restricted shares. RSUs offer many of the same advantages as restricted stock, but have some unique characteristics that make them preferable to actual stock in some cases.

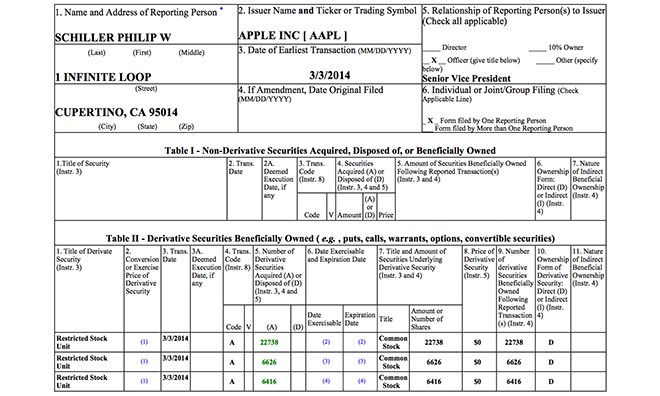

Restricted stock units represent a promise by the employer to pay the employee a set number of shares of company stock in the future upon completion of a vesting schedule. The employee is assigned an appropriate number of units that represent his or her interest in the stock, but there is no actual funding until vesting is complete the assignment of these units is merely a bookkeeping entry that has no tangible value of any kind.

RSUs usually have vesting schedules that are similar or identical to grants of actual restricted shares. They do not pay dividends directly, but may pay dividend equivalents that may be funneled into an escrow account to help pay withholding taxes, or be reinvested into the purchase of more shares.

Taxation of RSUs

Restricted stock units are taxed in much the same manner as actual restricted shares. Employees must pay income and withholding tax on the amount received on the vesting date, based on the closing market value of the stock price. They generally have the same options to choose from in order to pay withholding tax; they can either pay the tax out of pocket, or sell the required number of units to cover this amount. The closing share price at vesting then becomes the basis for gain or loss computations when the stock is sold.

The Section 83(b) election is not available for employees who receive RSUs. This is because this provision only applies to tangible property of some kind, and no actual property is conferred to them as it is with shares of restricted stock. However, RSUs are not taxed until both the vesting schedule is complete and the employee constructively receives the actual shares that were promised. Of course, these two events usually happen at the same time, but employees are able to defer taxation in some cases (except for Social Security and Medicare tax, which must always be paid at vesting) by electing to receive the stock at a later date.

Advantages of RSUs

RSUs offer many of the same advantages and drawbacks as their restricted stock cousins. The following key differences apply:

- Possible Lower Taxes. Due to the absence of Section 83(b) provision, there is no possibility for the overpayment of taxes.

- Deferral of Share Issuance. Employers can issue RSUs without diluting the share base (delays issuance of company shares). This is a substantial advantage not only over restricted stock, but other forms of stock plans, such as employee stock purchase plans and statutory and non-statutory stock option plans.

- Cheap. Employers incur lower administrative costs, since there are no actual shares to hold, record, and track.

- Tax Deferral. It is possible to defer taxation beyond the vesting date by delaying issuance of shares to employee.

- Foreign Tax Friendly. Issuance of RSUs to employees working outside the U.S. can make taxation easier because of differences in when and how stock options are taxed.

Disadvantages of RSUs

- No Voting Rights. RSUs do not offer voting rights until actual shares are issued at vesting.

- No Dividends. RSUs cannot pay dividends, because no actual shares are used (employers can pay cash dividend equivalents if they choose).

- No Section 83(b) Election. RSUs do not offer the Section 83(b) election because the units are not considered to be tangible property per the definition of the Internal Revenue Code. This type of election can only be used with tangible property.

From an employees perspective, there is realistically not a great deal of difference between receiving restricted stock versus restricted stock units, except that there is no 83(b) election available for RSUs. Employers typically benefit more from the use of RSUs because it allows them to defer the issuance of company shares until the vesting schedule is complete, which then delays the dilution of the share base.

Final Word

Restricted stock and RSUs are more flexible forms of tax-deferred stock compensation that do not present some of the limitations that employers often face with conventional stock option plans, such as dilution of company shares. Although both types of plans are becoming more popular with employers, RSUs are beginning to eclipse their counterparts because of their greater simplicity and deferment of share issuance.

For more information on these forms of equity compensation, consult your HR representative or financial advisor .