What Are Hedge Funds Risks v

Post on: 28 Сентябрь, 2015 No Comment

Definition, How They Work and Risks vs Returns

Definition: Hedge funds are privately-owned companies that pool investors’ dollars and reinvest them into all kinds of complicated financial instruments. Their goal is to outperform the market — by a lot. Unlike mutual funds. whose owners are public corporations, hedge funds traditionally weren’t regulated by the SEC (Securities and Exchange Commission). For this reason, and many others, hedge funds are very risky. However, it is exactly this risk that attracts many investors who believe higher risk leads to higher return.

Hedge Funds Rewards

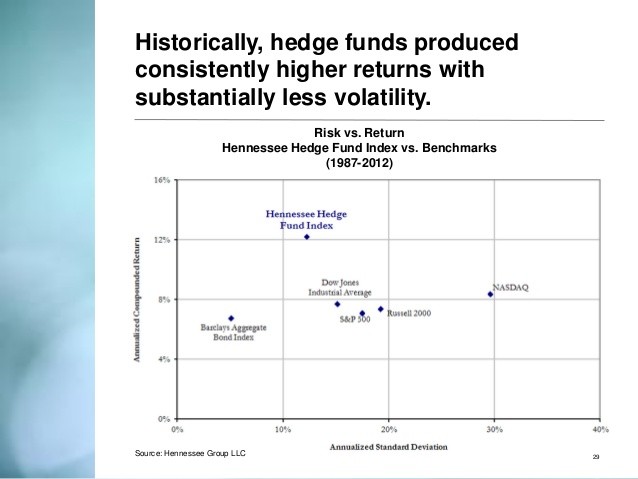

Hedge funds offer more financial reward because of the way their managers are paid, the types of financial vehicles they can invest in, and their lack of financial regulation .

- Hedge fund managers are compensated as a percent of the returns they earn. This attracts many investors who are frustrated by the fact that mutual funds are paid fees, regardless of fund performance. Thanks to this compensation structure, hedge fund managers are driven to achieve above-market returns.

- Hedge fund managers specialize in using sophisticated derivatives. such as futures contracts. options and collateralized debt obligations. Derivatives allow hedge fund managers to profit even when the stock market is going down. Hedge fund managers can use put options. or can sell stocks short. Basically, these products all do two things: they use small amounts of money, or leverage, to control large amounts of stocks or commodities. Second, they pay out by a particular point in time. The combination of leverage and timing means that managers make outsize returns when they correctly predict the market’s rise or fall.

- Since hedge funds aren’t regulated, they have free rein to invest in these high return, but speculative, financial vehicles.

Hedge Fund Risks

The same three characteristics that allow hedge funds to promise greater rewards also makes them very risky.

- Hedge funds managers are paid a percentage of their funds’ returns. What happens if the fund loses money? Do they pay the fund a percentage of that loss? No, the managers get zero no matter how much money they lose. This structure means hedge funds managers are very risk tolerant. This makes the funds very risky for the investor, who can lose all the money they invested in the fund.

- Hedge funds invest in derivatives that are very risky because of leverage. Options must be delivered within a certain window of time. If a black swan, or completely unexpected, economic event happens during that time period, even if the manager is correct about the long-term trend, he could lose the investment. In that sense, hedge fund managers are trying to time the market, which some would say is very difficult if not impossible to do.

- The lack of regulation means that hedge fund earnings aren’t reported to the SEC or any other regulatory body. Although hedge funds are still prohibited from fraud, this lack of oversight creates additional risk. In addition, hedge fund investors are also part owners of the LLC. This means they could lose their investment if the hedge fund goes bankrupt as a business — even if the investments do OK. (Source: SEC, Hedging Your Bets ; About.com Guide to Beginners Investing, What Is a Hedge Fund? )

How Hedge Funds Contributed to the Financial Crisis

Hedge funds’ unregulated use of derivatives helped cause the financial crisis of 2008. They bought lots of mortgage-backed securities. When housing prices started to decline in 2006, the underlying mortgages defaulted. Hedge fund managers thought they were protected from that risk because they owned credit default swaps. a type of derivative insurance. However, the sheer number of mortgage defaults overwhelmed issuers of the swaps, like AIG. These insurers needed a federal government bailout to stay in business and make good on the swaps. As a result, the market for this type of insurance collapsed. Banks were then not willing to lend without them, making it difficult to get new credit.

Furthermore, many banks also had hedge fund sub-divisions. They often tried to increase their returns by investing in derivatives through these hedge funds. When these risky investments went south, banks like Bear Stearns went to the federal government for bailouts. When the government refused (or was unable) to bail out Lehman Brothers in September 2008. its bankruptcy sent global stock prices plummeting. For more, see How Hedge Funds Created the Financial Crisis.

New Hedge Fund Regulations

In 2010, the Dodd-Frank Wall Street Reform Act started regulating hedge funds. Hedge funds above $150 million must now register with the SEC. The Act also created the Financial Stability Oversight Council, which looks for hedge funds and other financial companies that are growing too large. If they become too big to fail, the Council can recommend that these funds be regulated by the Federal Reserve. (Source: New York University Stern School of Business Hedge Funds After Dodd-Frank )

Dodd-Frank limits the amount of hedge fund investments banks can make. Banks can use hedge funds on behalf of their customers only, and not to boost their own corporate profits.

Dodd-Frank also calls for regulation of derivatives under the SEC. Hedge fund managers must now be registered. They must also disclose their risk metrics, strategies and products, and performance. The SEC also requires them to reveal the positions held by the hedge fund itself, the overall credit exposure they hold, how many assets are traded using computer algorithms, and their debt-to-equity ratio. (Source: St. Thomas University, Wall Street Not Afraid of Dodd-Frank ) Article updated March 6, 2015.